Uncertainty over a credit rating downgrade could be one of the issues weighing on the country’s major banks.

Despite providing exceptional results in tough times, South Africa’s biggest banks have failed to convince investors of their resilience and their market valuations remain disproportionately cheap.

The PwC major banks analysis, which collates the results of South Africa’s “big four” banks, was released this week. It shows that, for the first half of 2016, the banks managed to boost their operating income by 13.3% and their headline earnings by 5.7% despite challenging conditions, including increased expenses.

Johannes Grosskopf, PwC’s financial services industry leader for Africa, said it was “remarkable” that the banks – Barclays Africa, First Rand, Nedbank and Standard Bank – had delivered such good results over the past six months.

It doesn’t appear to mean much to the market, however, and bank shares are relatively cheap.

Shares most susceptible to domestic developments are those that earn their money in South Africa, such as retailers. But it’s the banks that are bearing the brunt of a slowdown.

A company’ market valuation is measured by the price-to-earnings (PE) ratio. This is the company share price divided by its earnings per share. A higher PE ratio typically indicates a high investor confidence in a company.

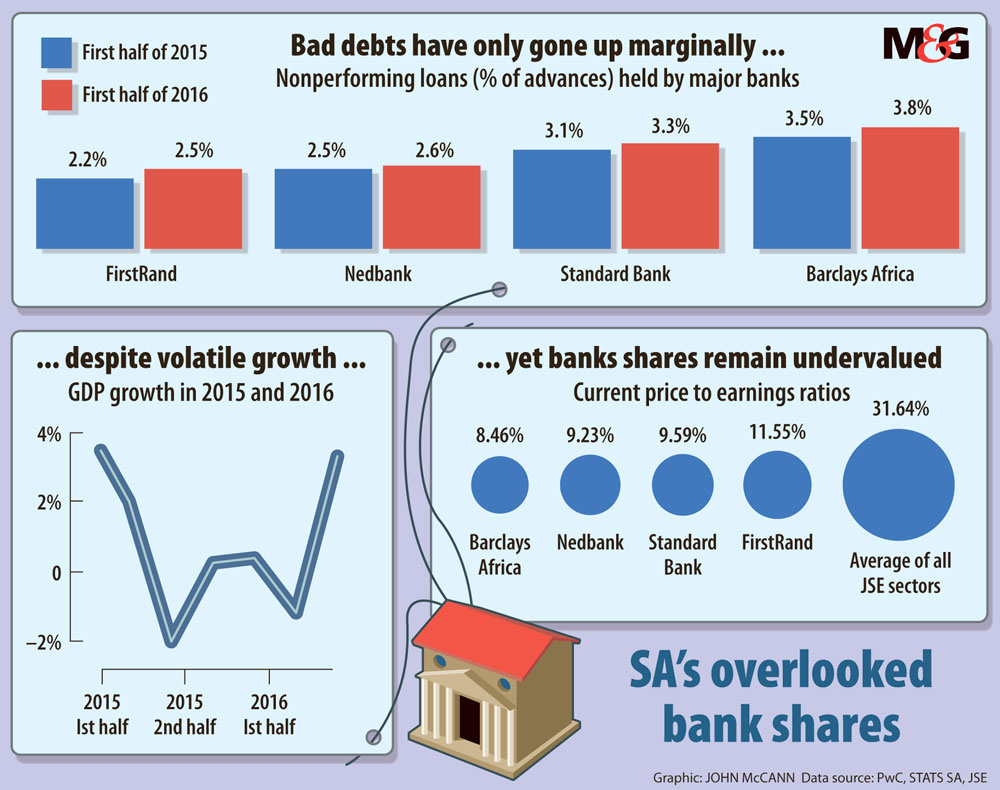

According to the JSE, its average PE ratio is 31.64. But South Africa’s big banks have much lower ratios. Barclays Africa has a PE of 8.46, Nedbank has 9.23, Standard Bank 9.59 and First Rand, which fares better, has a PE of 11.55.

