Finance Minister Enoch Godongwana. (David Harrison/M&G)

The medium-term budget policy statement has heralded the triumph of fiscal consolidation, with the chokehold on government spending nearing its end.

Despite this, Finance Minister Enoch Godongwana, who tabled the policy statement in parliament on Wednesday, has underlined the need for a continued prudent approach to fiscal policy.

The policy statement said that, by the end of 2023, government revenue will exceed spending for the first time in 15 years.

The country’s gross loan debt is also set to stabilise at 71.4% of GDP in the 2022-23 financial year. This is two years earlier and at a lower level than expected in the February budget.

The improvement in the pace of debt stabilisation is largely a result of higher-than-anticipated inflation and the commodity-driven revenue windfall, according to the policy statement.

The improvement will be partly offset by the government’s plan to take over a large chunk of Eskom’s staggering R392-billion debt.

A portion of the revenue windfall will be used to reduce the budget deficit over the medium term and to fund infrastructure.

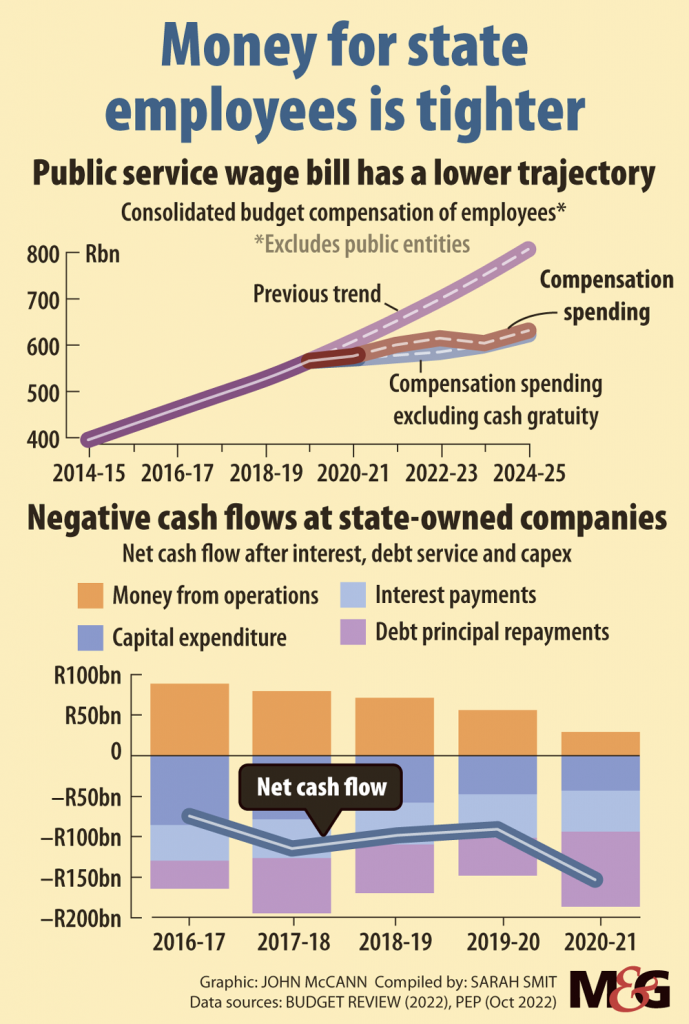

It will also go towards addressing fiscal risks flagged in the February budget, including higher-than-anticipated debt service costs, the public sector wage bill and financial risks from some state-owned entities.

Over and above the government’s commitment to take on somewhere between one- and two-thirds of Eskom’s debt, the treasury has doled out bailouts to the South African National Roads Agency, Transnet and Denel.

The positive fiscal developments come after Godongwana indicated in his February budget that consolidation efforts were drawing to a close, with the state set to achieve a primary budget surplus by 2023-24, a year earlier than expected.

The 2021 medium-term budget policy statement charted a course for fiscal consolidation that would lead to the surplus 2024.

