Some experts call index-linked products retirement funds for the 21st century. (Delwyn Verasamy, M&G)

New retirement savings products could significantly drive down charges, improve competition and increase transparency in the sector, say proponents.

The government has been at pains to find ways to encourage South Africans to save as part of broader reforms to the financial services sector. These include scrutinising the charges endemic to retirement funds.

These new offerings, such as index-linked retirement annuity products, use passive investment vehicles like exchange traded funds as the building blocks of their portfolios.

A number of them quote annual fees of 1.35% and lower — well below industry averages, meaning potential retirees stand to come out with more benefits after charges are accounted for.

Passive investment funds track the performance of market indices, which they are benchmarked against, while actively managed funds rely on the decisions and expertise of asset managers who try to outperform the market.

A complex, costly system

In July, the government released a technical discussion paper for public comment, titled Charges in the South African Retirement Industry.

The large number of retirement funds, their voluntary nature — which affects design, cost and complexity — and the low rate of preservation are all "significant drivers of costs" in the South African system, which appears expensive by international comparison, according to the treasury.

As a result, charges in the sector differ between fund types, both in the level of fees and their complexity. This complexity makes comparisons very difficult for consumers.

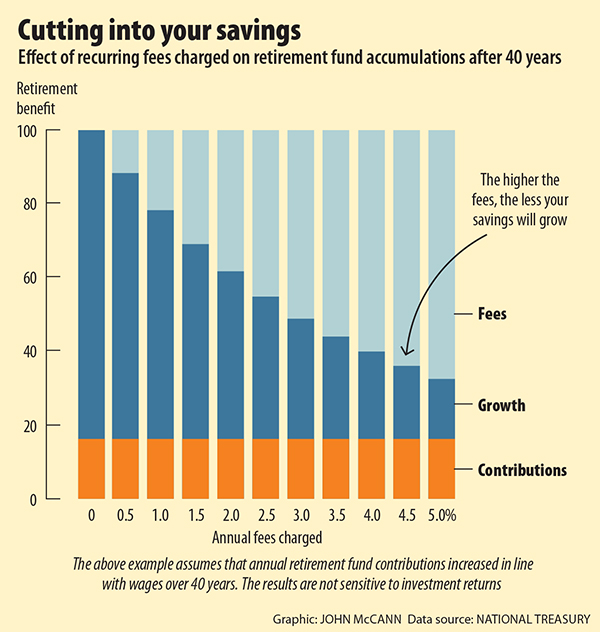

The discussion paper illustrated how severely charges, particularly recurring fees, can reduce what individuals get out after saving over a number of years.

The treasury calculated that if the recurring charges deducted from the fund account of a regular saver are reduced from 2.5% to 0.5% of assets each year, he or she would receive 60% more at retirement after 40 years.

Put another way, the saver could get the same retirement benefit by making contributions that were 40% lower.

Recurring charges had a greater effect on retirement benefits, but in South Africa these are borne by fund members. Initial charges, which had less of an effect on retirement benefits, are usually borne by employers.

The paper highlighted a number of other problems that contributed to the pricey nature of South Africa's retirement industry. These include:

• Low levels of fee disclosure;

• A broad shift away from upfront charges based on contributions to "less visible" recurring charges expressed as a proportion of assets under management;

• Preference for active management that meant fees for investment management are significantly higher, particularly for retail investors;

• The extent of financial intermediation that may unintentionally raise the complexity of retirement fund designs as well as cost; and

• The layered charging structures investment platforms applied, adding complexity as well as cost to retirement funds, and potentially increased opportunities for conflicts of interest.

Game changers?

Mike Brown, the managing director of etfSA, which launched its retirement annuity fund in August, believes index-linked products are "retirement funds for the 21st century".

The lower costs, complete transparency and performance consistency are the chief advantages of products such as these, according to Brown.

The etfSA retirement annuity fund has an all-in annual cost of 1.35%, which is far below the average costs of the industry, said Brown.

While South Africa may favour active investment management, globally there is a greater level of passive management.

The growth of savings products such as index-linked retirement annuities had been relatively small as they were up against a very aggressive active industry, Brown said.

