On Monday, Eskom CEO Phakamani Hadebe said the tariff hike and assistance from the government were necessary for the utility to remain a going concern. (Waldo Swiegers/Bloomberg/Getty Images)

The department of public enterprises (DPE) issued a correction to a presentation it made in Parliament on Wednesday, removing any reference to power utility Eskom being insolvent.

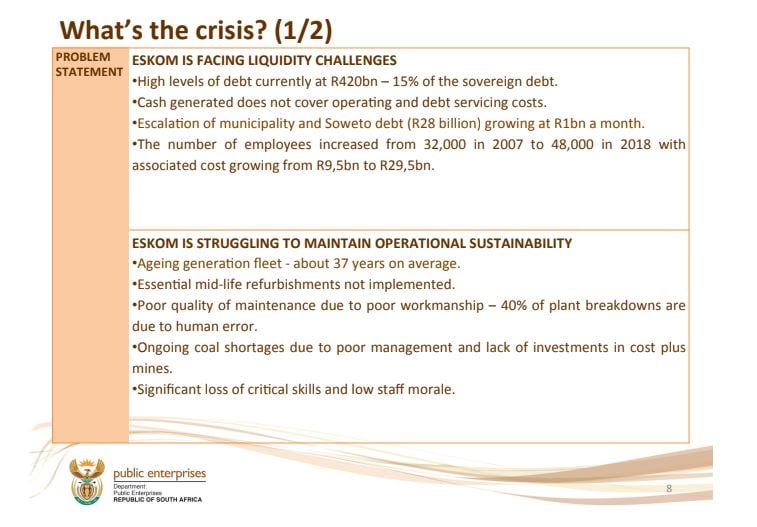

Instead, the presentation, which originally stated that Eskom was “technically insolvent and will cease to exist at [its] current trajectory by April 2019” was corrected to state “Eskom is facing liquidity challenges”.

Spokesperson for public enterprises Adrian Lackay was not immediately available to explain the need for the correction or the cause of the error at the time of publication of this article at 6.05pm. He later got back to the Mail & Guardian, clarifying that Eskom was not insolvent to the extent that its liabilities are greater than its assets. “The problem is that they are not generating sufficient cash to cover their operational costs,” he said.

“So by April, they would run out of money and not be in a position to pay their debt.”

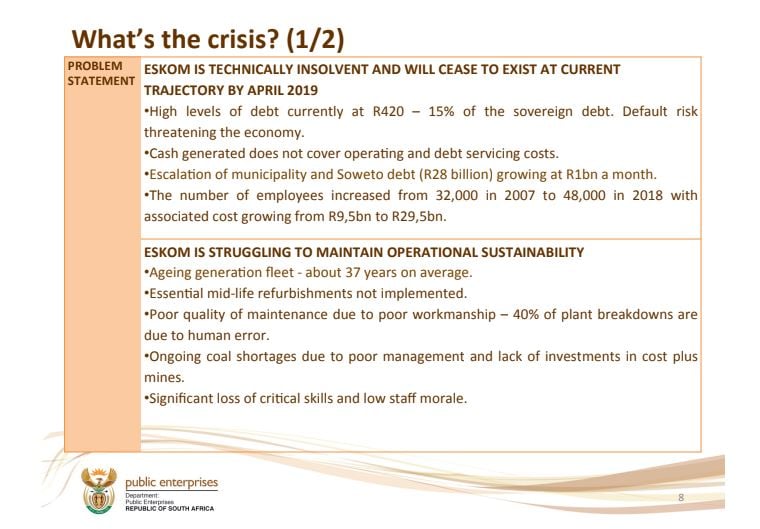

This is page 8 of the original presentation:

This is the corrected version of the same page:

The presentation, which was disseminated earlier in the day, was delivered to the portfolio committee on public enterprises and outlined the series of challenges that the company is facing, both financially and operationally.

Eskom began intensive load-shedding on Monday — after the unexpected outages of several of its generation units.

On the financial front it is labouring under R420-billion, and the cash Eskom is generating does not cover operating and debt-servicing costs. The DPE noted in the presentation that the risk of Eskom defaulting on its debt, threatened the economy.

This article has been amended to reflect DPE spokesperson Adrian Lackay’s comment.