Mathapelo Malao

The government’s national infrastructure plan is intended to transform the economic landscape of South Africa, create a significant number of new jobs, strengthen the delivery of basic services to the people of South Africa and support the integration of African economies.

In response to the challenge of facilitating infrastructure investment, Cabinet established the Presidential Infrastructure Co-ordinating Commission (PICC), with its supporting management structures.

The government will be integrating and phasing investment plans across 18 strategic integrated projects (SIPs).

The New Growth Path sets a goal of creating five million new jobs by 2020 and highlights opportunities in specific sectors and markets to drive job creation.

Though the industry faces significant challenges including the recent labour unrest, falling productivity levels and increasing input price pressure, the mining sector has been identified as one of the most significant sectors to drive job creation.

There are currently three SIPs that have a particular emphasis on mining-related investment, namely:

• SIP 1: Unlocking the northern mineral belt with Waterberg as a catalyst

• SIP 3: South-eastern node & corridor development

• SIP 5: Saldanha-Northern Cape development corridor

The mining industry plays a vital role in the growth and development of South Africa and its economy.

Since the earliest discoveries of minerals in the region, this rich endowment of mineral resources has been a key driver of South Africa’s social and economic development.

Mining continues to be one of the most significant sectors of the South African economy, providing jobs, contributing 8.6% to gross domestic product (GDP) and building relations with international trading partners.

Mining is the cornerstone of the economy of the northern mineral belt (in particular the Waterberg region) and currently accounts for more than 50% of the GDP of the area.

It is critical that South Africa’s mineral resources be directed to benefit key social and economic objectives for sustained growth and meaningful transformation.

Unlocking the northern mineral belt with Waterberg (SIP 1)

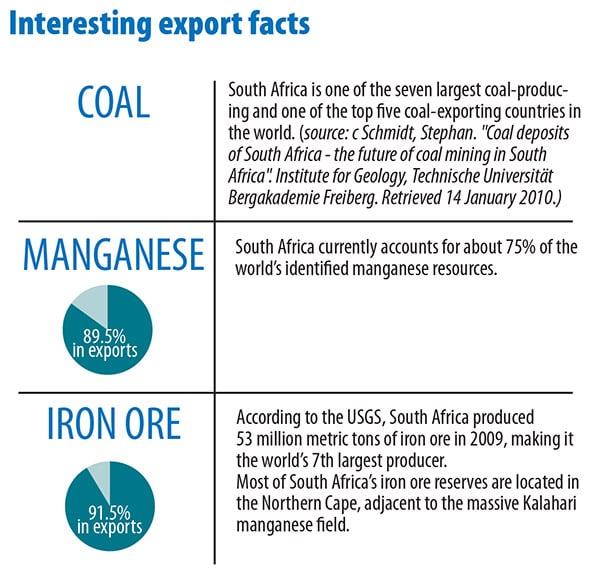

Mining activities in the northern mineral belt include coal, platinum and other minerals for local use and export.

This creates a compelling case for the development and extension of rail capacity to Mpumalanga-based power stations and for export principally via Richards Bay and in future Maputo (via the Swaziland link).

The additional rail capacity will see the shift of coal transportation from road to rail in Mpumalanga leading to positive environmental and social benefits.

Additional supportive logistics corridors will help to strengthen Mpumalanga’s economic development.

The key features of SIP 1 are to:

• Invest in exploration of mineral resources

• Develop rail, water pipelines, energy generation and transmission infrastructure

• Create jobs

• Create urban development in the Waterberg

• To develop rail capacity to Mpumalanga and Richards Bay

• Shift from road to rail in Mpumalanga

• Develop a logistics corridor to connect Mpumalanga and Gauteng

South-eastern node and corridor (SIP 3)

SIP 3 involves the development of a major new south-eastern node that will improve the industrial and agricultural development and export capacity of the Eastern Cape region, and expand the province’s economic and logistics linkages with the Northern Cape and KwaZulu-Natal.

It is progressing apace with the building of a dam, using the Umzimvubu River to expand agricultural production in the province.

The south-eastern node features some of the currently most chronically underdeveloped areas in South Africa, but the SIPs should see that change.

They will strengthen economic development in Port Elizabeth through a manganese rail capacity from the Northern Cape.

Also in the works is a possible Mthombo refinery and trans-shipment hub at Ngqura, and port and rail upgrades to improve industrial capacity and performance of the automotive sector.

The Ngqura port was officially opened by the president in 2012, with further investment towards a fully-fledged trans-shipment hub.

Rail and port development required to transport 16-million tonnes a year of manganese ore from the Northern Cape for export through the port of Ngqura and supply to a planned manganese smelter at the Coega Industrial Development Zone (IDZ), will include the following:

• An upgrade of existing rail network to support heavy haul operations;

• Doubling of sections and extension of passing loops to accommodate longer (200-wagon) trains;

• Compilation yards for long trains;

• Consolidation yards for smaller miners;

• New dual-voltage locomotives and wagons;

• Material handling facilities; and

• The construction of a new and expanded terminal at Port of Ngqura.

The relocation and decommissioning of the current manganese terminal from Port Elizabeth to a new, expanded and modern manganese terminal in the Port of Ngqura will offer cost effective logistics solutions to emerging miners and larger mining houses which will ultimately contribute in the positioning of the South African manganese industry as a leading global producer.

SIP 3 will also see the development of the N2 Wild Coast Highway, which improves access into KwaZulu-Natal and the national supply chains.

Saldanha-Northern Cape development corridor (SIP 5) SIP 5 entails:

• Integrated rail and port expansion;

• Back-of-port industrial capacity (including an industrial development zone);

• Strengthening maritime support capacity for oil and gas along the African West Coast; and

• The expansion of iron ore mining production and beneficiation. The Saldanha Port iron ore infrastructure and operations will be expanded to increase South Africa’s iron ore export capacity.

This proposed port expansion forms part of an overall project to increase the throughput capacity of the Sishen-Saldanha iron ore corridor from 60- to 88-million tonnes a year.

The proposed project is motivated by South Africa’s aspirations to remain a strong competitor in the iron ore export industry and position the country to reap the benefit from increasing global market share and revenue generated from iron ore exports.

The three main project components of the overall expansion project include mine-side ore loading, iron ore rail transport and a port iron ore terminal.

The current capacity limitations of the iron ore corridor constrains South Africa’s market share. Current iron ore exports contribute approximately R70-billion to South Africa’s gross domestic profit.

The proposed expansion will provide for an increase in iron ore exports by approximately more than 40% compared to the current exports. Therefore a substantial increase in revenue from iron ore exports would be achieved through this proposed expansion.

In concept, this proposed facility will provide for a consolidation yard for off-loading, blending and stockpiling of various grades of iron ore to be loaded onto the trains for export via the Port of Saldanha.

To facilitate the growth in iron ore exports, expansion of the iron ore terminal and its associated infrastructure is needed at the Port of Saldanha.

Mathapelo Malao is senior manager of transaction and restructuring advisory services for infrastructure and major projects at KPMG

This article forms part of a supplement paid for by KPMG. Contents and photographs were sourced through and signed off by KPMG