Transnet says it can’t afford to pay employees more

Picture: Transnet, (M&G)

A Gupta-linked advisory group, Trillian, is sucking cash out of Transnet at a furious ratedespite a reported treasury investigation into deals between the two companies.

AmaBhungane has obtained copies of Trillian invoices totalling R74-million signed off for payment by Transnet chief financial officer Garry Pita at the end of June.

This came on top of R93-million paid out late last year without a competitive bid, bringing the total to R167-million.

The payments underscore how big the stakes are in the battle over state-owned enterprises raging between Finance Minister Pravin Gordhan and President Jacob Zuma.

An outcry following Monday’s announcement that Zuma would personally head up a new state-owned enterprises coordinating council prompted the presidency to claim in a statement that it was the outcome of longstanding reform initiatives and “nothing sinister”.

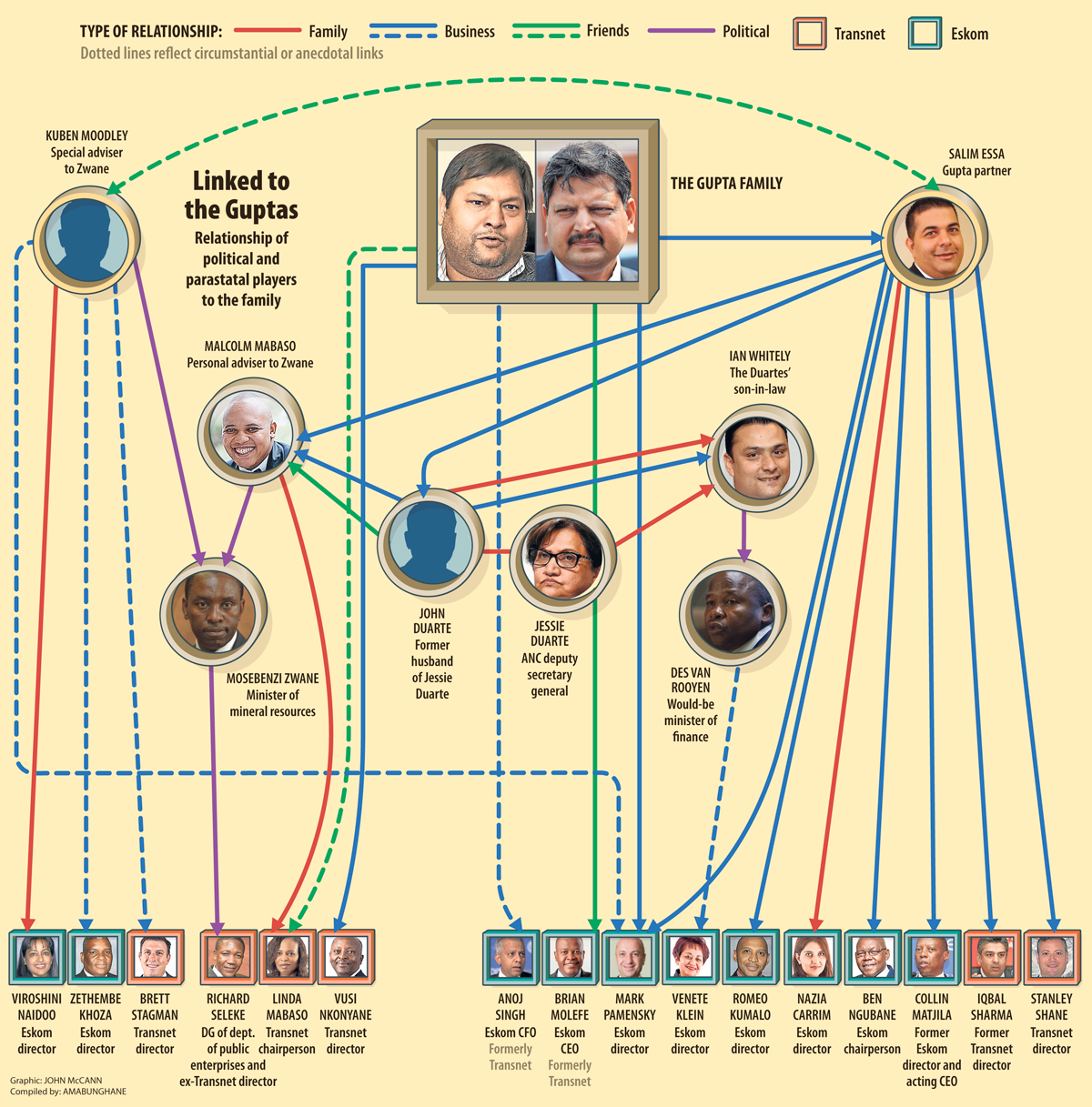

Trillian Capital Partners, the apex operational company in the Trillian group, is held 60% by Trillian Holdings. Its sole director is close Gupta associate Salim Essa, but its ownership is a black box.

