According to the Association for Savings and Investment

Parts of South Africa's investment industry are thriving despite a weak currency, a sluggish economy and over-burdened consumers.

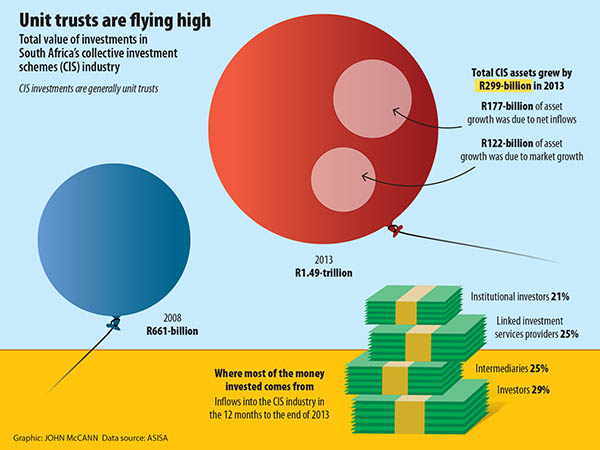

According to the Association for Savings and Investment (Asisa), assets under management in the collective investment scheme industry — which typically refers to unit trusts — have doubled in the past five years.

At the end of December last year, investors had almost R1.5-trillion invested in the industry, more than double the R661-billion in assets under management in 2008.

The statistics, released by the association this week, show investments also increased fivefold over the past 10 years.

According to the Financial Services Board, collective investments are financial vehicles in which many different investors put their money or pool it into a portfolio that is managed and invested by professional investment managers.

According to Asisa, the bulk of the inflows to the collective investment scheme industry in the 12 months to the end of December 2013 came directly from individuals (29%). Intermediaries, such as independent financial advisers, contributed 25%.

A remarkable upward trend

Linked investment services providers (companies that enable clients to invest in a wide range of collective investment schemes) generated 25% of sales and 21% was received from institutional investors such as pension and provident funds.

Leon Campher, chief executive of Asisa, said the increase in assets under management in unit trusts was not just attributable to new inflows but was also partly owed to market performance, which has seen a remarkable upward trend since the crash of 2008, which caused the JSE to decline 46%. But last year, its top-40 index hit a string of record highs and gained 19% in that year following 22% in 2012.

From December 2012, assets in the industry grew by R299-billion to R1.49-trillion at the end of December 2013, of which the net flows were R177-billion; R122-billion was because of market growth.

Geoff Blount, the chief executive of Cannon Asset Managers, said the buoyant equity market has led to a natural increase in assets.

But part of the market has become expensive and is being driven up by a few narrow shares.

"This is about multiple expansion [when the price-to-earnings ratio goes up because investors value those earnings more highly and will pay more for them]; it is not reflective of the real economy," Blount said.

Rand's depreciation drives up the shares

He added that the rand's depreciation in the last quarter of 2013, slumping from R10 to the dollar to R11.11 in three months, also helped to drive up the shares of some big players earning in foreign currency and listed on the JSE. So the increase in assets does not always mean that people have been putting more away each month.

But the R177-billion in net inflows far exceeded the previous record net inflows of R120-billion achieved in 2012, Campher said.

"While the strong run of the equity market has certainly played a role in the growth of collective investment scheme assets, unprecedented net quarterly inflows in recent years strongly bolstered assets under management," Asisa said in a statement.

By and large, the inflows are from South Africans.

"There is some offshore money which comes in but that tends to go into managed portfolios," Campher said. New money is also coming from disinvestment in other options as unit trusts have begun to attract more people, he said.

"With a low interest rate regime over the last number of years, we have seen interest from people who have traditionally invested in deposits going out of that and typically investing in multi-asset class funds."

A unique investor preference

South Africa's multi-asset category consists of 522 portfolios and holds almost half of the total industry assets. It attracted R113-billion in net inflows in 2013.

Campher said that investor preference for multi-asset portfolios appears to be unique to South Africa. Internationally investors tend to opt predominantly for equity funds, followed by bond funds.

In an Asisa press release, Campher said: "Local investors tend to be more risk averse and are more easily spooked by market volatility."

At the end of December 2013, the local collective investment scheme industry offered investors a choice of 1 062 portfolios.

"Unit trusts in South Africa have been in the sweet spot as the retail saving vehicle of choice … it has come off a low base and growth has been rapid and consistent," said Jaco van Tonder, sales director of Investec Asset Management.

Van Tonder said the performance of the market has underpinned some robust growth, which has made people who do save more keen to save.

Market experiences a downturn

"It is quite odd in an environment like this to see a certain asset pool growing quite strongly."

But this year the market has experienced a downturn as a result of investors moving money from emerging markets back into recovering developed economies. This will cause a reversal in the macroeconomic environment, Van Tonder said.

But in the next five to 10 years, he believes South Africa will still see "pretty robust growth" in investment, but perhaps for different reasons, such as steps being taken by the government, including structural reform, to increase saving.

Despite the money flowing into unit trusts, South Africans are still considered to be poor at saving, with their savings equating to 13% of gross domestic product in 2012. It is 51% in China and 34% in India, according to World Bank data.

Hedge funds attract old money

The hedge fund industry enjoyed steady growth in 2013 with assets under management reaching R46.5 billion — a 30% increase for the 12 months ending December 2013, data from the Association for Savings and Investment South Africa (Asisa) shows.

Hedge funds are traditionally the preserve of high-net-worth individuals. But Robert Foster, convenor of the Asisa hedge funds standing committee, said new money is flowing into the industry as a result of a new regulation in the pension fund industry that allows pension funds to invest a portion of their investments in hedge funds.

"[The year] 2013 has definitely seen certain retirement funds take a position in hedge funds," he said.

South Africa's domestic pension fund industry is ranked among the top 15 largest in the world and is estimated to be worth more than R1-trillion.

Besides this, given that the hedge fund industry is equity-centric, part of the increase will have come from the good performance of underlying investments in equity markets, which performed well last year.

Incoming legislation proposes that the regulatory framework for hedge funds should be effected through the existing Collective Investment Schemes Control Act.

Foster said this would be the last piece of legislation to assist the hedge fund industry to become part of the mainstream and to allow the industry to have similar levels of diversification and protection as unit trusts do.