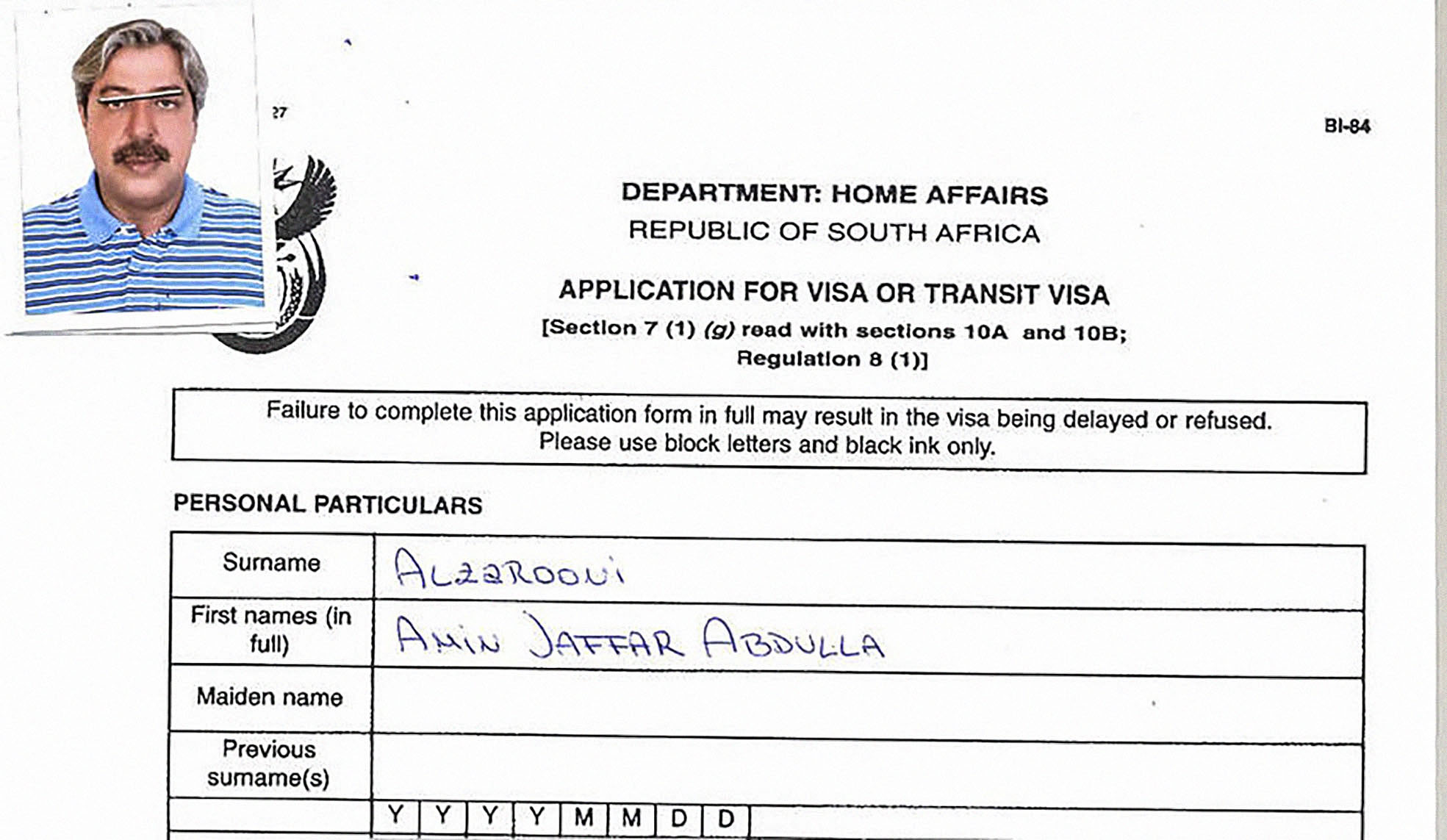

Amin Al Zarooni, who visited the Guptas in South Africa in October 2015, apparently owns Charles King, which is buying the Gupta mine company Tegeta Exploration (Delwyn Verasamy/ M&G)

Many questions remain about the Gupta family’s announcement on Wednesday that it was selling Tegeta Exploration, a company with coal mines that, according to Eskom, are critical for keeping the lights on in the country. But two questions stand out: Who is buying Tegeta, and who is selling it?

Neighbours in the vicinity of the buyer’s offices are not much help.

“I just know him from when we’re both crossing the street sometimes,” said one. “I think he may be French.”

The presumed Frenchman may — or may not — be the sole employee of Charles King, the holding company that is to buy Tegeta and its coal mines for R2.97‑billion.

