A survey by Accenture indicates high interest in next-generation in-car technologies among drivers in emerging economies, which could help shape future demand for sales and provide the automotive industry with a sustained revenue stream.

However, across five major emerging markets, South Africans were the least likely car buyers to let their decision be influenced by in-car technology.

Accenture surveyed over 14 000 drivers in 12 countries, including South Africa, on their current use of in-vehicle technologies and expectations for future use.

Areas covered by the survey included navigation and traffic services; a range of autonomous driving aids; in-car services, including entertainment, work tools and learning; safety services; black box-type monitoring of a person’s driving patterns that can help reduce insurance premiums; and a number of passenger-related services.

In-car technology is rapidly becoming a key car-purchasing criterion.

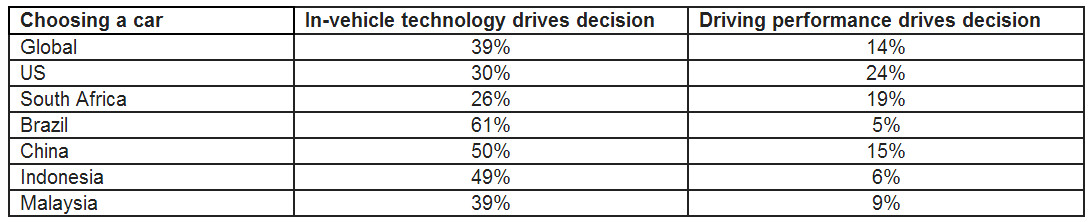

Globally, drivers are twice as likely to choose a car based on in-vehicle technology options than its driving performance.

Interest

While South African tends to emulate mature markets, the interest in in-vehicle technology was far more pronounced in other emerging markets, as tabled below.

In South Africa, there is strong interest in a number of aspects of autonomous driving, primarily in relation to safety features. South African interest outweighs that of the other countries surveyed in terms of:

- Night vision device – 83% of South Africans interested in this technology, 67% globally

- Front/ rear-end collision alarm warning – interest of 82% in South Africa, 72% globally

- Lane changing warning systems/ blind spot warning system – 80% interest in South Africa, 62% globally

- Fatigue warning device – 65% interest in South Africa, 53% globally

- A system that allows the passenger to stop the car if, for example, the driver suffers a heart attack – 62% interest in South Africa, 51% globally.

South Africans are the current highest users of vehicle tracking services at 34%, versus 17% globally.

South African drivers also have the highest interest in access to a breakdown call system at 86% (global average is 77%), and driver support technology that identifies traffic signals, congestion and accidents – 89% of South Africans would like the technology, versus 76% globally.

The research also uncovered strong interest among consumers in vehicle health reports and vehicle lifecycle management services. While only 7% of South African drivers surveyed said they currently use a vehicle health report and 8% use vehicle lifecycle management services, 40% and 35%, respectively, expect to start using these services soon.

New revenue stream

According to Accenture, OEMs that are able to tap into this demand could open up new revenue streams around maintenance-related technology and engine and parts wear and tear.

Says Ciaran Seoighe, managing director: automotive, Accenture SA: “There is high consumer interest in connected-car technologies, particularly in the emerging markets. South Africans in particular are already the highest users of vehicle tracking services and show the highest demand of all consumers surveyed for additional safety features.

These include automated emergency alerts in the event of a crash, fatigue and lane changing warning systems as well as collision avoidance capabilities. The challenge in South Africa will be to provide the support and infrastructure required to meet this demand in the short-term.”

The local car market that is expected to have minimal growth in sales this year. The National Association of Automobile Manufacturers of South Africa is forecasting overall sales to rise by only 0.2% to 652 000 units from 650 620 units last year. – Gadget.co.za

Follow Gadget on Twitter on @GadgetZA