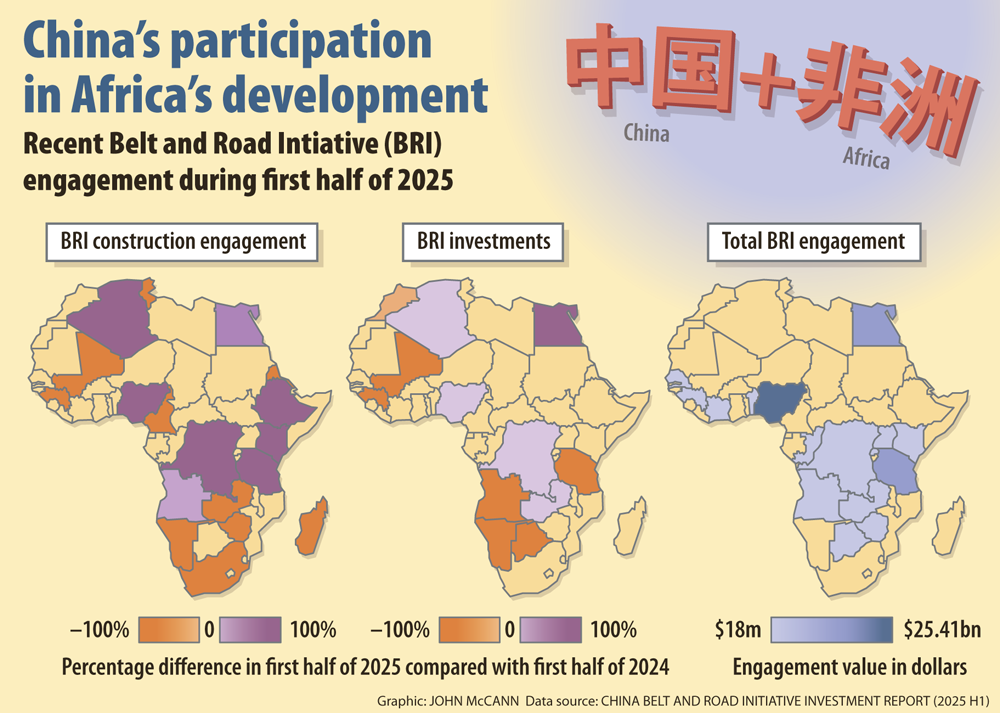

Africa received $30.5 billion in construction contracts — up from just $6.1 billion a year ago — and $8.5 billion in direct investments

China’s transactions with Africa through the Belt and Road Initiative (BRI) surged to $39 billion in the first half of 2025, outpacing all other regions and reflecting the Asian superpower’s global infrastructure foreign policy pivot toward mineral-rich and high-growth potential African states.

Countries on the continent received $39 billion in construction and direct investment from Beijing during this period as China looked to secure critical resources and forge new geopolitical alliances amid trade tensions with the US.

According to a recent report by the Green Finance & Development Center, BRI-related engagement globally reached $124 billion in just six months, surpassing the $122 billion recorded for the entire year in 2024.

Africa received $30.5 billion in construction contracts — up from just $6.1 billion a year ago — and $8.5 billion in direct investments. The Middle East came in second with $19.4 billion worth of Chinese investment.

Nigeria emerged as the top beneficiary, securing $21 billion in construction deals, primarily focused on oil and gas processing infrastructure, followed by Saudi Arabia with $7.2 billion, the United Arab Emirates with $7 billion, Tanzania with $3.6 billion and Indonesia with $2.1 billion.

BRI is not merely an economic endeavour “but a geopolitical instrument, wielding influence through structured dependency”, policy analyst Siseko Maposa told the Mail & Guardian.

“China’s growth hinges on strategic alliances with mineral-rich states, financing critical infrastructure to establish supply-chain footholds that bolster its manufacturing dominance. The acceleration of BRI reflects countermeasures against global economic volatility, especially as the US and EU shift trade and investment to consolidate their own interests,” Maposa said.

Since its launch in 2013, the BRI has reached cumulative engagement of $1.308 trillion across 150 countries that have signed cooperation agreements with China. This includes $775 billion in construction contracts and $533 billion in non-financial direct investments. But the 2025 data shows a shift in both scale and strategy — with Africa emerging as China’s biggest investment venture.

In the first half of 2025, Chinese energy-related investments reached $42 billion globally — the highest ever recorded in any six-month period, said the report. A significant portion of this went to oil and gas projects in Nigeria, while green energy saw $9.7 billion in new investments in solar, wind and waste-to-energy projects across the continent.

Maposa said energy is a determinant to development, which further complicates Africa’s development landscape.

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

“African states still face barriers in attracting sustainable financing. China’s model, unlike Western financing, which often comes with rigid conditionalities, offers more flexibility, which makes China a pragmatic partner. But African governments must ensure BRI terms support domestic value chains and promote debt transparency.”

The minerals and metals sector saw a similar investment leap, with $24.9 billion in total BRI investment in the first half of 2025 — surpassing the previous annual record.

Around $10 billion was channelled into processing infrastructure on the continent — a development that seems to align with local mineral beneficiation.

Securing access to the continent requires elevated foreign direct investment and the shift toward value addition is becoming central to African policy, said Lauren Johnson, a senior research fellow at the South African Institute of International Affairs.

“African governments have moved in a direction of ‘resource nationalism’ which requires investors to invest in processing in-country for access to the minerals amid competition with the USA and Europe,” Johnson told the M&G.

She said global developments, such as Donald Trump’s political resurgence in the US and ongoing tension with the EU, have made finding new growth markets essential for China.

“China has already diversified investments into agriculture, such as soybeans in Angola and Ethiopia,” Johnson said.

Maposa argued that, while the BRI serves as China’s global infrastructure blueprint, African states should avoid framing it as a binary against Western alternatives like the US-backed Lobito Corridor — a rail project linking Angola, Zambia and the Democratic Republic of the Congo to facilitate mineral exports.

He added that the focus should be on “financing models that reinforce state sovereignty, interconnectedness and sustainable development, principles enshrined in the right of nations to self-determination”.

“Rather than treating these as adversarial, Africa should leverage their distinct value: the BRI offers scale, whereas Lobito provides specificity,” said Maposa. “Where BRI diversifies infrastructure, Lobito’s mineral-specific investments could model targeted, lower-risk partnerships if governed by African industrial priorities.”

As China’s footprint expands, concerns have grown about debt sustainability and the potential erosion of sovereignty. But Johnson said these fears need to be contextualised within responsible borrowing frameworks, adding that borrowing must always be for growth-generating investments.

“The core principle is that the rate of growth the investment will generate should be higher than the interest rate on the debt, ” she said.

The real test, Johnson added, is how well African countries can align foreign capital with domestic development strategies. “Equivalently, the race to secure important minerals should prove to African countries which nation is the better investor.”

Maposa warned, however, that unless African states negotiate better terms, they risk remaining locked in “perpetual extraction economies”.

“The race to the bottom is no abstraction,” he said.

“Major powers are actively courting resource-rich African states, often locking them into perpetual extraction economies. These dynamics trap African nations in a developmental paradox. True sustainability demands progression from raw mineral exports to value-added beneficiation, yet the prevailing system incentivises continued dependency on primary commodity production.”

Johnson said African governments need to consider each case carefully and look at the opportunities — with both immediate and long-term goals in mind.