Tegeta supplies Eskom with thousands of tonnes of coal every day, coal so crucial for generating electricity that Eskom has gone to extraordinary lengths to keep it flowing.

If all goes according to plan, it will soon be owned by Charles King, which operates out of a building in a side street of Lausanne, Switzerland, which it shares with a yoga studio and a violin-maker.

Employees at those businesses say Charles King’s sole employee is not particularly gregarious, and so they know nothing about him. Another problem is that the neighbours aren’t actually sure whether he works for Charles King at all.

“There are a lot of company names on the mailbox,” said one neighbour. “We wonder what it is that is going on up there.”

Charles King is a peculiar owner for a coal mining company over which empowerment titans such as Cyril Ramaphosa used to do battle. Its sole line of business used to be selling clothes under the brand Charles King Paris: shirts with dragon motifs, hats with butterfly motifs and hoodies featuring highly stylised birds, all somewhat derivative.

[Charles King has had no mining dealings but it did trade in flowery clothes]

According to meticulous Swiss corporate records, its sole corporate officer is Ronald Beau. He is a tax planner and corporate service provider who went into business for himself after his employer, accounting firm Arthur Andersen, was shut down for facilitating, and then trying to hide, one of the biggest frauds in global corporate history by United States energy firm Enron.

These days, Beau deals mostly with companies involved in shipping, with the occasional Brazilian oil company operating in Sudan thrown into the mix.

But Charles King is simply a vehicle for the use of “highly respected” Amin Al Zarooni, who is “a leading businessman in the United Arab Emirates”, the Gupta family reassured on Wednesday, citing seven of his businesses as proof of his credentials.

Two of those companies have generic names impossible to trace. Four are joint ventures with European companies that do everything from making fire-fighting foam to planning urban spaces.

None of the four this week responded to questions about Al Zarooni. The final company, Jaffar Al Zarooni Real Estate, is very clear that it is run by Mohammed Abdul Kareem Al Zarooni, and also did not respond to questions about Amin.

Amin Al Zarooni apparently served as a front for a Gupta family member to set up a corporate presence in Dubai, investigative journalism organisations amaBhungane and Scorpio reported this week, citing emails from the Gupta Leaks.

Who actually owns Tegeta?

Unlike the buying company, the identity and credentials of the selling company are well known. It is just not clear that it actually owns what it says it is trying to sell.

Oakbay Investments had agreed to sell “its” Tegeta Exploration to Charles King, it announced on Wednesday.

Oakbay Investments is the corporate holding company used by — and, when it last disclosed its shareholding, wholly owned by — the Gupta family.

But when Tegeta bought the coal mines of the once high-flying Optimum out of business rescue in early 2016, it was majority owned by two black empowerment vehicles, respectively controlled by President Jacob Zuma’s son Duduzane and close Gupta business associate Salim Essa.

The acquisition was approved by both competition authorities and the mining ministry on the basis of that empowerment shareholding — and, as a condition of lucrative Eskom contracts still in place, Tegeta was required to continue being majority black-owned.

Mining companies have often complained that the transfer of mining licences is too closely regulated, and the empowerment conditions attached too onerous, when mines are bought and sold.

Oakbay did not respond to questions on Tegeta’s current ownership.

And nine other questions we’d love answers to

The sale of major Gupta mining interests this week followed hot on the heels of an announcement that the family had sold its media assets to high-profile supporter Mzwanele Manyi (see Business). Both announcements were thin on details, had many curious elements to them, leaving a set of crucial questions hanging, including:

- Will the Gupta family sell all its South African assets, including its much-vaunted Shiva Uranium project, as it vowed to do during 2016?

- With little to no access to banking services, just how is the Gupta family receiving the money from the “sale” of its coal mines and media outlets?

- Considering the extent of allegations in the #GuptaLeaks of money being spirited offshore, will the proceeds of the asset sales be within reach of South African law enforcement agencies if they ever decide to seize Gupta assets?

- Where did Tegeta’s new owner, Charles King, find R2.97‑billion to buy South African coal mines?

- Will the government approve the transfer of Tegeta’s mining licences to an unknown shelf company controlled by an little-known foreign resident who has no track record in either South Africa or in mining?

- Will Eskom approve the transfer of its coal contracts with Tegeta?

- Will Eskom, which insists on 50%-plus-one black ownership in its suppliers, be satisfied with a supplier with initially no black (or South African) owners and has promised only a 30% share to a black partner?

- What are the terms of the “vendor financing” agreements (such as the interest rate) between the Gupta family and Manyi for his R450‑million purchase of The New Age and ANN7?

- How much of the money raised in asset sales will ultimately flow to the likes of Gupta partners Duduzane Zuma and the Umkhonto weSizwe Military Veterans Association?