A conveyor belt that will be transporting coal from the mines to Medupi.Lephalale is bursting out of it seams as construction of Eskom's Medupi Powerstation is underway a few kms away.

The storm over nuclear may continue to rage but, until a new Integrated Resource Plan (IRP) replaces the current but outdated one produced in 2010, 9 600 megawatts (MW) of nuclear power is officially part of South Africa’s energy future.

Speaking to the Mail & Guardian this week, the head of electricity regulation at the National Energy Regulator of South Africa (Nersa), Thembani Bukula, said the plan to procure large-scale nuclear power was signed off by the department of energy and Nersa in 2011.

In accordance with the Electricity Regulation Act, the minister of energy, with Nersa in agreement, must decide on the amount of additional power required, how it will be generated, to whom it will be sold and who will buy it, and on the establishment of competitive tenders.

The minister’s responsibility is the stability of electricity supply and Nersa’s is to monitor its affordability, Bukula said.

South Africa faced a power crisis when the existing IRP was agreed upon in 2010. Nersa concurred with the IRP 2010-2030 (or as updated), signed under the tenure of then energy minister Ben Martins. In it, 9 600MW of nuclear power was agreed upon. Although the IRP is required to be updated every two years, the 2010 IRP has yet to be replaced by the department.

Industry insiders say it is continually being sent back to the drawing board because computer modelling shows the country does not require as much nuclear power as envisaged in 2010, and will not require it soon. As a result, the much lower cost of renewables now means that green power, not nuclear, should be prioritised.

Some analysts fear an expensive and poorly-run nuclear build will cripple the economy, and there are grave reservations about the motives behind the push for nuclear.

An affidavit submitted to the public protector by Deputy Finance Minister Mcibisi Jonas, and leaked to weekend newspapers, reportedly claimed the politically connected Gupta family offered him R600?000 in cash and a further R600-million to be paid in instalments on condition he supported the nuclear build programme.

Meanwhile, Eskom has grown increasingly vocal in its support for nuclear.

The IRP in effect says the nuclear power will be procured by the state (specifically the department of energy) with Eskom only as the buyer.

In August, the utility insisted it would not build nuclear but could operate it. But Energy Minister Tina Joemat-Pettersson recently disclosed in a parliamentary briefing that she would recommend to the Cabinet that Eskom be appointed as the procurer, owner and operator of the new nuclear energy build programme as per the Nuclear Energy Policy of 2008.

Bukula said, although Nersa agreed for the state to procure nuclear energy, the current law has not yet been amended and still, in effect, designates Eskom as the only entity to procure all the power. Whether it has the capacity to do so is subject to fierce debate. (See “Would you trust Eskom?”, below].

The renewable energy industry fears that Eskom’s growing support for nuclear will result in independent renewable projects being sabotaged.

Anton Eberhard, a professor at the University of Cape Town’s Graduate School of Business, said nuclear would only be viable if the procurement of renewable energy was constrained, as reported in an opinion article in the Business Day this week.

