(Graphic: John McCann)

Public sector unions will take to the streets if necessary to protect their members’ pensions, said Ivan Fredericks, the general manager of the Public Servants’ Association (PSA), following government denials that the Public Investment Corporation (PIC) could be forced to bail out ailing parastatals.

They were not convinced by the “charade” of unity by the finance ministry, the PIC and its board. “We believe it was only a charade because of the pressure put on them.”

The PSA, which has about 230 000 members, is the majority union in the department of home affairs, the South African Revenue Service (Sars) and the treasury and any possible strike could cripple the government.

“My finger is on the red button,” he said, if it got wind of any attempts to use the Government Employees’ Pension Fund (GEPF) or the Unemployment Insurance Fund (UIF) to prop up failing state-owned companies such as SAA.

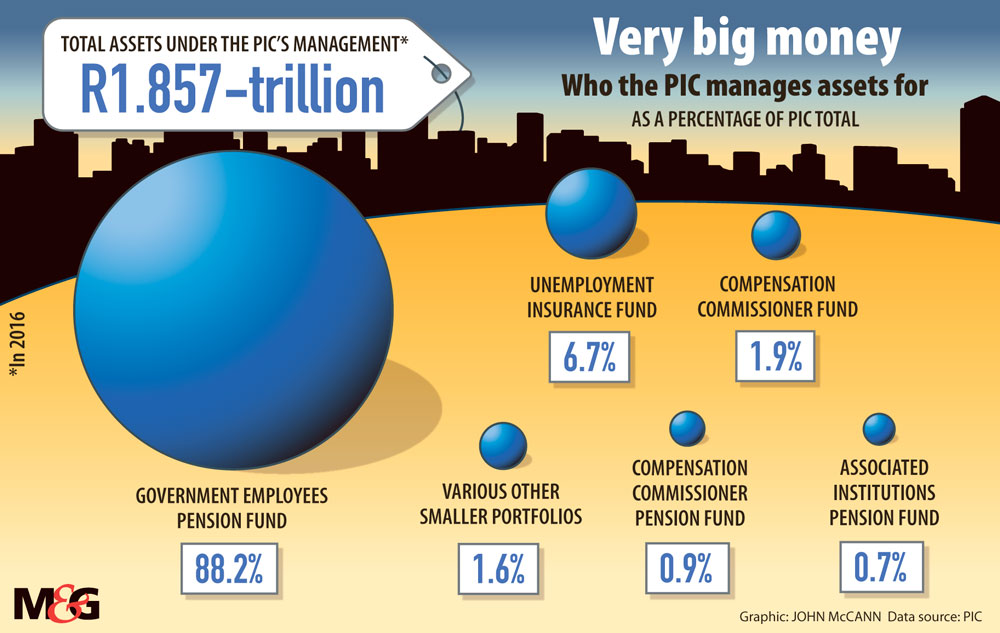

Fredericks said that the union remained willing to “put measures in place” to move workers’ money from the PIC if it became aware of any attempts to use funds this way. The PIC manages almost R1.9-trillion in workers’ money through the likes of the GEPF and the UIF.

There is no legal requirement that the government pension fund must use the PIC to invest its pensions.

“The PIC needs to careful not to upset … the public service and not to upset the PSA,” Fredericks said.

On Tuesday, the PIC’s chief executive officer, Dan Matjila, Finance Minister Malusi Gigaba and PIC board chairperson and Deputy Finance Minister Sfiso Buthelezi denied reports that the government was seeking as much as R100-billion to plug the funding gaps in various parastatals.

They also refuted allegations, including those reportedly made by Matjila himself to the Sunday Times, that there was a plot to oust him from his post.

Matjila rejected an article in which he was quoted saying that he was being targeted by people who wanted easier access to the PIC coffers. He described the article as “distasteful, inaccurate and designed to drive a wedge between myself and the minister”. He promised to release a full statement on the article but by Thursday afternoon it had not been issued.

The GEPF represents the bulk of all the assets the PIC manages. Last year, the fund paid the PIC about R907-million in asset management fees. The PIC’s total revenue from management fees was just over R1-billion.

Following the briefing, Dennis George, the general secretary of the Federation of Unions of South Africa (Fedusa), said it would monitor the process.

The federation, to which the PSA is affiliated, is demanding that a worker representative be appointed to the PIC’s board to ensure that the funds are not mismanaged.

Despite the fighting talk of the PSA, the GEPF said this week it “is happy with the PIC’s management of its assets to date”.

At the briefing, Matjila, Gigaba and the PIC board gave assurances that PIC was on solid ground and that pensioners’ money was safe.

But two weeks ago, Matjila was unexpectedly called to attend a special board meeting to address claims that he had used PIC money to fund an alleged girlfriend’s business.

The board heard Matjila’s explanation but said, “for completeness of the process and for its final assurance”, the internal audit division was asked to review Matjila’s representations.

The PIC’s refusal to prop up SAA appears to be at the heart of perceived attacks on him. On Saturday, about R6.8-billion in loans to SAA will become due.

Matjila confirmed at the briefing that SAA had approached the PIC for a loan of R6-billion without the treasury’s approval, but said it “was not abnormal to do so”. He said the PIC had done a due diligence on SAA and decided that, in terms of the minimum requirements of its investment mandate, it could not invest in the airline.

In July, SAA was granted a cash injection of more than R2-billion by the state.

At least one lender, Citibank, is reported to be unwilling to roll over its loans. The treasury has warned that SAA cannot default on its loans because this could trigger cross-default clauses on its debt and spook investors that hold the debt of other state-owned enterprises.

The sale of the state’s shares in Telkom, valued at roughly R12-billion, to the PIC has been mooted as a way to raise the money.

Matjila said, although the PIC viewed Telkom as a good investment, and it would participate in any possible sale, it may not be able to take up the full stake because of the para-meters of its client mandate.

How the state will find the money for SAA is still not clear. Treasury director general Dondo Mogajane said the matter would deliberated at a Cabinet meeting this week — for a fourth time — adding that government was in constant discussions with the airline’s lenders.

The UIF is being watched

The Unemployment Insurance Fund (UIF) would also be “watched like a hawk” for any signs it would be used to prop up ailing state-owned companies, said Ivan Fredericks, the general manager of the Public Servants’ Association (PSA).

The UIF is the Public Investment Corporation’s (PIC’s) second-largest client and accounts for 6.7% of all the money it manages.

The fund has a surplus of about R120-billion under management by the state-owned asset manager.

Money from the UIF may have already been earmarked for projects that have generated controversy.

As of last year the fund, through a wholly owned company called Blue Falcon Trading, held a 21% stake in the proposed Thabametsi coal power plant, according to an application for an electricity generating licence made to the National Energy Regulator.

But the plant’s construction was challenged by the nongovernmental organisations the Centre for Environmental Rights, Earthlife Africa Johannesburg and groundWork.

The court ruled that the department of environmental affairs had failed to consider adequately the effects the station would have on climate change, and ordered it to reconsider its approval for the power station. In the run-up to the case late last year, the environmental groups asked why workers’ money could potentially be invested in a project that could end up as a “stranded asset”.

The UIF’s spokesperson, Makhosonke Buthelezi, said that the fund was not aware of this investment and could not comment on it. The PIC did not respond to a request for comment.

But the UIF was adamant that it makes investments “strictly in accordance with its investment mandate”.

The fund had not invested in any state-owned enterprises in the past 18 months, Buthelezi said. Before that, it had invested in various parastatals by taking up their bonds. The fund had not been approached to recapitalise SAA, he said.