Local vehicle sales numbers — seen as a lead economic indicator — have been released for January. Car sales are like the canary in the mine — a good indication of the economic conditions ahead. Car sales will be the first casualty when the economy is slowing and the first beneficiary when the economy is on the up.

Passenger car sales rose 15% year on year, which is the first annual growth since January 2007 when it increased by 4,2%. Total passenger and commercial sales were up 12% year-on-year, due to commercial sales falling 4,9% in the month.

The graph below reflects the level of the decline, where on a smoothed three-month basis almost 60 000 vehicles a month were sold, now running at half that peak.

Source: Nedbank

Money market returns declining

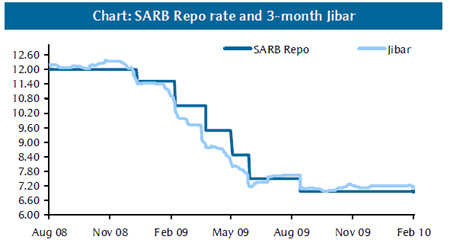

Last week the Monetary Policy Committee of the SA Reserve Bank decided to leave the repo rate unchanged at 7%. This is the core rate that drives shorter term interest rates. There is still a possibility that the current target of 3% — 6% inflation is amended and we see a further 0,5% cut in rates.

With the decline in 2009 of this repo rate, rates earned on money markets remain flat at just over the 7% level.

The chart below reflects the clear correlation between the step down of the repo rate and the three month Jibar (Johannesburg Interbank Agreed Rate). It’s this rate that drives the money market rates. A year back investors were getting 12% on money market. Now, the three-month Jibar is steady at 7,18%. This is a low premium over inflation, which was last recorded at 6,3%.

Source: Absa Capital

Improved earnings expected to support share prices

The old investing adage says that: ‘As January goes, so goes the year.”

This won’t be pleasant if this does indeed play out for 2010, given that the JSE all-share index fell 3,5% in the first month. The decline was led by resources, which fell 6,4%.

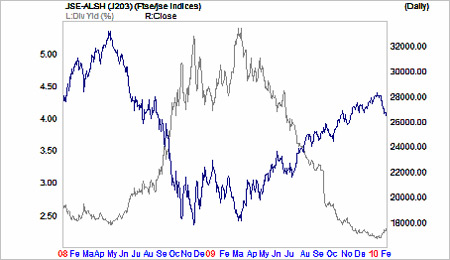

While short-term interest rates have dropped lower and lower, share prices moved up rapidly in 2009. The graph below reflects how rapidly the historical dividend yield has declined from the recent market trough in March 2009 to the current level at 2,27%. Analysts are pricing in earnings and dividends increases in 2010, which will support the current more expensive valuations.

Source : Sharenet and Market Tracker

Seed Investments