Mail & Guardian reporter Govan Whittles takes a satirical look at what’s making headlines.

Selling South Africa as a good-news story to international investors at the moment is an unenviable task. Details of political skulduggery continue to emerge and pressures on the budget, such as the demand for free tertiary education, populate the news on both local and global channels.

But when Finance Minister Pravin Gordhan meets investors in New York in early October, he will be on a better footing than he was when he embarked on an international roadshow in March this year.

For one, the fiscal side of things is looking up — the rand has strengthened and economic growth rose substantially in the second quarter of this year, raising the prospect of higher government revenues. But this will be countered somewhat by the treasury having to find an additional R2.6-billion to fund higher education.

Embattled state-owned entities have shown some improvement — the national power grid has stabilised and a new board has been appointed at SAA, which has finally released what are admittedly disgraceful results. Some progress has also been made on key reforms concerning both labour and mining.

Ratings agencies have responded favourably to the progress of the Presidential CEO Initiative, which includes a youth unemployment programme and a R1.5-billion small business fund. There is also a nine-point plan to re-energise the economy, and news of 40 priority investment projects has been received well by investors

Political green shoots are also evident, including the controversial Gupta family’s business account being closed by the banks and President Jacob Zuma finally paying back some of the public money that was spent on nonsecurity upgrades at his Nkandla homestead.

But observers say that, although there is reason for cautious optimism, all could come to nought because of an extreme political event such as the capture of the treasury orchestrated by the country’s chief liability and political wrecking ball — Zuma.

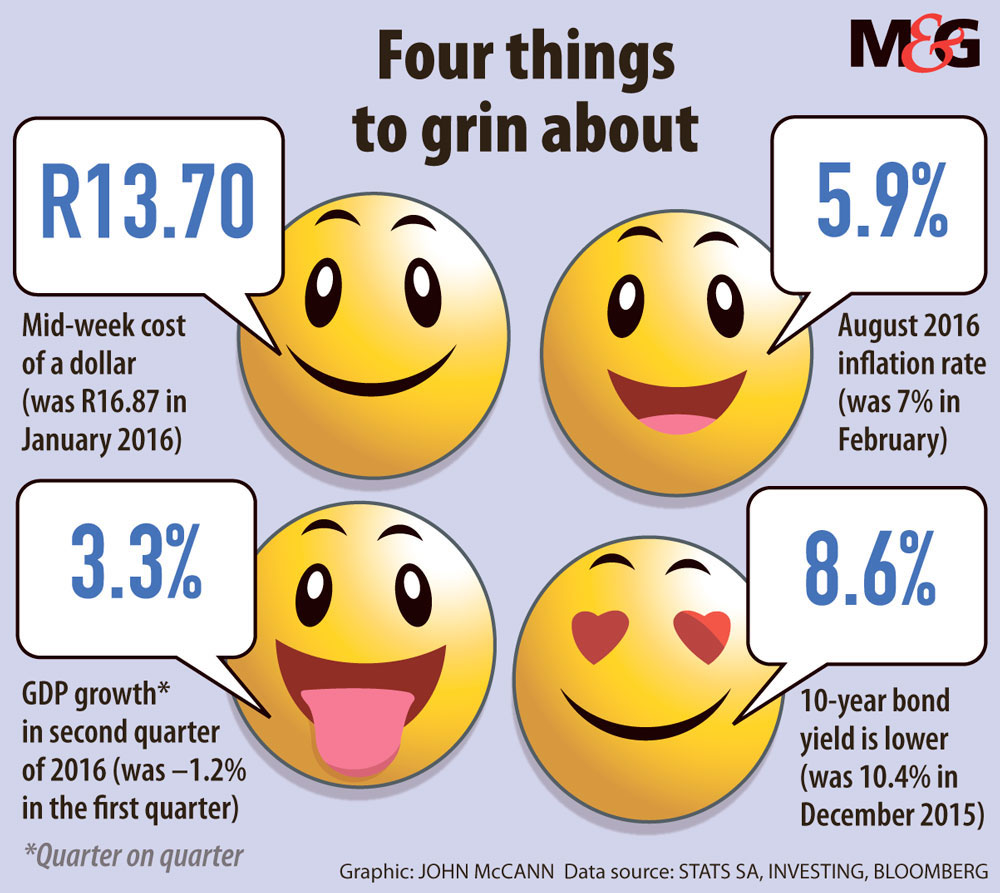

Azar Jammine, the chief economist of Econometrix, said things were looking up for the economy. For one, the growth rate has recovered. GDP results were surprising — Statistics South Africa data showed the economy grew 3.3% in the second quarter of the year, rebounding from negative growth of 1.2% in the first quarter.

