'Some care is in order when interpreting higher oil prices as a sign of easing disinflation

The truism‚ “don’t fight” the Federal Reserve, has morphed into hedge fund manager David Tepper’s recent caution against taking on the four Feds: the European Central Bank, the Bank of Japan, the People’s Bank of China and United States’s central bank.

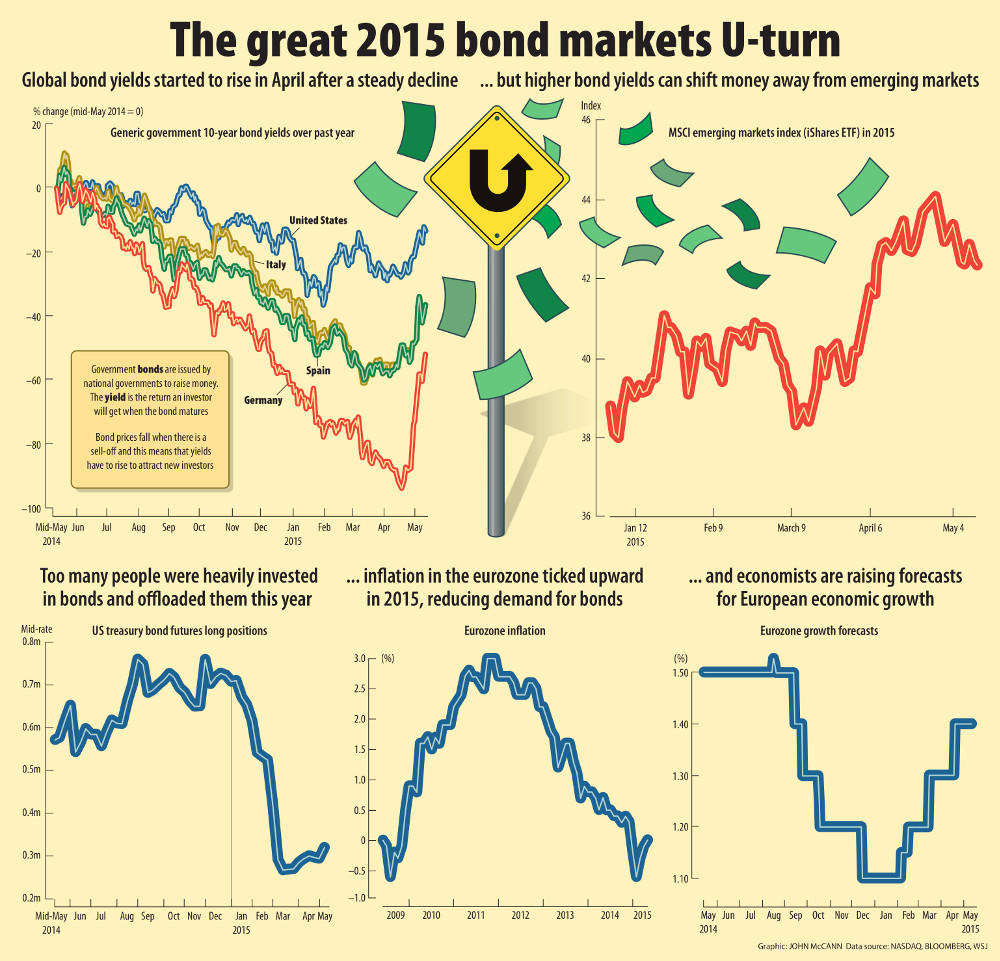

Although international debt markets have lost about $433-billion and yields have spiked from the US to Germany, monetary policy makers show no sign of an imminent increase in the price of money, and those in Europe and Japan are still conducting quantitative easing (QE). With the amount of bonds offering negative rates diminishing, the upside for yields is perhaps still capped.

Keeping monetary policy loose is still justified given that economists at JP Morgan Chase reckon global economic growth of 1.2% in the first quarter was the second weakest outside of a recession in the past 25 years and worldwide inflation of 0.4% was the lowest.

This backdrop has Torsten Slok, the chief international economist at Deutsche Bank, declaring to clients that the QE trade is not over and that yields should soon reverse their rise once markets stabilise.

He said what had been seen in markets over the past two weeks was triggered by fear and not by a change in the outlook for economic fundamentals. “I continue to see US rates under downward pressure as a result of money printing abroad.”

The call is underpinned by an analysis from Bank of America Merrill Lynch economist Gustavo Reis who, like Slok, sees “less change in global fundamentals than recent market moves imply”.

Weaker supply

Take oil. Although it is about 45% off its low of January, Reis estimates about 60% of that move is related to weaker supply rather than greater demand, meaning “some care is in order when interpreting higher oil prices as a sign of easing disinflation”.

Regarding the outlook for prices, he finds little to no change in markets’ inflation expectations in the past two weeks in the US or Europe, and that there are still many in both economies betting inflation will remain below 1%.

“The snap higher in bond yields seems to be lagging, rather than being propelled, by changes in inflation risks,” he said.

Therefore, the bond sell-off could ultimately be sowing the seeds of its own demise if it ends up preventing the central banks from withdrawing stimulus. The US Fed and Bank of Japan have previously shown a willingness to keep on expanding policy even after markets initially declared victory.

“Any policy that creates such a high degree of homogeneous positioning will inevitably raise volatility,” said Mark Schofield, a strategist at Citigroup. “It will be extremely difficult to exit.”

Fixed-income markets

The value of the world’s fixed-income markets dropped to $45.07-trillion on Tuesday from $45.51-trillion on April 17, according to a Bank of America Merrill Lynch index.

Record central bank stimulus had sent investors piling into debt at the same time that dealers pulled back from making markets, a combination that saw investors paying a price for holding bonds with yields not far from record lows and the Federal Reserve discussing an increase in US interest rates.

“People fell into a terrible complacency as yields fell to incredibly low levels with central banks pushing on rates,” said Christopher Sullivan, who oversees $2.3-billion as the chief investment officer of the United Nations Federal Credit Union in New York.

“They figured they would be able to get out before the tide turned, but the rug has been pulled out, catching a lot of people off guard and exacerbating the move.”

Investors in US government debt did get a reprieve on Tuesday. Yields fell after the treasury department’s auction of three-year notes demonstrated there’s no buyer strike in the bond market.

The benchmark 10-year treasury note was little changed on Wednesday, with the yield at 2.25%. – © Bloomberg