It was only recently that enough exchange traded products had been listed that covered all asset classes. These can be used to form the basis of balanced portfolios.

Brown believed that more service providers were looking at these kinds of offerings and that there would be "greater competition in the future".

Steven Nathan, chief executive officer at retirement investment services provider 10X Investments, said that investors had been completely "disempowered".

The company, which has been in the game since 2008, is one of the earliest providers of products consisting of index-linked portfolios for both individuals and companies.

Nathan backed the treasury's research, saying that the retirement industry offered consumers too much choice and was characterised by complexity, which increased costs, made price comparisons difficult and increased the scope for conflicts of interest.

Calculations done by 10X showed that an investor saving R1 000 a month for 40 years and earning a real (after-inflation) return of 5% a year will have a retirement investment of almost R1.5 million in a zero cost environment.

This comprises about R500 000 in contributions and R1-million in investment returns. Costs of 1% will absorb a third of an investor's real return, while costs of 3% — which according to 10X was the approximate industry average — would reduce potential real returns by 75%.

The solution was to offer simple default options that reduced the need for financial planners and other intermediaries.

Retirement solutions from 10X are based on index-linked funds. Typically, costs came in at under 1% a year for individuals and even lower for companies, said Nathan.

The passive vs active debate

The treasury has been critiqued for tacitly backing passive investments options over active management. However, officials say this is not the case but getting an appropriate balance was key.

Niel Fourie, public policy actuary at the Actuarial Society of South Africa, said there is room for passive investment offerings and he expected this sort of investment management to grow.

"We will probably also see active-managed funds fees come down in a response to this," he said.

The society noted in a submission to the treasury that there was a place for passive and active investment management but that by mandating a passive default [in portfolios] the treasury would be seen "as a supporter of passive investments as the best choice for all investors".

This could lead to problems, since passive investment "only works well off the back of an actively traded market".

Sanlam chief economist Jac Laubscher made a similar critique of passive investment. He told the Mail & Guardian that very widespread passive investment management could potentially "undermine the activity of the financial market as a whole, which would hurt the performance of the economy".

Passive investment

In an economic commentary published in August, he pointed out that widespread passive investment undermined price discovery in the market — the ability to determine the best price of a share by examining the available information.

In addition, it could undermine efficient capital allocation because "mispricing of stocks, which is more likely in a market dominated by passive investment, will distort the calculation of the cost of capital and, therefore, investment decisions It also affected companies' ability to raise capital on the stock markets, and undermined corporate governance, he argued.

David McCarthy, retirement policy specialist at the treasury, said that passive management had "the great advantage, in that it commodifies asset management services and forces providers to compete on the basis of price and service alone, rather than vaguer promises of superior performance".

He argued that decades of academic research have demonstrated that, after controlling for risk and correcting for survivor bias — essentially correcting for the fact that backward-looking analyses tend to overstate historical performance because they ignore the asset managers that did not survive — more than half of active managers typically under-perform their benchmarks.

No analysis had been presented to the treasury during its work on retirement fund costs that accounted for both those factors.

The criticism that passive management would negatively affect price discovery in the financial markets, thereby outweighing the benefits of lower asset management costs, was a "false dichotomy", McCarthy said.

Efficient price discovery

Even in a market that was 99% passive, a remaining 1% that was frequently and actively traded could be sufficient to ensure efficient price discovery, he said. But South Africa was so far from this point that this argument had little relevance to the debate.

"We are highlighting the fact that, first, the under-use of passive management vehicles is a red flag, pointing to issues of conflicted intermediation in the sector," McCarthy said.

"Second, a vibrant market in passive management is generally associated with lower active asset management fees and helps to discipline active asset managers."

He added that there are different types of exchange traded funds and that it is important that investors understand what they are getting. Some of these funds hold underlying shares relative to their weighting on an index.

Other "synthetic" exchange traded funds hold derivatives that track the shares or the index.

These synthetic funds, which are typically cheaper, may expose investors to greater counterparty risk, although this is often managed through the use of collateral and central clearing houses.

"Regulators are actively considering how to deal with the special risks posed by synthetic exchange traded funds".

Final recommendations on the discussion paper may be finalised before April and the new legislation is expected by the end of 2014.