British demonstrators protest against tax avoidance. In South Africa

Zeroing in on the super-wealthy and tax reluctant remains at the top of the global agenda as budgets across the world grow increasingly hungry for extra revenues. Now a draft report from the Davis tax committee makes recommendations that will help South Africa close the gaps exploited by tax avoidance schemes.

The report warns that jumping the gun could be counterproductive and deter investment.

The 300-plus page report went largely unnoticed, having been released for comment by the treasury-appointed tax committee on December 23. It puts forward suggestions South Africa could implement as part of the global effort to clamp down on tax avoidance, which is said to cost the country billions of dollars each year.

The recommendations include measures to address concerns related to the digital economy, transfer mispricing and treaty abuse.

The Davis document responds directly to an Organisation for Economic Co-operation and Development (OECD) report that outlines seven deliverables for countries to counter base erosion and profit shifting (Beps) – tax planning strategies that multinational corporations use to exploit gaps and mismatches in tax rules to lower their tax liability.

Among the myriad recommendations, the Davis report suggests that nonresident companies with South African-sourced income should submit income tax returns even if they don’t have a permanent establishment; that South Africa must allow for spontaneous information exchange pertaining to tax rulings with other tax authorities across the globe; that treaties with zero or low withholding tax be renegotiated; and that the submission of transfer pricing documents by corporates become compulsory for those with a turnover of R1-billion or more.

Concern is expressed over treaties that aim to prevent taxation in each of two jurisdictions but often end up allowing for no taxation in either. For example: “The treaty with Switzerland was renegotiated and now provides a tax credit for foreign tax suffered by South African residents in Switzerland.” The report does not offer a specific recommendation here.

Speaking to the Mail & Guardian this week, Judge Dennis Davis, chair of the tax committee, said renegotiating treaties was not an easy process.

“But in the report we do indicate there may be some consideration given to renegotiating.” The art, he said, was not to curb legitimate investment or trade.

Compared with some OECD nations, South Africa appears ahead of the game in pondering the Beps action plan. However, the Davis report stresses that South Africa needn’t follow the OECD countries slavishly or attempt to “reinvent the wheel”. Most importantly, it should wait and see what the OECD nations decide to do first as further deliverables are expected in 2015.

The Davis report said the OECD Beps measures should not be adopted without considering the need to encourage foreign direct investment in light of the National Development Plan and the need to preserve the competitiveness of South Africa’s economy internationally.

The report warns that South Africa therefore should not pre-empt or unilaterally respond to Beps’s action points until OECD member states have reached consensus and clear guidance is issued because competitiveness is at risk when countries act alone.

The concern is valid – some nations are forging ahead. Accounting firm Ernst & Young’s Global Tax Policy Outlook for 2015 said respondents report that more than six in 10 countries are making some form of Beps-related tax reform, before the Beps recommendations are in full and final form.

More deliverables are expected to be released later this year.

“I think it’s unfortunate that some countries and some issues are proceeding before waiting for the finalising of the OECD Beps report”, said Dan Lange, global tax leader at auditing firm Deloitte. “It will introduce complexity.” Lange said the OECD had met previous deadlines and should be done at the end of their calendar year, “so it’s a relatively short period of time to wait for clarity”.

Everyone on board?

“People are saying the current Beps project is driven by OECD members but doesn’t apply to developing countries,” said AJ Jansen van Nieuwenhuizen, tax partner at Grant Thornton. “There is a competing agenda.”

Lange said he thought the concern about developing countries was legitimate when the OECD started the process, but following extensive consultation, believes this was no longer the case.

“I think on a number of the issues that the OECD is looking at, there will be consensus. The biggest area where OECD is going to have a very hard time reaching consensus will be especially on issues in developing countries.”

Said Davis: “Where there is an affinity in interests between developed world and developing world, that is where action will take place.”

Ernest Mazansky, head of Werksmans tax practice, said his biggest concern was that South Africa’s capacity would pose a problem in drafting necessary changes and implementing them.

“This is a problem at treasury, Sars [South African Revenue Service] and even in the private sector,” he said.

“It’s an enormous number of pages, and it’s just one of Davis’s reports. There are others issued and yet to be issued. With these capacity constraints, how much of this will see the light of day?”

Mazansky noted that much of what was being discussed was not new. “Treaty shopping is as old as the hills, the idea of having antishopping provisions goes back decades – so it’s a matter of looking at what they have done in the past, and asking what can they do better.”

