Glencore Xstrata’s decision to apply for a secondary listing on the JSE raised some eyebrows initially, coming on the back of bad publicity regarding the South African mining sector, but local analysts say investors are looking for somewhere to put their money.

Glencore, with a market capitalisation of about R685-billion, will be the third-largest company on the JSE, exceeded only by British American Tobacco (R1.1-trillion) and SABMiller (R823-billion). BHP Billiton takes fourth place at R633-billion.

Glencore Xstrata’s market capitalisation will be twice that of the other large diversified company listed on the JSE – Anglo American (R346.6-billion).

Glencore chief executive Ivan Glasenberg has been hailed as something of a risk taker for choosing to come back to his country of origin to list, but, to quote one market observer, Alec Hogg, Glasenberg “does not do sentimental”.

Glasenberg’s dealings with London-listed Xstrata after Glencore’s $29-billion acquisition of the company earlier this year is a case in point.

More than 33 offices and $576-million cutbacks in the coal sector were made in Xstrata, amounting to $2-billion in savings.

Public attack

Glasenberg’s very public attack on former Xstrata chief executive Mick Davis at the shareholder meeting last month came as a surprise to many since Glencore had held 40% of Xstrata before the merger.

But Glasenberg said that Glencore had not been aware of the extent of the fat that needed to be cut.

Regarding Glencore Xstrata’s South African listing, Glasenberg told investors last month at a meeting in London that South Africa has a “strong institutional investor base” and that it would make a good starting point for entry into Africa, where he sees growth.

Glencore has come under close scrutiny since it listed on the London Stock Exchange in 2011. It sailed straight onto the FTSE 100 list of the United Kingdom’s premier companies – and into international headlines.

It has been accused of a number of environmental offences – such as the 2012 Zambian government’s announcement that it would be closing Glencore’s Mopani copper plant, citing unacceptable emissions – and for some of its business dealings, which include allegedly aiding Iran’s nuclear programme by selling it aluminium.

Many past contraventions emerged during its initial public offering in May 2011, contained in a 1 000-page document.

Exposed to scrutiny

Glasenberg, the very private billionaire, and Glencore have gained a reputation for being willing to go where few other companies will, which has contributed to its financial success but exposed it to scrutiny.

Glasenberg owns an 8% stake in Glencore, making him the largest single shareholder.

Azar Jammine, chief economist at Econometrix, said that his only concern was that Glencore Xstrata’s listing further dilutes local ownership on the JSE.

“Foreigners are playing a big role in the market and what we really need is job creation and new mining ventures that will create jobs.

“The advantage for companies listing on the JSE is that it’s a good liquid market,” he said.

“South Africa has a lot of advantages that could see it playing an important role in assisting Glencore’s expansion into Africa and it would have long-term benefits for the country.

“I would rather we have the listing than not,” he said.

Timing is the key

Jammine said Glencore’s timing could affect how well its initial trading goes. It hopes to list in Q4 and begin trading immediately.

“A lot will depend on when they list and what is happening at the time. At the moment, the money markets are looking at bonds rather than equities. There is a lot of fear around quantitative easing by the United States Fed [Federal Reserve],” he said.

Capital inflows for equities and bonds are at present about R100-million a year, Jammine said.

Chris Gilmour of Absa Asset Management said that, from a fund manager’s perspective, when it comes to new investment opportunities, choices are very limited on the JSE.

He said the 25% cap on foreign investment limited opportunities and historically pushed stock prices to “ridiculous levels” because money was being kept in the country.

“With new entrants into the stock market, people diversify their holdings more because they have a wider choice, which also lessens risk.”

Latest listings

The two most recent mining listings on the JSE were Giyani Gold, a Canadian-based exploration firm, and Sibanye Gold, which was spun out of Gold Fields and consists of its local assets.

Glencore Xstrata has not yet said how many shares will be issued. It said only that it intends listing in Q4.

According to Sasfin’s David Shapiro, “Glasenberg is too savvy a businessman to make decisions that do not make sense.

“There are billions of rands to invest in the JSE through investors like PIC [Public Investment Corporation], and the likes of Coronation and Alan Gray, and few appealing choices for big investors,” he said.

The listing will also provide new options for the smaller investors.

Patrycia Kula, business manager of the JSE, has said an investment of this size will change the allocation of funds for those who track indices and will greatly increase trading volumes.

Hoping for more investors

It’s hoped that the Glencore Xstrata listing will also attract other investors to the exchange.

