SAA chair Dudu Myeni.

SAA is on the brink of bankruptcy – and it has been put there by its seemingly untouchable chairperson, Dudu Myeni, and her reckless pursuit of an empowerment fantasy at the expense of an airline that is already severely distressed.

Interviews and internal documents obtained by amaBhungane reveal how SAA has been steered towards a debt mountain by Myeni’s insistence on overturning a R9-billion deal with aircraft manufacturer Airbus that the treasury had checked and approved.

Finance Minister Nhlanhla Nene last year took over responsibility for the state-owned airline after Myeni, who chairs the Jacob Zuma Foundation and is considered close to the president, openly defied Public Enterprises Minister Lynne Brown.

Instead of allowing the approved deal to go ahead, Myeni attempted to use it to incubate an unidentified new African leasing company to take over the transaction – and to insert her hand-picked transaction adviser to manage the process.

The interference has prompted Airbus to demand immediate payment of $17-million (R240-million), which SAA cannot afford, according to an internal memo amaBhungane has seen.

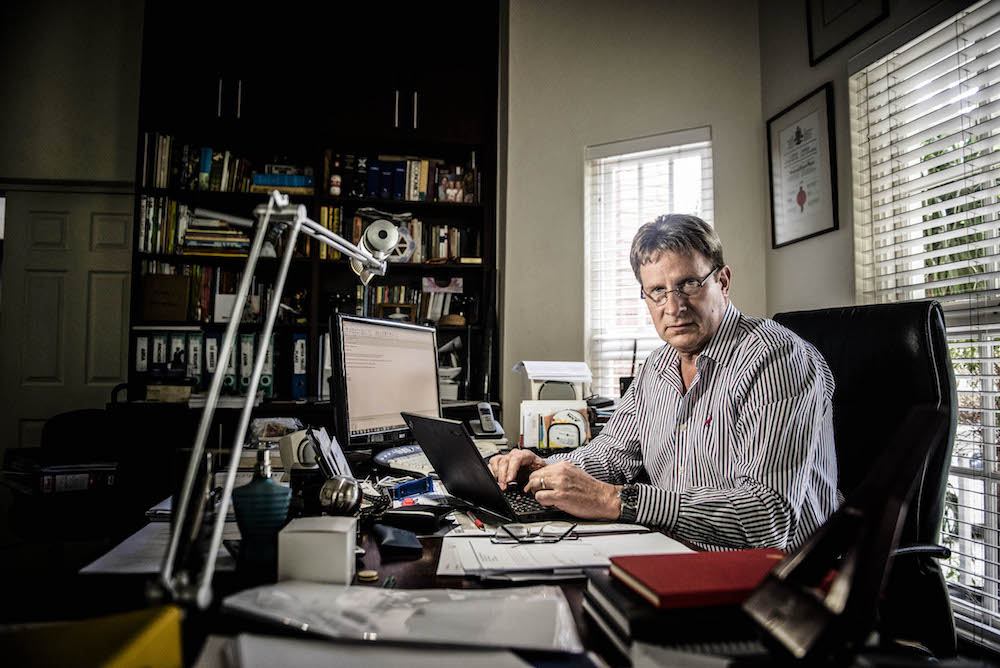

Former chief financial officer Wolf Meyer warned of the dangers of defaulting on the airbus deal. (Nelius Rademan/Rapport/Gallo Images)

The memo, drafted by then chief financial officer Wolf Meyer, warns if Airbus decides to issue a default notice the move will likely trigger cross-default clauses on other loans and leases – meaning that banks and lessors have the right to call for full repayment of all outstanding debt.

As a consequence, the government would face claims against existing government guarantees amounting to some R11-billion.

Meyer resigned last week, saying he could no longer associate himself “with the conduct of the board”.

Nene’s spokesperson, Phumza Macanda, told amaBhungane: “We are not able to comment on your specific questions right now, but be assured that the minister is seized with the SAA matter. The issue is at a delicate stage right now.”

Myeni’s influence seems to have prompted caution in the treasury. Several sources described frustration among treasury officials, who say Nene’s “hands are tied”, preventing him from taking action.

