(Graphic: John McCann/M&G)

The economy shrank for a second consecutive quarter, Statistics South Africa announced this week, dashing hopes that the country could dodge this bullet and scrape through with mildly positive growth.

It puts South Africa firmly into a technical recession and again raises the spectre of a downgrade by credit ratings agency Moody’s, which has yet to relegate the government’s debt to junk status.

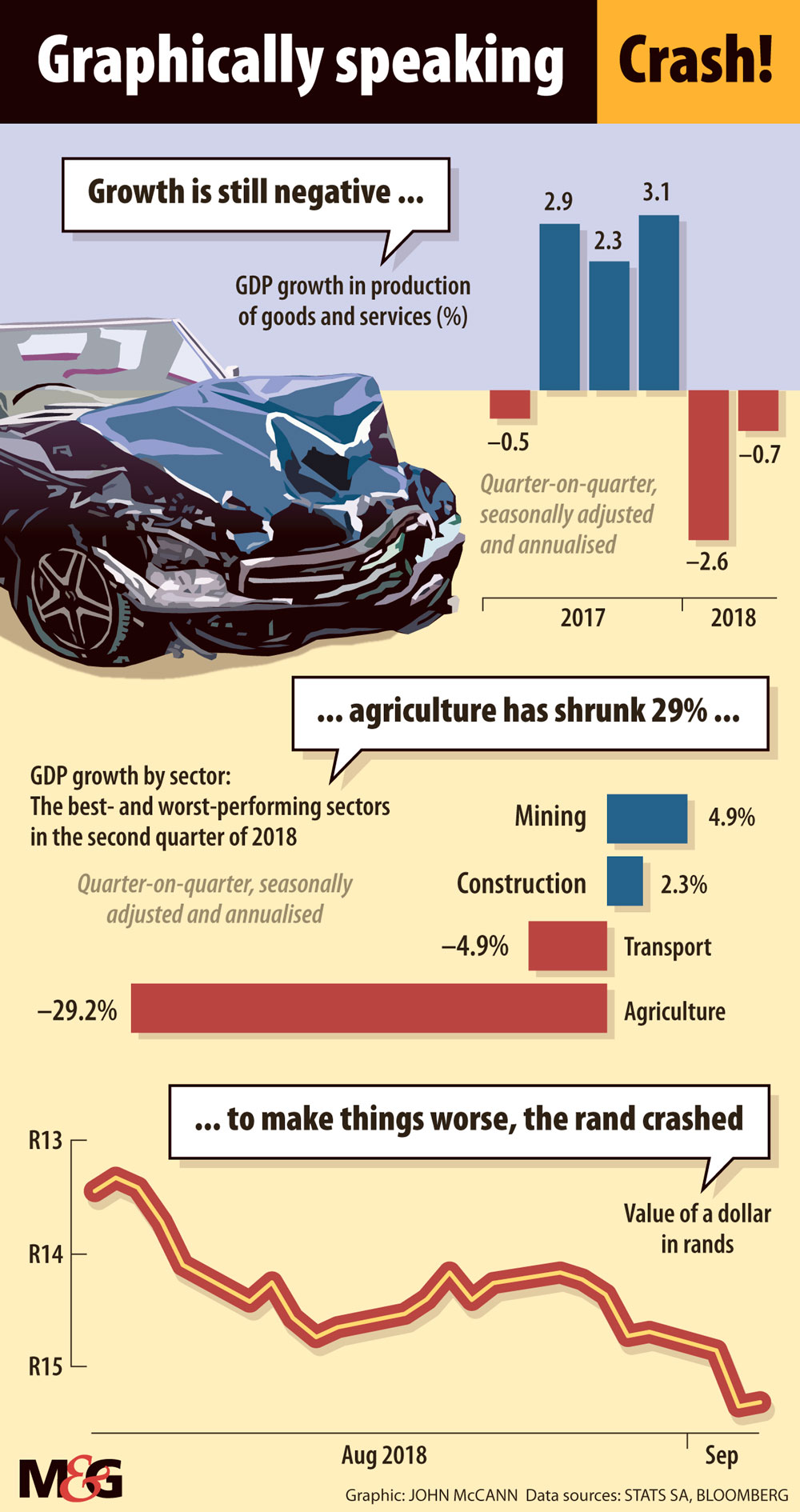

The rand was left bruised by the news, brushing the R15.60 to the dollar mark, early on Wednesday. South Africa’s 10-year bond yield rose to well over 9% and the local bourse also shared in the pain, with the JSE Alsi down on Tuesday.

