A tough job: Evictions in Marlboro

In the otherwise empty storehouse, an overoptimistic number of chairs are set out for today’s auction. There are just six people to bid on the property – a four-bedroom, two-bathroom house in an urban area of Johannesburg.

Along the walls, shelves dip and buckle under the weight of the case files kept here. Another hefty file, about 10cm thick, will join them soon.

The sheriff of the court stands unassumingly in front of two trestle tables and, once the Absa bank representative arrives, the bidding can begin.

He cannot be named without the permission of the South African Board for Sheriffs.

Data from the property specialist Lightstone shows the four-bedroom house was last sold for R70 000 in 2002. The municipal valuation of the house now is R320 000.

The bidding opens at R20 000 and quickly ratchets up. In just under three minutes, the sale closes at R251 000. An additional R12 700 is payable to clear the outstanding rates and taxes as well as other historical debt owed to the municipality.

Three other houses were on the original auction list but were cancelled in the run-up to the auction date – the sheriff explains later that this is normal, as people often make hasty arrangements when faced with the prospect of eviction and an auction.

The auction of this particular property followed after the owner had exhausted all avenues to get help, without success.

Investing in this kind of property can be lucrative, but it can also be a nightmare.

“If people don’t do their homework, they can get their fingers burnt,” the sheriff says. “I had one purchaser who abandoned the house [he bought on auction]. He paid up the deposit and took out a bond. But the occupants just didn’t want to budge. There was violence involved. The poor guy eventually just walked away.”

Sheriffs for different jurisdictions and different courts are appointed by the minister of justice and are regulated by the Board for Sheriffs. If they employ deputies, they must be approved by the board. Although appointed by the state, sheriffs must run their own business in line with the fees and tariffs prescribed by law. Like attorneys, sheriffs handle trust accounts. But higher education is not a qualifying criterion to become a sheriff.

Sheriffs carry out several duties, which include serving divorce papers, bringing people to court, issuing summonses and warrants for arrest, attaching assets and executing eviction orders.

Unsurprisingly, the sheriff is often viewed as the bad guy.

“I take it in my stride. I fully understood that it came with the job,” he says, noting that the job requires a thick skin and a cool head.

Rain or shine

Come economic bumps or slumps, tighter or looser regulation, the sheriff says his business has brought in a stable income over the years.

The bulk of his day-to-day work involves orders relating to unpaid debts. Until recently, emolument attachment orders (EAOs) comprised a big part of that, he says.

But following widespread abuse of these orders, which allow the deduction of debt repayments directly from a person’s salary, a court judgment in September declared that they can now only be granted by a presiding officer of the court, such as a magistrate or a judge. Issuing such orders now requires a great deal more judicial oversight.

“You know, even though as sheriffs we are supposed to act impartially, I mean, the perception out there is that we are heartless. But given the volume of EAOs we have got and the manner in which they were granted – all these issues that were brought up in the court case were things we have previously brought up with the authorities,” the sheriff said.

In his office, at least, the number of EAOs coming through has dropped by as much as 70%.

The attachment of goods is another way to recover debts – an order the sheriff must also execute.

“Those goods are then brought to my storeroom, where they are auctioned off. We do that quite often but that part of my work has dropped off a bit. After all these years, I have probably taken out everything [all types of possessions] I could possibly take out. Really, it’s as bad as that.”

He says it’s not unusual to attach goods from the same people several times. Anything ranging from appliances and lounge suites to jewellery, firearms, company shares and rental leases can be attached, but sheriffs cannot attach anything that will diminish a person’s basic human rights.

“Clothing, blankets, food and your tools of trade, up to a certain amount, we can’t take. We can’t take a bed but, of course, if it’s a hotel, it’s different.”

Hardest part

“If you ask any sheriff what is the toughest part of our job, it is to take people out of [their] homes. But unfortunately it has to be done. The eviction process means you have to take out all persons occupying that particular property, together with all movables – furniture and things like that – and virtually put those things on the pavement … on the pavement!”

The sheriff says he and others have approached the department of justice requesting that a more humane approach be taken, as in some other countries where items are housed in municipal compounds.

“I suppose the department may have more urgent things to deal with but so far this sort of appeal has fallen on deaf ears,” he says.

Head of the deputy minister of justice’s office, Nicholas Maweni, said the matter has not been raised directly or officially with the department of justice and constitutional development by the sheriffs.

