ANALYSIS

No matter the outcome of the Brexit vote, the fight over Britain’s place in the European Union has revealed the faultlines underpinning the European project.

The EU’s continued stability is a far bigger issue, say economists and academics, especially with the move towards populist politics and protectionism being seen around the world.

This is particularly important for a country such as South Africa, given its open economy and its high reliance on foreign capital inflows, which to a large degree ebb and flow based on international investor sentiment.

“If the [European] union continues to operate as it is, it is unlikely to flourish and will be plagued by on-going political moves for exits,” said Stanlib chief economist Kevin Lings.

There is a growing tide of Euroscepticism, reflected in the parties on the extreme left and right of the political divide in individual EU member countries.

Before the Brexit count was in, France’s leader of the far right, Marine le Pen, was already motivating for a similar referendum in France.

Lings believes this is part of a global move away from more centrist politics to a politics underpinned by nationalism and protectionism. It is also part of a reaction to the rise of globalisation, which preceded the 2008 financial crisis and coincided with global trade growth at unpre-cedented levels of about 8% a year.

But globalisation saw the development of winners and losers — countries that benefited from it and could successfully compete in a more integrated world and those that could not, Lings said. This became apparent in the EU where some economies performed better than others, most notably the northern EU states such as Germany that outperformed their southern counterparts.

The financial crisis was a catalyst for further discontent and its effects are still being felt. It has been compounded by a growing refugee flow into Europe because of the Syrian crisis and the sustained unrest in the Middle East, said Lings.

This has led to rising nationalism and growing sympathy for political parties that advocate various kinds of protectionism, including controlling national borders or taking a tougher stance on migration.

In the United Kingdom, the referendum has been fuelled in part by the debate over migration, and particularly concerns over the influx of EU migrants into Britain, as well as a call for greater sovereignty over how it regulates this and other aspects of its economy.

According to British tax authorities, however, people from the European economic area contributed more in tax revenues than they claimed in social benefits. In data released in May, the revenue service said European migrants made a net tax contribution of slightly more than £2.5-billion in the 2013-2014 tax year. “The more important question is the future of the euro area and the European Union,” Lings said.

On the whole, and despite its problems, the EU has benefited member states and they are stronger together than they would have been on their own, he said.

But the EU is in limbo, with countries drifting apart instead of moving towards greater integration, and it has yet to take key steps towards further integration, such as the creation of a banking union. This would unify the rules and regulations that govern commercial banks and see all banks being supervised by the European Central Bank (ECB), which could help to prevent another financial crisis, Lings said.

The next level of integration would be a welfare union, which would ensure that all citizens in the EU received similar benefits. And the culmination of integration would be a fiscal union, with one central budget, where money for items such as defence and infrastructure was centrally allocated.

But pushing for greater integration appears politically unfeasible, said Lings, and, as a result, the EU is likely to muddle along until the next crisis. This is bad for expectations of global trade and growth, he said, particularly given increasing protectionist politics elsewhere — a good example being the rise of United States presidential contender Donald Trump — as it heightens inter-country conflicts.

European leadership should take the push for Brexit as a sign that there is a serious need for reform, said Professor Daniel Bradlow of the Centre for Human Rights at the University of Pretoria.

There is a perception of “a democratic defecit” within the EU, with “faceless bureaucrats in Brussels running the show”, he said.

The question of migration is another issue. There is no good governance structure in place to deal with it, Bradlow said, and people feel the Schengen visa system does not work satisfactorily.

In Europe, the welfare state is coming under increasing pressure and, whether accurate or not, there is the feeling that this is as a result of uncontrolled migration.

“People feel they are losing control to Europe over the benefits that they have spent decades winning,” he said, adding that a further problem is the imposition of unpopular austerity measures in many European countries.

Izak Odendaal, an investment analyst at Old Mutual Wealth, said Europe has gone through about four years of “existential panics” over whether the EU will survive.

Brexit was preceded by fears over a Grexit — Greece leaving the euro zone. “The bigger worry is what this means for Europe,” he said.

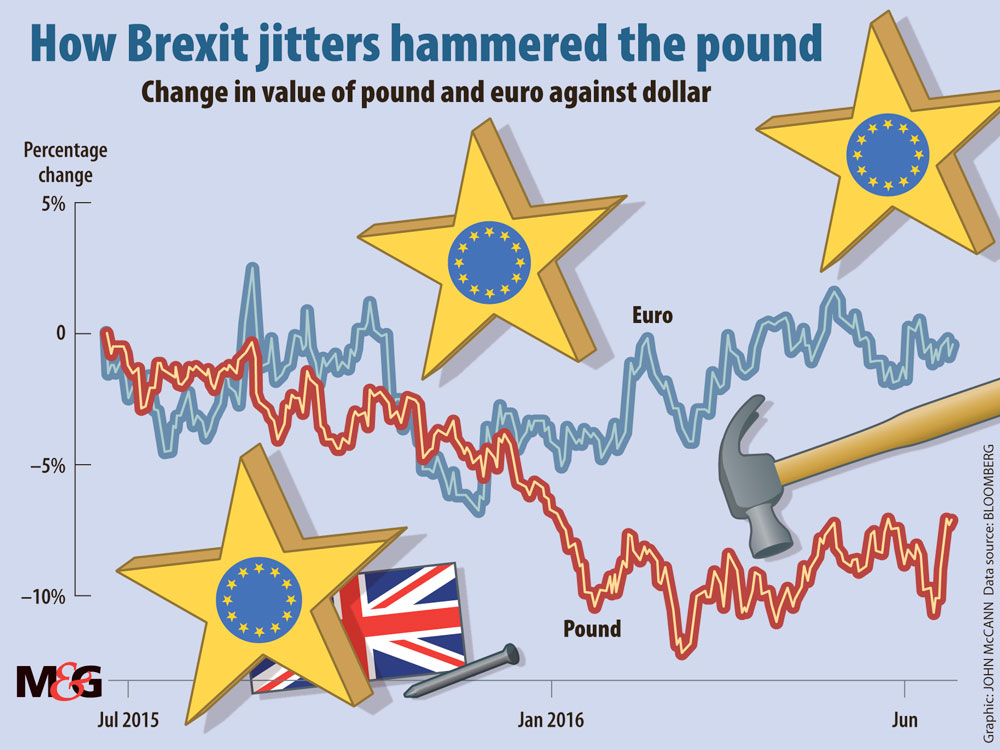

These concerns have a major impact on financial markets and are unlikely to be short-lived, he said.

South Africa is running a large current account deficit – 5% of gross domestic product in the first quarter of 2016 – and relies on foreign capital inflows to sustain this. But these flows are “very closely linked to global sentiment” and, depending on how global risk appetite changes, this will affect the rand, said Odendaal.