Furthermore, meteorological experts expect the drought will end soon and rain will fall.

“One should not underestimate the effects the drought has had,” Jammine said. “Cumulative agricultural output declined by half in 18 months.”

Inflation is also turning out to be lower than expected, despite political turmoil, he said. On Wednesday headline inflation for August came in at 5.9%, down from 6% in July.

The rand gained ground and “that’s a reflection that money is coming into rather than leaving the country”, Jammine said, adding that the currency is still cheap by international standards, which presents an opportunity for exporting industries to do well. Consumers have also enjoyed relief because of the price of fuel, which is at 2013’s level.

“People tend to want to blame everything on Zuma,” he said. “What is dominating is the global picture and the [changing] expectations of a rate hike in the United States.”

Carmen Nel, a fixed-income strategist at Rand Merchant Bank, said: “Maybe some of the hysteria is overdone on the political side.” She estimates that about 60% of the economic movements were because of offshore developments. The rest were domestic, such as a lack of confidence among local businesses and uncertainty in households, leading to lower investment and consumer spending.

The benchmark government 10-year bond yield has tracked the currency to a strong level and, at 8.5% on Thursday, has almost entirely priced out concerns about the finance minister’s arrest after he was summoned to make a warning statement last month, Nel said.

Despite a tight budget and an ever-growing list of needs, there is general confidence that Gordhan can keep spending in check.

He will almost certainly highlight the stability of the power grid, managed by Eskom. “Although he will be pushed on how much is [chief executive] Brian Molefe’s doing and how much is [because of] lower demand,” said Peter Attard Montalto, the head of emerging markets at investment bank Nomura.

“Gordhan also promised in March to stabilise SAA. That hasn’t happened yet but the new board is in place as a positive deliverable.”

Ralph Mathekga, the head of political economy at the Mapungubwe Institute for Strategic Reflection, said the minister has to assure investors that he has control of the state-owned entities.

“This is another spending area where partnership with the private sector is possible. The environment, however, has recently been contaminated by interest groups. This makes for an unstable environment to invest,” he said.

Jeffrey Schultz, an economist at BNP Paribas Securities South Africa, said the treasury is likely to provide more detail on the “shareholder ownership model”, which will outline the legislative framework for meaningful state-owned entity reform.

“This was a key point made at the end of the recent ANC Cabinet lekgotla last month and, I think, will be an important strategy in treasury’s toolbox, which it is hoping will buy it another six months from ratings agencies,” Schultz said.

There has also been some progress on key reforms regarding labour and mining.

But Gordhan may not be able to give much detail on these, said Nel, “although government is some way down the line in adopting a national minimum wage”, she said.

But Attard Montalto warned there is a risk that some negative factors would be presented as reforms.

“The minimum wage is the most likely example of this, where Gordhan has presented it before as a labour reform but in reality it has the possibility to be very negative in an economy with 36% real unemployment,” he said.

Mike Schussler, an economist and director at Economists.co.za, said draft legislation to shorten the length of strikes is a key reform and hopefully will be in place soon. There is also an expectation that a decision about secret strike ballots will be announced.

Many of the issues relating to the Mining Charter have been resolved, although the main sticking point remains over “once empowered, always empowered” — a dispute over whether mining houses need to maintain black ownership at 26% at all times.

But the Chamber of Mines recently said the process to resolve the matter is at an advanced stage.

The progress on these reforms might be slower than expected, but it still counts in South Africa’s favour, Nic Borain, a political consultant to BNP Paribas Securities South Africa, said. “The markets are looking for signs in an environment of increased uncertainty. So these all matter as they have become a signifier of broader reform,” he said.

The credit ratings agencies are particularly worried about how South Africa will stimulate growth but the government’s nine-point plan and the priority investment projects could go some way toward tempering these concerns.

Nel said the recent progress of the Presidential CEO Initiative is also very positive.

It is a collaboration between business and the government, with the support of labour, to build confidence in the economy and reignite growth.

Last week the initative reported on its progress, which includes setting up a youth employment programme to place one million young people in paid internships in the private sector, and establishing a fund to assist small enterprises that have growth potential and to which the private sector has contributed almost R1.5-billion.

Despite its troubles, South Africa has managed to attract some major investments.

The Coega Development Corporation recently signed an R11-billion investment deal with the Beijing Automobile International Corporation — the biggest automotive investment in Africa in the past 40 years — and Bombardier Transportation’s first propulsion and control manufacturing facility for Transnet’s locomotives was also launched this year.