However, “if items are to be placed in storage, who is to pay for that storage? The judgment debtor already has no money as his/her goods are being attached, and to expect the judgment creditor or the sheriff to carry the costs is unreasonable,” Maweni said.

He said, the South African Rules Board for Courts of Law is currently finalising the amendments to rules relating to execution, and judicial oversight which will be released before the end of the year.

The emotional nature of an eviction means police need to accompany the sheriff in executing such an order. An increasing degree of lawlessness has also made a police presence vital.

“Believe you me, I have had petrol bombs placed under my vehicles. I have had my deputy attacked with an axe. The role of police is to stand by and ensure all parties are protected. But they are not expected to pick up a teaspoon.”

But a lack of police assistance has frustrated evictions this year.

“In my area, because of a lack of police assistance, I have not been able to successfully evict anyone for months.

“Everything came to a standstill, I thought, because of the local elections. But now the local elections are over and I still can’t make any headway with the SAPS [South African Police Service].”

In a presentation to a recent Board for Sheriffs workshop, the South African National Association of Progressive Sheriffs (Sanaps) said: “Many sheriffs have not received any assistance from the SAPS since March 2016 … It would seem no local SAPS has access to the SAPS’s legal department, which verifies the authenticity of all court orders where police are required for assistance,” the association said. As a result, one sheriff is being sued for damage to a building because of his failure to evict the occupants, it noted.

The SAPS did not respond to questions on the matter.

Breaking down

The sheriff sees lawlessness as filtering into all quarters. For example, he says, an increasing number of fraudulent eviction orders are doing the rounds. He received one recently.

“People are taking the law into their own hands. Possibly, landlords are frustrated in getting a legal court order and so go and get an illegal eviction order.”

Others with legal orders see the sheriff taking no action and so might decide to take the law into their own hands.

In the presentation to the board, Sanaps said: “We have heard instances of self-help [where] parties would use forged court orders for evictions – at times with the assistance of rogue SAPS officers after hours, during weekends, in the evenings, whilst it rains and/or in midwinter – and the sheriff is then blamed for this inhumanity.”

The matter has also become politicised with party-affiliated community members interfering in evictions. The sheriff recalls cases where the rightful occupants have been placed in their homes, only to be kicked out by the community after the sheriff has left.

Sheriffs can, and have been, suspended and criminally charged if they are found to have misused their position.

“I believe this lawlessness is about a breakdown. There is a breakdown in government. Everything is linked in one way or another, and people will sometimes take the law into their own hands because they are so frustrated,” the sheriff said.

“That’s why I say buying a house on auction is risky. We have moved to the point where the government has placed all its obligations it owes to its citizens on the landlord.”

The legal route may not be all that easy but it is not used enough, the sheriff says. If you approach the courts, you could possibly save yourself from eviction.

“Of course, I feel for these people,” he says. “But it makes me so angry; you come to me as a sheriff and, when I ask you to approach the court, you sit and do nothing and rather fight with me in the street.”

The Board of Sheriffs’s code of conduct prohibits sheriffs from speaking to the media about their office without permission from the board. Attempts were made to get permission, but this had not been granted by the time of going to print