AmaBhungane has been trying for months to access Trillian Holdings’ share register – a legal right under the Companies Act – and has resorted to having a summons served at Essa’s home and business addresses to force him to comply with the law.

Shared Interests

Essa’s shared interests with the Gupta family include VR Laser, a steel-cutting business that has formed a controversial joint venture with state arms company Denel to market weapons across Asia.

The Trillian group, established late last year only, offers financial advisory, consulting and related services.

In May, the Sunday Times reported that the national treasury was investigating Transnet contracts with Trillian and another advisory firm, Regiments Capital.

Former Regiments director Eric Wood left Regiments last year to become chief executive at Trillian Capital Partners.

AmaBhungane understands that Woods’ departure was in part due to other directors’ unhappiness about his relationship with the Guptas.

AmaBhungane has also learned that the Transnet transactions form part of the Public Protector’s investigation into allegations of “state capture” that are focused on the alleged influence of the Gupta family.

The Trillian invoices – all signed off by Transnet’s Pita on June 29 – are remarkably skimp on detail and do not indicate time or personnel allocated. They show:

- Trillian invoiced some R8-million monthly for undefined work on the “GFB Breakthrough” project. GFB stands for general freight business, the bedrock of Transnet’s much vaunted market demand strategy, under which massive capital investment was supposed to deliver increased volumes.

- Trillian invoiced R36-million for undefined “work done to close the SWAT II project”. It is not clear what this is.

- Trillian invoiced R11.4-million for “financial structuring advisory services on the fund raising required to facilitate African and global sales of rolling stock”.

- Trillian invoiced R2.7-million for undefined “work done” on the “TRXGCIA-DCT affordability model”. It is not clear what this is.

Transnet declined to give detail of Trillian’s work this week, saying: “Transnet has in excess of 23 000 suppliers with whom we have transacted over the past 24 months, and it is not our policy to divulge the details of our commercial terms with these partners without a just cause.”

AmaBhungane has also confirmed that Transnet paid another Trillian group company, Trillian Asset Management, R93.5-million last December.

This was purportedly for acting as the “lead arranger” for a R12-billion “club loan” last November by a syndicate of five banks to help fund the R50-billion purchase of 1064 new locomotives.

Typically in such a deal, the “lead arranger” is one of the lenders, putting up at least as much money as each of the others.

But analysts told amaBhungane that Trillian Asset Management, then freshly rolled into the Trillian group, was at the time a small boutique asset manager without the capacity to lead a R12-billion bank syndicate.

Indeed, Transnet insiders said it put up no money, had no “skin in the game” and therefore could not have been a “lead arranger”.

No competitive tender

Evidence seen by amaBhungane suggests Trillian was appointed to that role without a competitive tender.

Transnet did not answer questions this week whether either set of payments had resulted from competitive bids, saying only that “the contracts … were awarded in accordance with our policies and procedures and approved by the applicable delegated authority as dictated by our governance requirements”.

“All service providers are paid for services rendered once we have satisfied ourselves that they have fulfilled their obligations in terms of agreed contractual scope. The matters you refer to were no exception.”

Trillian said through a PR agency that it was “confident that all due processes were followed and that we delivered high quality work and value to the client…

“If you have any concrete proof of any wrongdoing, please provide it to our board of directors and we shall address it immediately.”

Treasury did not reply to questions this week about the status and scope of its investigation reported by the Sunday Times.

Transnet said it was “not aware of any ongoing investigations”, while Trillian said: “We are not aware of any investigation and have never been notified.“

The revelations about the Trillian payments come despite efforts by Transnet to clamp down on leaks to the media.

Earlier this year Transnet chair Linda Mabaso issued a staff circular saying: “It has come to the attention of the Transnet board of directors that some of us are in the habit of leaking confidential Transnet information to outside third parties, including the media.”

She warned that anyone found leaking could be dismissed, and announced the formation of a special board subcommittee to “determine where the leaks come from” and “stop this type of activity”.

Mabaso’s son, Malcolm, was until last year a business partner of Essa, the Gupta associate who controls Trillian Holdings.

The amaBhungane Centre for Investigative Journalism produced this story. Like it? Be an amaB supporter and help us do more. Know more? Send us a tip-off.