The figures come on top of other pressures for the economy, not least of which is global turmoil in emerging markets, led by troubles in both Argentina and Turkey.

But Maarten Ackerman, wealth management firm Citadel’s chief economist, said the disappointing numbers should not have come as a surprise to the market. “Is it really a shock? We knew the economy was struggling and we had a very bad first quarter,” he said.

Recent data releases that preceded the gross domestic product figures, such as retail and manufacturing, had pointed to an economy that was performing poorly, he said.

The budget numbers forecast in February were unlikely to remain feasible, he said, particularly the treasury’s growth estimates. It was likely this would be revised down in next month’s medium-term budget policy statement, raising “the potential risk of another credit ratings downgrade”, he said.

Ratings agencies Standard & Poor’s as well as Fitch have downgraded South Africa’s debt to below investment grade. While Moody’s rates South Africa’s debt one notch above junk.

Ackerman said South Africa had been in a “recessionary environment” for some time. Although economic growth in recent years had not been negative, it was not keeping pace with the growth of the population.

“If your population is growing faster [than your economy], you can’t create enough jobs, you can’t collect enough tax [and the] government, fiscally, is under pressure,” he said.

According to StatsSA, the economy shrank by 0.7% in the second quarter of the year, following a contraction in the first quarter of 2.6%, which, because of a revision of the data, came out slightly worse than the figure of -2.2% originally reported for the first quarter. A technical recession occurs after two consecutive quarters of negative growth.

The declines were led by the agriculture, forestry and fishing industry, which fell unexpectedly sharply by almost 30%.

Wandile Sihlobo, an Agricultural Business Chamber economist, said in a note that this reflected the tail-end negative effects of the Western Cape drought and a delayed harvest in the summer crop- growing areas, particularly the grain and oil seed production regions.

“This is on the back of a late start of the summer crop season due to unfavourable weather conditions earlier in the year,” he said.

But, he added, the agricultural economy could move back into positive territory in the third quarter because of, among other things, a large maize harvest of an estimated 13.8-million tonnes, a record soybean harvest of 1.6-million tonnes and a large sunflower seed crop of 858 605 tonnes that was expected.

The other major declines were in the transport, storage and communication industry, which decreased by 4.9% quarter on quarter, and the trade, catering and accommodation industry, which decreased by 1.9%, according to StatsSA.

Household final consumption expenditure decreased by 1.3% in the second quarter, the first quarter-on-quarter decrease since the beginning of 2016, StatsSA said.

“This is a reflection of what households are dealing with,” said Ackerman, which included the recent increase in value-added tax, rapid hikes in fuel prices and higher unemployment.

Households contributed 66% to economic growth, according to Ackerman, so the extent of the move was “notably worrying”.

Gross fixed capital formation, a broad indicator of investment in the economy, also declined by 0.5% during the quarter, following a contraction of 3.4% in the first quarter.

Elize Kruger, an NKC African Economics analyst, said in a note that the “current environment of policy uncertainty, particularly relating to land reform, is stifling investment and keeping a lid on economic growth”.

Adding to it were many other headwinds, including the hefty fuel increases, which had dampened consumer spending, and fiscal difficulties, which would remain a constraint on the economy for some time, she said.

“Add to the mix the contagion coming from other troubled emerging markets and a growing threat of spillover effects from a global trade war, and you have a perfect storm for the South African economy,” Kruger said.

*This story previously erroneously stated that Moody’s had downgraded South Africa’s foreign denominated debt to sub-investment grade. This had been corrected and we regret the error.