For a continent that boasts abundant renewable energy sources like hydropower, solar and wind, this cannot continue. Key challenges are infrastructure-related and poor investment. (Photo by Denis Doyle/Getty Images)

As the work of the new team tasked with fleshing out the details of a deal to support South Africa’s electricity sector transformation gets underway, there are questions about what it means for the unsustainable debt burden on the state and Eskom.

This comes at a time when consumers of electricity are dealing with rolling blackouts, which are expected to last for years, before new power reaches the grid.

For this reason, regulatory changes to speed up private sector investment into renewable independent electricity generation are among the most welcomed developments by investors lining up facilities to finance new renewable and clean energy.

Investec, a banking and financial services group, believes there is enough pent-up appetite for private sector finance in independent power production to help South Africa meet its clean energy goals.

“While Eskom has achieved a fair amount of transition already, it is evident that they are going to need to roll out between six and 10 gigawatts of renewable power in order to transition away from coal,” Investec said in a recent statement. “And as the pressure to decarbonise intensifies, the question is will South Africa meet its net zero by 2050 target — given the time it’s taken to where we find ourselves today.”

The state power utility is decommissioning coal-fired power stations that are reaching their end of life over the next decade.

The country will have its energy plans anchored to climate change commitments in global accords such as the Glasgow Climate Pact adopted at the United Nations Climate Conference, COP26, in Scotland earlier this month.

Private sector finance, which is sorely needed to meet the commitments and close the energy gap, is not lacking in South Africa, says Investec’s head of power and infrastructure finance, Martin Meyer. He spoke to the Mail & Guardian about the role of the private sector in the country’s energy mix, which has long been monopolised by Eskom.

Meyer said private sector investment in projects to speed up the delivery of safe and clean energy sources such as wind and solar was hampered by the slow regulatory changes required.

“We had four rounds of a very successful programme, which then came to a grinding halt. So, for the past five years, people have become a little bit frustrated, a little bit negative about what that meant,” he said. “It gathered a whole lot of momentum, there was a whole lot of investment in the manufacturing side of it, as well as building the plants and investment. And that came to a halt. You obviously redirect people elsewhere because there simply weren’t projects to invest in.”

But, Meyer said, the amendments to the Electricity Regulations Act give the private sector renewed room for these market conditions to attract private investments, adding that the latest round of successful bidders in the government’s Renewable Energy Independent Producers Programme was a welcome development.

“I think with the renewed programme and the roll-out and in the plans we’ve seen in the IRP [Integrated Resource Plan], I think you’ll see that the money will come back,” he said.

“We are seeing new international players coming into the market in the latest round. There were in excess of 100 bids for around we’re probably going to get 21 projects ordered. So there was a lot of appetite for the latest round. It was very competitive. The tariffs, we believe, are going to be competitive. So that money is ready to flow. It needs projects. So I think there was a lack of projects and rather than going away from renewables, it was because there just weren’t the projects to invest in.”

The independent producers programme has procured 600 megawatts of power in the past four rounds and round five will see 2 600MW of additional capacity put into the country’s strained power grid.

Meyer said financing the energy transition to a low carbon future required innovation and creativity in the financial sector. This was particularly true for the new 100MW threshold in the Electricity Regulation Act amendment, which significantly increased the amount of power that can be independently produced without a licence. The presidency said the government was expecting the regulatory change to fill a 5 000MW capacity gap.

“At the end of the day you need to make the tariffs competitive with Eskom’s tariffs, you need to make the tariffs attractive to the private sector. So, in order to do that, the banks need to put longer term funding in. There needs to be innovative ways that we fund these and whether it’s looking to the development institutions to play a role then that’s something we could do,” said Meyer.

Finance Minister Enoch Godongwana told parliament last week during his medium-term budget policy statement that there was no increase in new proposed power since the threshold was adjusted in June 2021.

The electricity sector transition to cleaner power is estimated to cost R400-billion over the next decade.

Although Investec sees the private sector as a vehicle that could support 50% of the move to renewable energy, reducing carbon emissions in the electricity sector have so far been largely public funded.

“If you want to get international banks involved then you may need some tweaking around foreign currency. At the moment, there’s no ability to fund these and where you can fund in foreign currency there’s no real protection. So there may need to be some tweaks but I think the environment is there and ready,” Meyer said.

International finance hooked on climate change mitigation activities such as reducing carbon emissions is now dependent on the country’s climate commitments.

The government is establishing a just energy transition finance facility to channel financing towards Eskom decarbonising.

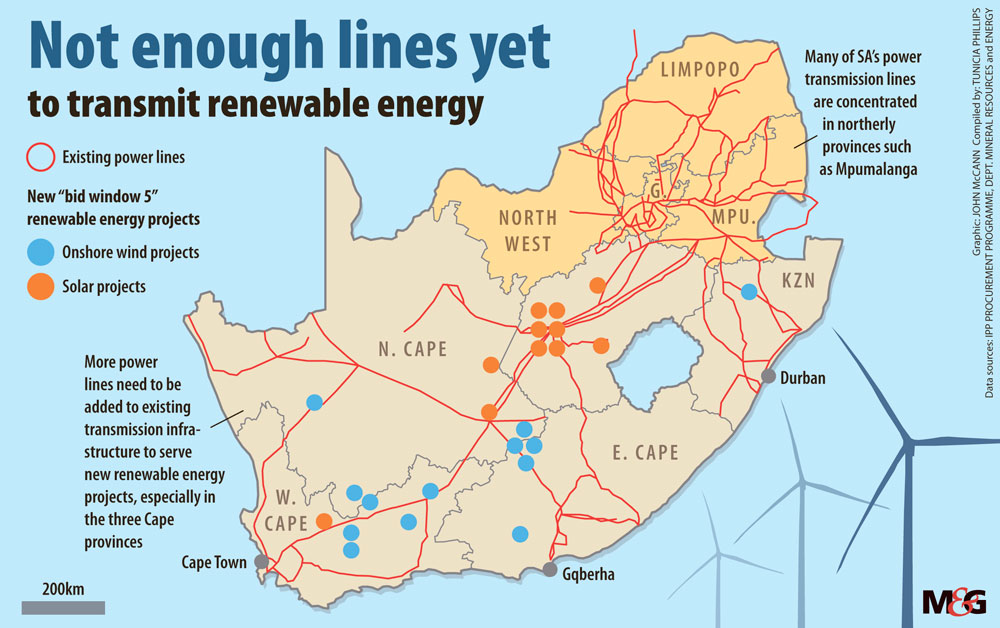

(John McCann/M&G)

(John McCann/M&G)

The presidency’s Rudi Dick recently told the Presidential Climate Commission hearings that the facility would use concessional finance, adding that: “We need to get into the nuts and bolts of it and again it depends on who funds us.”

The treasury’s director general, Dondo Mogajane, told the commission that there were key questions regarding financing the energy transition

“We have to consider what is grant funding, what is concessional loan funding, and what is normal funding, including how to ensure that we reduce the debt burden of the country. We are talking anything between 80% to 90% debt to GDP currently, we’re talking R400-billion plus to Eskom debt … Balancing all of that is going to be quite critical,” Mogajane said.

He made the comments before the announcement of a COP26 finance deal worth $8.5-million between South Africa, France, Germany, the European Union, the United Kingdom and the United States.

A task team is expected to set out the conditionalities of the agreement, which President Cyril Ramaphosa called a “watershed moment” for the country.

[/membership]