South Africa remains the most unequal among its peer countries.

South Africa’s tax regime and fiscal policies have done more to reduce poverty and inequality than its peer countries, the World Bank said this week.

But because inequality in South Africa starts at such high levels, the country’s Gini coefficient remains the highest among its fellows after they apply fiscal policies.

Better and more efficient public services, as well as higher economic growth, are needed to beat the “twin challenges” of poverty and inequality, the bank said in its most recent economic update on South Africa.

The question of how to continue reducing inequality through redistributive fiscal and tax policy has the government contemplating further tax increases next year, at the same time as it battles to find ways to boost dismal economic growth.

“South Africa’s deficit and debt indicators show that the fiscal space to spend more to achieve even greater redistribution is extremely limited,” the report said.

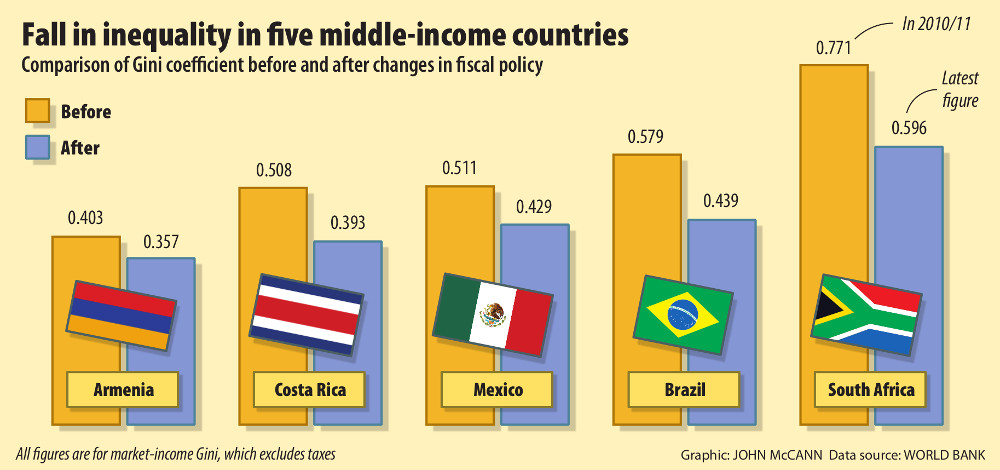

The World Bank found that, when tax policy and government spending programmes are accounted for, the country’s Gini coefficient falls from 0.77 to 0.59, achieving the largest reductions in poverty and inequality of 12 peer middle-income countries, including Brazil.

The Gini coefficient is a ratio between zero and one. The higher, or closer to one, a country’s Gini coefficient is, the greater the level of inequality in that country.

As a result of South Africa’s fiscal system, 3.6?million people have been lifted out of poverty and the rate of extreme poverty – the share of the population living on $1.25 a day – has fallen by half, the report said.

‘Slightly progressive’ tax system

South Africa’s tax system is “slightly progressive” and government spending is “highly progressive”. This means that the country’s rich “bear the brunt of taxes [and] that the government effectively redirects these tax resources to the poorest in society to raise their incomes”.

Direct taxes, such as personal income tax, are deemed progressive as the richest pay a proportionally higher share of direct taxes than their share of market income.

The most recent tax statistics released on Tuesday reveal that direct taxes on individual taxpayers, through personal income tax, provide the government with the lion’s share of its revenue – 34.5%. This is well above other sources of revenue such as company income tax of 19.9% and value added tax at 26.4%.

Overall, South Africa’s tax system and government policies have done more to reduce inequality than any of its peers. “Inequality goes from a situation where the incomes of the richest decile are more than 1?000 times higher than the poorest to one where they are about 66 times higher,” the World Bank noted.

Nevertheless, it stressed that South Africa’s Gini coefficient remains “unacceptably high”. Despite the steep reduction in inequality, because South Africa started out with such extreme levels of inequality, it remains the most unequal among its peer countries. Before the effects of fiscal policies are taken into account, South Africa’s Gini coefficient is 0.771, against Brazil’s 0.597 and Mexico’s 0.511.

The effects of government policy in redistributing wealth can be seen in other arenas. The FinScope South Africa 2014 consumer survey, released by the FinMark Trust this week, shows the marked migration of people from the lower living standards measure (LSM) categories to the higher LSM brackets.

In 2004, 67% of the people surveyed formed part of the lowest LSM groups – one to five. In 2014, this figure has come down to 47%.

The number of people occupying the middle LSM groups – six and seven – has risen to 40%, from 19% in 2004. The top-tier LSM group has swollen from 14% to 19% in a decade. According to the survey, the number occupying the LSM six to 10 bracket has grown by 12.2?million since 2004.

The survey also reveals the changing sources of income for people over the past decade: the number of people receiving government social grants has risen from 19% in 2004 to 30% in 2014.