The composition of the JSE has changed little in the past few years, with the top 10 companies in 2008 still leading – with the exception of Amplats and Implats. So the possibility of a new entrant in the top 10 has the market talking.

The JSE listing means that local investors will be able to buy Glencore Xstrata shares without having to use their foreign investment allocations.

Shapiro also points out that, apart from investors wishing to invest in large diversified companies and getting around exchange controls, a listing in South Africa will make it easier for Glencore Xstrata to “tap into the local market to raise money for its South African-based businesses”.

“Glasenberg has no ego when it comes to business,” Shapiro said. “He would not be making this move unless he believed it was a viable one. He is a hard manager and a man who does not spend unless he has to.”

Although the markets are still cautious about commodities, which continue to stumble, Glasenberg believes they have a profitable future.

Commodity prices

He told investors last month: “Commodity prices reflect too much capex [capital expenditure], not a weak demand.”

Shapiro said many companies were caught out by what they perceived to be growing demand for commodities, which stalled before they expected it.

“Glasenberg has been a trader. He started out in coal and he understands supply and demand dynamics,” Shapiro said.

There has long been speculation that Glasenberg could be eyeing Anglo American as the next acquisition. Xstrata was interested in taking it over five years ago.

But analysts say that Anglo American is in a better position than it was two years ago and that its chief executive, Mark Cutifani, appears to be making impressive changes.

Global mining house juggles its assets

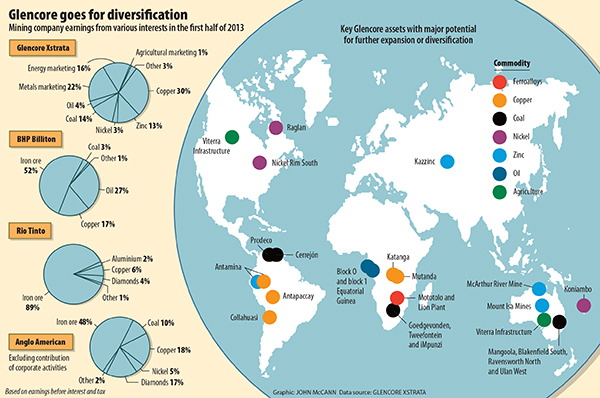

Glencore Xstrata, listed by Reuters as the third-biggest global mining house since its Xstrata merger, was already one of the world’s largest commodities trading companies.

It has interests in about 35 coal mines in Colombia, Africa and Australia, and is the third-biggest producer of mined coal and nickel.

It also has production facilities all around the world and supplies metals, minerals, crude oil, oil products, coal, natural gas and agricultural products to the automotive, power generation, steel production and food processing industries.

It employs about 190 000 people in 50 countries in its industrial and trading divisions.

The company was formed in 1994 by a management buyout of Marc Rich + Co, founded in 1974.

Billionaire trader Marc Rich, accused of tax evasion but pardoned by United States president Bill Clinton in 2001, eventually sold his half of the business to Glencore International, which had a 21-year relationship with Rich.

Off-loading greenfield projects

Current chief executive Ivan Glasenberg has gained a reputation for off-loading greenfield projects — Glencore consider’s them “risky” as challenges lead to 35% project overruns, he said.

“Glencore prefers brownfield and bolt-on mergers and acquisitions.”

Glencore is also cutting back on its coal production. About $576-million of the money “saved” from Xstrata was from the coal division, where Glencore, like other mining companies, is struggling with low prices and an oversupply.

Glencore head of coal, Peter Freyberg, said at the shareholder meeting in September, that it would be putting some operations on hold.

Savings made on copper, nickel, coal and other operations would be channelled into oil, where Glencore saw higher returns.

Glencore Xstrata has limited exposure to South Africa relative to its global business.

The future

It owns a 24.5% stake in Lonmin, besides other interests, which include ferrochrome (with Merafe Resources) and thermal coal operations.

Xstrata’s South African projects include the Goedgevonden thermal coal complex in Mpumalanga, the Eland platinum mine near Pretoria, the Helena underground plant in the eastern limb of the lucrative Bushveld Complex and the Wonderkop ferrochrome plant in North West province.

The future of Glencore’s holdings in Lonmin, and Eland platinum mine in particular, is being reviewed but the company is not in a hurry to sell, it has told shareholders.

Answering questions on investor day in September, Glasenberg said Lonmin is not a core asset of the group and that Glencore would review its holdings in Lonmin as time goes on.