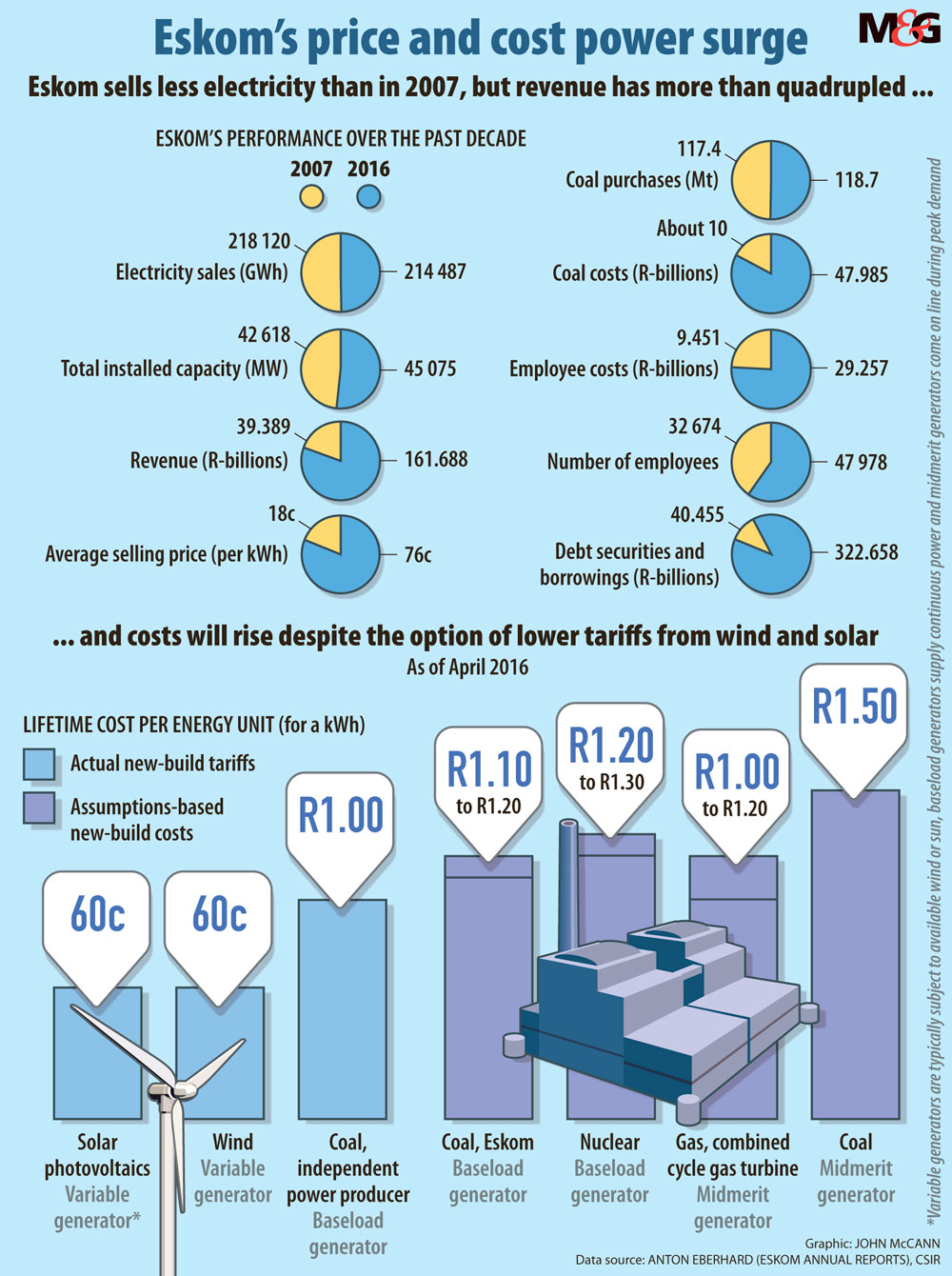

Eberhard said Eskom produces less electricity than it did 10 years ago but it employs 50% more staff, its coal costs have trebled, and its tariffs and revenues have increased fourfold.

Over the past 12 years, it has lost its investment-grade rating and, as a result, raising capital is more difficult and expensive. It has 10 times more debt than a decade ago, and its new coal power stations are not even half-built.

“Within this context, it is flabbergasting that Eskom now plans to rush the procurement of a fleet of new nuclear power stations,” Eberhard said.

Eskom has insisted it is not refusing to sign power purchase agreements for independent renewables projects but is simply seeking clarity on the matter.

But last week the South African Wind Energy Association (Sawea) laid an official complaint with Nersa, claiming that Eskom is refusing to enter into power purchase agreements and therefore is contravening ministerial determinations to diversify the energy mix and also its own licensing conditions.

Sawea has requested that the regulator fine Eskom 10% of its daily annual turnover for each day it delays the continuation of the renewables programme.

Bukula said Nersa can only react if it receives a letter from Eskom stating it will no longer sign power purchase agreements, which it has not.

Bukula’s contract, which has come to an end, has been extended for up to a year until the minister of energy appoints a replacement.

While Nersa waits on clarity from Eskom, already one major renewables manufacturer, SMA Solar Technology, has closed its South African factory. In a letter to the government it cited Eskom’s “shocking statements” and the government’s lack of commitment “to create a sustainable business environment and promote foreign direct investment”.

Eberhard warned that, should the Cabinet and Eskom rush into the procurement of nuclear power, a legal challenge will quickly be launched.

And it is likely to be challenged at every turn.

Already Earthlife Africa and the Southern African Faith Communities’ Environment Institute have launched a legal challenge against the department of energy, asking for the intergovernmental agreements between South Africa and Russia be set aside if proper processes have not been followed. The applicants claim South Africa has signed a binding nuclear with Russia.

The trial is set down for December 13 and 14.

Would you trust Eskom?

The minister of energy wants Eskom to procure nuclear power, but industry experts are divided over whether the utility could handle the undertaking.

Independent energy consultant Doug Kuni said Eskom does not have capacity to do it and is “totally incapable” of executing a large nuclear programme. “Eskom has a junk rating, and how big is the hole before they can get out of junk? Nobody knows,” he said.

Andrew Kenny, also an independent energy consultant, said it’s logical for Eskom to co-ordinate the nuclear build. “Eskom has all the expertise,” he said. “It’s true it hasn’t built in a long time and it hasn’t had the most continuity, but it would be mad for anyone else to have it.”

Kuni pointed to the mess of the mega-coal builds Medupi and Kusile, which are years overdue and significantly over costs. “How do you expect them to execute nuclear? Would you like to take a call on the first unit coming on line in 20 years?” he said. “There is some 9 000 megawatts not yet commissioned from Medupi and Kusile, so what will we need nuclear for?”

Kenny acknowledged Medupi and Kusile do not inspire much confidence. “They were built in a panic and they didn’t think things through properly.” But, he argued, much of the problem was because they are once-off power stations. He said nuclear vendors, with tried and tested designs, would eliminate this risk.

Eskom says it could pay for nuclear with estimated cash reserves of R150-billion in 10 years’ time.

Kenny said it is appropriate for nuclear to be funded off Eskom’s balance sheet and not from the fiscus. “It should not use a cent of taxpayer money,” he said, suggesting it could be funded through debt.

But Kuni argued Eskom will need a viable economy to sell the energy to: “Where does the tariff have to go for you to have R150-billion? You will kill the economy with high power prices,” he said.

Utility eyes an expanded nuclear role

Eskom does not see the introduction of the independent power producers (IPPs) as a threat or something that will “displace” its current fleet.

All the energy sources will be implemented at a scale and pace that the country can afford, it said. It supports the role the IPPs play and remains committed to facilitating their entry.

“We are pushing for an energy mix that includes renewables, coal, nuclear and other sources as determined by the national policy framework,” it said.

It said the department of energy will remain the nuclear policy co-ordinator for the nuclear build programme and the Cabinet will discuss the proposal that Eskom will become the procurement agent for the country’s nuclear power programme.