Among retailers, by contrast, Shoprite has a PE of 20.45 and Pick n Pay is at 31.45.

Wayne McCurrie of Momentum Wealth said the banks are extremely cheap at these levels. “Why banks in particular, I’m not sure. It’s inconceivable retail shares have such a massive PE.”

Sasfin’s David Shapiro said: “It’s odd they should be at these levels but the retailers they service are not. They [the banks] are in good shape [considering] things are tough for them. It’s hard to extract revenue in that kind of climate. Overall, our banks have produced pretty good results.”

McCurrie said PEs of eight, nine or 10 are indicative of companies going through tough times. Not many others are at these low levels except for the most embattled companies in the subdued construction and mining sectors.

Nico Smuts, an analyst at 36ONE Asset Management, said bank earnings have so far held up better than many expected but there are several reasons to remain cautious.

For one, slow economic growth and a weak labour market tend to go hand in hand with an increase in bad debts. “A relatively small increase in credit loss ratios can have a big negative impact on earnings,” he said.

The major banks have begun to show stress in this regard. Growth in loans and advances has slowed and the impairment charge incurred by the banks grew 29.3% in the first half of the year. But nonperforming loans as a portion of the total loan book were at 3.1%.

Grosskopf said it’s the first time since PwC started the South African banks analysis that all portfolios have seen an increase in bad debts, although this was expected.

“Rising interest rates are not good for banks. It becomes more difficult to issue loans and you start to see bad debts coming through,” McCurrie said. But the outlook for banks should improve.

“The interest rate increase has been normal, though. We must be very close to the top of our interest rate cycle and we will see inflation falling next year, hopefully.”

Because banks are such big players and enablers of transactions, a low-growth economy becomes a tough environment for them, said Jan Meintjes, the portfolio manager of Denker Capital.

“At the end of last year, after so-called Nenegate [when the finance minister was unexpectedly removed from his post, causing panic in the market], there was a huge derating of the banks, where they were valued at the same levels they were at around the financial crisis,” he said.

McCurrie said that, on a valuation level, banking shares are now within 20% or so of where they were at the height of the financial crisis.

Costa Natsas, the financial services risk and regulation leader at PwC Africa, said banks at the height of the economic crisis were better cushioned by low inflation and interest rates. In the current inflationary and rate-hiking environment, the pocket of the consumer is being hit.

But Grosskopf argued that banks today have better buffers to absorb bad debt, they have moderated their extension of loans and have been more stringent on the pricing of loans for riskier customers.

Smuts said that, over the past year, the country has seen a sharp rise in both economic and political risks, exacerbated by the spectre of a potential sovereign credit rating downgrade, and banks are particularly sensitive to these risks.

“A sovereign downgrade could result in higher funding costs, which translate into lower lending margins where these costs cannot be passed on to customers,” he said.

Shapiro said the skewed valuations could also be the result of foreign investors favouring retail shares rather than banking shares in the South African market.

Meintjes said banks might always have a lower valuation than retailers because, in general, the return on equity from the retailers is much higher.

The return on equity for banks, according to the PwC analysis, was 17.6% for the first half of 2016. But retailers operate on a return of equity ranging from the mid-20% level up to 40%, Meintjes said.

Shapiro said the bank valuations might also be influenced by the cheapness of other banks, such as those in the United States and the European Union, which have been affected by low and even negative interest rates.

“If you go to Wall Street now, the worst hit have been the banks,” he said, noting that, on a 12-month basis and at a time when major stock exchanges have hit record levels, American Express is down 12%, Goldman Sachs is down 8% and Citibank is down 8%.

South African banks offer value, Meintjes said, although the problem is the risk of things going wrong.

“There is uncertainty of the policy response to downgrade,” he said. “In the medium to long term, there is good value, [but] there is risk over next six months. There is a big possibility you may be able to buy them cheaper.”