Mazansky said it was well known that hybrid entities result in double nontaxation.

“When the House of Commons got their knickers in a knot at the likes of Starbucks and Amazon for using Luxembourg as a way of saving themselves tax payable in the UK, there was a question I kept asking: Did Her Majesty’s Revenue and Customs not know what the double taxation agreement that they signed actually meant?” said Mazansky.

“When Sars negotiated the double tax agreement with Mauritius, did it not know how Mauritius makes its living?

The quantum of the tax gap

The financial impact of base erosion and profit shifting is a risk to South Africa, but is hard to quantify as yet. A study by Global Financial Integrity found South Africa is one of the top 10 countries in the world that suffers illicit outflows, having lost more than $122-billion over 10 years.

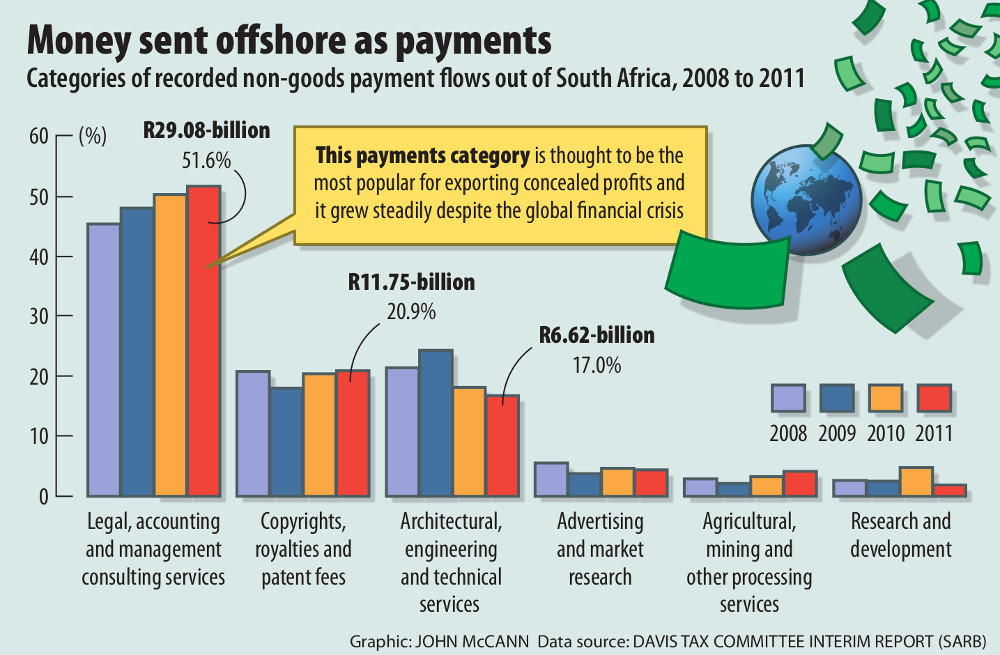

In an effort to make sense of the magnitude of the Beps problem in South Africa, the Davis report makes reference to data from the South African Reserve Bank and Sars that provides an indication of the extent of payments directed offshore. The timeframe under consideration covers the period of the financial market meltdown and the immediate aftermath.

The trends show that, overall, just after the financial crises in 2008, outflows increased by nearly 25%.

“It is a well-known fact that the South African economy did not feel the full brunt of the aftermath of the financial crises but it seems peculiar that legal, accounting and management consulting services increased by nearly R6.5-billion (an increase of 32.6%) and engineering and technical services by R3.7-billion (an increase of 39.5%),” according to the report.

“Consumption increases during the aftermath of a global financial crisis seem odd in the wake of sluggish economic activity, uncertainty and falling commodity prices. Cognisance of the bill for the 2010 World Cup must be considered, but the quantum of these monetary flows might not be explained by a singular event.”

This is highlighted in the graph (left), which shows that, since 2008, legal, accounting and management consulting services increased disproportionately in relation to other nongoods payments.

Davis said the outflows were “unusual” and would be “amber lights” for any tax practitioner.

“People may have repatriated their rands – but why would management fees increase rapidly? Because they were inflating expenditure at the same time,” he said.

Transfer pricing abuse in legal, accounting and management consulting services is “the classic way these companies avoid tax”.