Airbus, under negotiations taking place since 2014, would have swapped an onerous existing contract for 10 shorter-range A320s with an agreement to lease five modern long-range A330-300 wide-body aircraft. Airbus would have funded the lease initially, but was open to devolving it later to another lessor approved by SAA.

SAA desperately needs to modernise its long-haul fleet, which consists mainly of fuel-guzzling A340-600s that are costing the airline money.

The A320 contract, first negotiated in 2002, has lumped SAA with an obligation to buy 10 outdated aircraft it doesn’t need. The contract also makes provision for predelivery payments, some of which SAA has paid, whereas others – including the $17-million – are overdue. The swap deal approved by the treasury would have seen Airbus repay unspent predelivery payments to SAA and waive new ones, making for a desperately needed cash injection.

By committing to five new A330s, Airbus was all but assured of benefiting from any future expansion of the SAA long-haul fleet, rather than Boeing, because of the extra cost of maintaining a multi-vendor fleet.

In April the SAA board approved the swap transaction in principle. On July 31 Nene gave approval in terms of section 54(2) of the Public Finance Management Act, and SAA acting chief executive Nico Bezuidenhout and Meyer sought SAA board ratification for the final agreement.

The attempt to ratify the deal with Airbus was blocked because the board failed to achieve a quorum.

Dudu Myeni (right), SAA’s seemingly untouchable chairperson, also heads the Jacob G Zuma Foundation and is known to be good friends with the president. (Siyabulela Duda)

The board is barely functional. In 2014 Brown sacked the board appointed by her predecessor, Malusi Gigaba, who had also clashed with Myeni.

Brown retained just two nonexecutives from the previous board: chairperson Myeni and her close associate, Yakhe Kwinana, who is also attached to Zuma’s foundation.

Brown added just two others – retired accountant Tony Dixon and John Tambi, an obscure bureaucrat attached to the Nepad Planning and Co-ordinating Agency – to create an “interim board”.

A year later this skeleton directorate is still in place, allowing Myeni to dominate board decisions with the aid of a few allies.

In September she grabbed the SAA joystick. She wrote to Airbus, seeking to insert a new player.

In a letter first disclosed in the Sunday Times, she stated: “On behalf of the board of South African Airways … I am pleased to inform you that SAA has decided to do this transaction differently, by engaging an African aircraft leasing company to engage directly with you.”

According to the report, Airbus chief executive Fabrice Brégier responded by saying that SAA could not tell his company who to deal with and warned: “Without immediate closure, Airbus will be forced to take appropriate actions in order to preserve its rights.”

An insider told amaBhungane this week: “When Airbus received this letter, they were flabbergasted. This was September. The deal had been done. Their head of sales, Hadi Akoum, called Meyer to say: ‘What the fuck is going on here?’”

The insider said Myeni’s claims that she wants localisation and transformation are a “smokescreen”.

Akoum declined to comment this week, noting: “All discussions with our customers are bound by a confidentiality agreement.”

On September 27 Meyer wrote to the board to say he was not aware of any such board decision, and warning that Myeni’s interference threatened the deal and had implications for SAA’s cash flow and solvency.

The insider said that on September 28 Myeni told the executive committee and the board that she had good news: she had found money for the fleet. But she would not give details, saying she knew board members would leak them to the media. In early October she laid out her plan.

In a letter to the board, seen by amaBhungane, she said: “There has been a development in which a South African third party has indicated that it wishes to make a funding proposal … This consortium comprises both private and state-controlled financial institutions … The board needs to determine whether this might be in the best interests of SAA, and how best we can reduce costs with the current proposal.”

She noted Airbus had requested an urgent meeting “this Saturday” with the board – an engagement clearly prompted by Myeni’s September letter. With the crunch meeting just days away, Myeni asked the board to authorise her to engage “a transaction adviser” to help decide which was the better option: the deal approved by the treasury or her new option.

“I have reflected on this and it would make sense that the transactional adviser be included in the meetings referred to above … I have accordingly approached Quartile Capital, whose experience is unparalleled and [is] recommended highly for such transactions.

“I have considered them as they are perceived to be independent and credible. They have indicated that they are willing and able to advise the board, notwithstanding the short notice.”

Such powerful advisory roles are normally put out to tender, but Myeni cited the self-induced urgency for why the board should waive normal procurement procedures.

