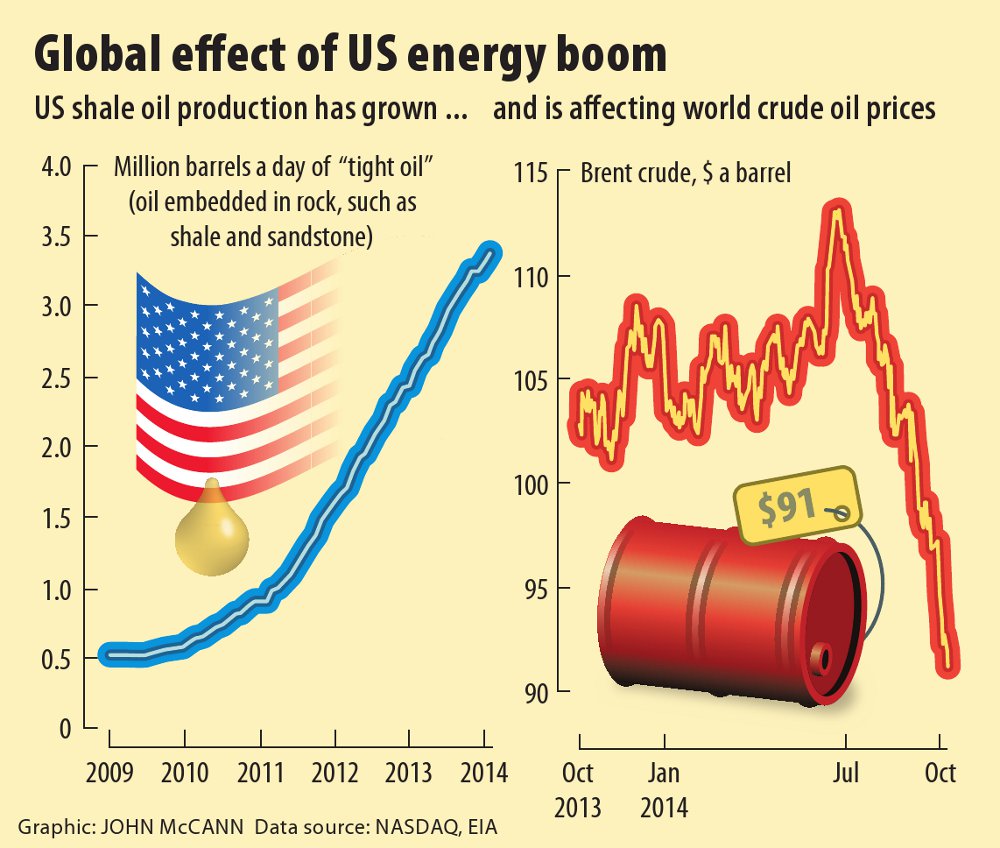

Shale oil has sparked an energy boom in the US.

Warnings about dwindling oil supply paired with an ever-bolder self-proclaimed Islamic State should mean a higher oil price. Instead, the price this week hit a three-year low of $91 a barrel owing to supply and demand dynamics that are proving stronger than geopolitical tensions.

Oil prices have been ramping up since the 1980s, when demand outstripped supply, and skyrocketed to $147 a barrel in 2008 before the recession took hold. As the global economy picked itself up the price has bounced between $100 and $120 since 2011.

Now the price has fallen by more than 20% since June. Demand is subdued as alternative oil comes on line and Saudi Arabia responded, oddly, by cutting the price further.

“Looking at offshore and onshore oil produced through normal extraction technologies, regular conventional oil production has been largely flat since 2005,” said Jeremy Wakeford, chairperson of the Association for the Study of Peak Oil South Africa.

What has changed the picture dramatically is shale oil, which, like shale gas, is extracted through hydraulic fracturing (or fracking) and both have driven an energy boom in the United States.

Top producer

The US, previously the second largest importer of crude, this year surpassed Saudi Arabia as the largest crude oil producer in the world.

“US shale oil production – it’s up to about 2.3-million barrels per day at the moment and that has been gradually ramping up,” Wakeford said. “In North Dakota oil production is ramping up month on month.”

A 2013 PwC study on the impact of shale oil on global oil prices found a potential 14-million barrels could come on line by 2035 and could see the price drop by about 25% to 40%. Production in the US, however, experienced a fairly steady increase, Wakeford said, and did not explain the sudden plunge in the oil price.

The world economy is not growing as fast as predicted and demand for oil has been weaker in the past few months, particularly in China and in Europe, where concerns about the region’s economy have been stoked by fresh monetary stimulus measures.

“Partly because of Europe’s troubles, the US dollar has also been strengthening and when the dollar strengthens the oil price declines. There is an inverse relationship,” Wakeford said.

“[The] shale [gas and oil boom] wouldn’t have happened if oil prices didn’t get to the point they reached.

“Hydraulic fracturing technology has been available for a long time but was costly. Only lately have oil prices been high enough to justify it,” said Wakeford.

Whether or not a supply cut is on the cards is expected to become clear at the final scheduled meeting of the year of the Organisation of the Petroleum Exporting Countries (Opec), which takes place in November.

Interesting reaction

Anton Botes, Deloitte & Touche’s oil and gas industry leader, said so far Saudi Arabia has reacted to the price drop in an interesting manner.

“Instead of decreasing production in an attempt to curb supply and bolster prices, they did exactly the opposite,” said Botes.

“The Saudis, who were losing market share because of US production, have decided to keep producing, allowing the price to creep downward, thus forcing high-cost producers out of the market and hoping they will re-establish market share.”

Saudi Arabia announced it would cut the price of oil – by about $1 a barrel – signalling that they perhaps aren’t considering a cut in production.

“That in itself is strange,” Wakeford said. “Any time the price has dropped, Opec has dropped production … I would certainly expect that Opec would cut production.

“But they are also quite sensitive about the demand situation and don’t want to kill the golden goose by putting countries into near recession territory.”