Staving off auctions is their bread and butter

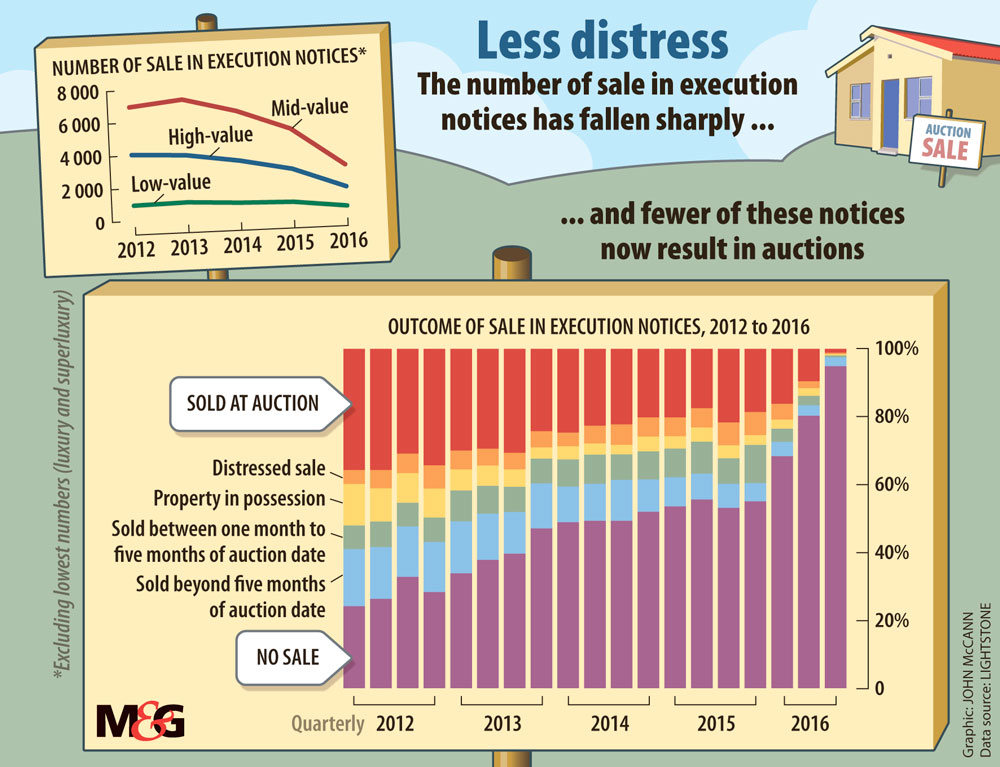

In a stagnant economy you might expect property auctions to be on an upward trend but, according to data provided by Lightstone, this sales method is in fact declining. For all properties in all value categories, sales-in-execution notices declined from 12?930 in 2012 to 9?340 in 2015, with 5?170 notices in 2016 so far.

The number of notices that end in an auction are also significantly lower than in 2012. The statistics show that the majority of sales-in-execution notices this year have resulted in no sales.

The head of real estate at Lightstone, Hayley Ivins Downes, says the trend is the result of factors such as a slowing market and more available assistance for distressed homeowners. It also stems from tighter credit regulations when assessing affordability, as well as debt counselling being implemented, Downes says.

Contributing to the declining property auction trend is Problem Bond, which assists those at risk of losing their homes to the banks.

Every Friday all sales in execution are advertised in the Government Gazette, of which there are roughly 250 a week, says Problem Bond managing director Johan Muller. The company then traces the homeowners to offer its services in helping them to avoid an auction.

Usually when homeowners receive a summons, they do nothing because they believe they have no other recourse because they are already in arrears, Muller says. “Unfortunately, then the law takes its course. Many of our clients don’t receive the summons; they are un-aware of the judgment because the sheriff just chucked it somewhere. Sometimes they just wake up and there is an auction.”

A sheriff, speaking on condition of anonymity, says the manner in which summonses can be delivered is regulated by law. And before a court awards a judgment, it has to be satisfied the other party has been given notice.

But Muller estimates about 60% of homeowners are unaware of the pending sale in execution when they are approached by Problem Bond.

A common solution the company provides is helping the client to restructure their loan with the bank. In many cases, Problem Bond has been able to have auctions cancelled by showing that the bank has debited legal fees against the bond account or changed the interest rate, Muller says.

The company takes on about 18 such clients a week, he says – those who can pay the required service fees – and has a success rate of between 70% and 80%.

In the event that a property does go to auction, the client can seek an interdict.

“We refer them to attorneys but that’s a costly process. Sometimes clients are between a rock and a hard place. Their case may have good merits but they don’t have the funding.”

Pieter Bezuidenhout* has had a running battle since the auction of his house in 2014. He had made arrangements with the bank to keep up with his bond repayments, so he was surprised to find his house up for auction. The selling price was not enough to cover the outstanding debt, and he was still responsible for the shortfall.

Confident he had been wronged, he refused to move from the property while Problem Bond took his matter to the high court.

“Just after the house was sold, the new owner came and threatened me,” he said. “Later they came to my house and broke the windows. They took off the doors and taps and even the palisade fencing.”

At another time, the new owner was granted an attachment order for the financial losses suffered, and was able to have the sheriff attach and sell Bezuidenhout’s assets.

This year, Bezuidenhout’s case succeeded in court.

“They [Problem Bond] picked up that the bank never had the right to put my house on auction. They were also charging me excessive rates.”

* Not his real name