In the same letter she also asserted that Quartile should be appointed to advise the board on a R15-billion project to consolidate all SAA’s existing debt into one giant borrowing transaction, a deal with enormous implications – and fees.

“She had been hiding in a corner of the hotel, waiting for the others to leave”

Myeni said SAA’s formal request for proposals (RFP) for this R15-billion transaction was flawed: “The current RFP does not talk about 8-BEE and the 30% set aside, a clear demonstration of a deliberate strategy to continue to exclude historically disadvantaged groupings and military veterans in contradiction of board resolutions.”

What happened next is taken up in Meyer’s memo to the board, dated October 26. He wrote: “A scheduled board meeting was called with Airbus on Saturday October 10, to discuss and finalise the swap transaction. This meeting was attended by Ms Kwinana, Dr Tambi, Mr Dixon and myself with Mr Hadi Akoum from Airbus.

“The company secretary apologised that the chairperson could not attend. After a lengthy debate between the four board members present, it was resolved that the swap transaction could proceed on the basis that Airbus would recognise and engage directly with this African leasing vehicle but that it would still be subject to a proper due diligence in terms of their governance requirements …

“It subsequently came to my knowledge that, after Mr Dixon and myself had left the meeting, the chairperson had in the meantime arrived together with the transaction adviser.

“Another meeting was held by the chairperson, the transaction adviser, Ms Kwinana and Dr Tambi with Mr Akoum.

“From subsequent Airbus correspondence, dated October 14, it transpired that the nature of the transaction had changed from leasing the A330 aircraft to actually purchasing them outright by SAA.”

One account of the October 10 meeting provided to amaBhungane claimed: “Kwinana was literally holding Akoum by the sleeve, and then Myeni arrived. She had been hiding in a corner of the hotel, waiting for the others to leave … She brought [chief executive Modise] Motloba from Quartile Capital. And he said: ‘I can give you the R6?billion [purchase price], so let’s do the deal.’

“Akoum told them it was not possible. They would first have to start a new process, which would take months, and Quartile would have to bid.”

Motloba declined to confirm or deny the meeting.

According to Meyer’s memo, the October 14 letter from Airbus put SAA on strict terms.

Any new transaction proposal had to be finalised in 30 days. Meanwhile, SAA was immediately required to make a payment equivalent to the past predelivery payments due on the old A320 contract, about $17-million. At the execution date an additional $100-million was required.

SAA did not have the cash, Meyer told the board.

“SAA is now at risk of cross-default clauses being invoked as a result of the airline inevitably defaulting on its existing payment obligations,” he warned, adding: “On October 15 I was obliged, in terms of my fiduciary duty as the CFO [chief financial officer] and director, to inform [the] national treasury that SAA will, in all likelihood, not be able to make due and punctual payments in terms of its obligations.”

On November 5 Meyer, acting chief executive Thuli Mpshe and SAA legal counsel Ursula Fikelepi signed a memorandum to the board.

AmaBhungane is in possession of the memo, but cannot report on it owing to an interim court injunction obtained by SAA against Business Day, Media24 and Moneyweb.

Business Day reported on the contents before the injunction, but will be challenging the ban next week.

But the affidavit SAA tabled in court is clear.

In it Fikelepi states: “On October 29 2015 I was requested by exco [executive committee] to provide a legal opinion to the board of SAA.

“My advice was sought on the legal risks and implications for the rights and obligations of the applicant arising out of correspondence from Airbus, dated October 2 and 26 2015 [and] related to a potential dispute between applicant and Airbus over a transaction related to the purchase and swap of Airbus aircraft.”

She states that the advice she delivered “makes reference to … information [that] has the potential of causing real and serious reputational and financial damage to [SAA] and the government of the RSA.”

Neither SAA nor Myeni responded to questions.

* Got a tip-off for us about this story? Click here.

The M&G Centre for Investigative Journalism (amaBhungane) produced this story. All views are ours. See www.amabhungane.co.za for our stories, activities and funding sources.

The M&G Centre for Investigative Journalism (amaBhungane) produced this story. All views are ours. See www.amabhungane.co.za for our stories, activities and funding sources.