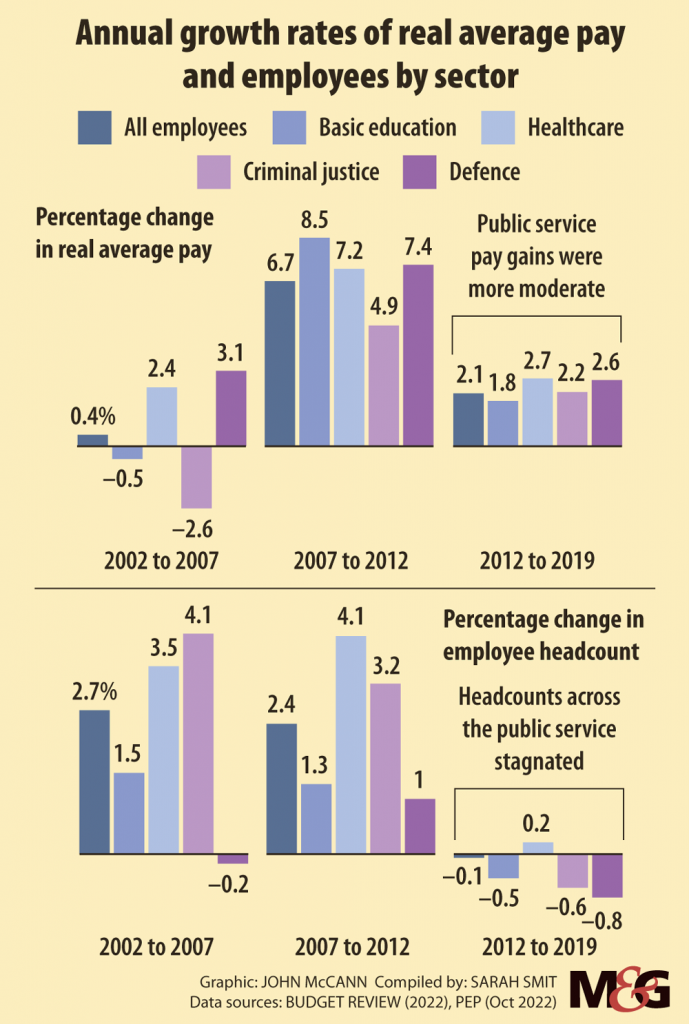

At the time, former head of the treasury’s budget office Michael Sachs said the treasury’s proposed strategy is a deep shock to public expenditure. In real terms, he explained, core spending would contract by 4% each year, which amounts to a reduction in real spending per capita of more than 10%.

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)Speaking to the Mail & Guardian on Wednesday, Edgar Sishi, the budget office’s current head, said the controversial strategy has been a success.

“We have seen the fiscal matrixes improve considerably, not just because of the improvements in revenue, which have been considerable. But also because spending restraint has been strong,” he said.

“We did not last year, for example, see aggregate overspending on budgets and this year we won’t see overspending … That has coupled well with the revenue improvement.”

Acting treasury director general Ismail Momoniat shared this sentiment.

Speaking at a media briefing before Godongwana’s speech on Wednesday, Momoniat described the upcoming primary budget surplus as “a great achievement”.

“That begins to flatten the debt to GDP. So we begin to stabilise that … I think we have been really successful on fiscal consolidation. And in a sense we will begin to enjoy the fruits of that from next year and beyond,” Momoniat said.

“Now that debt has stabilised — yes, even when you take into account the Eskom debt — what the minister has outlined is that we can put more money into infrastructure, into social services. Infrastructure is growth enhancing. So you’ve got a very positive outcome.”

Sanisha Packirisamy, an economist at Momentum Investments, said ratings agencies will take the treasury’s fiscal consolidation victory into account.

But they will be concerned about whether the assumptions made in the policy statement are reasonable given the significant pressures to increase spending.

Amid pressures to roll out basic income support, Godongwana announced on Wednesday that the government has decided to extend the R350 social relief of distress grant for another year until the end of March 2024.

Although the announcement may come as a relief to the grant’s recipients, the government will probably continue to have its feet held to the fire for more permanent support — especially considering grant beneficiaries will now receive below-inflation increases.

“Discussions on the future of the grant are ongoing and involve very difficult trade-offs and financing decisions,” Godongwana said in his speech.

“Despite the provision made in this budget, I want to reiterate that any permanent extension or replacement will require permanent increases in revenue, reductions in spending elsewhere, or a combination of the two.”

There is also the matter of the public sector wage negotiations, which — although the treasury has pencilled in its last tabled offer of 3% — are not over yet.

A number of key unions, including labour federation Cosatu’s largest affiliate, the National Education, Health and Allied Workers Union, and the Public Servants Association have rejected the 3% wage hike. The latter union announced this week that it has filed a notice to strike.

If the wage agreement exceeds the available budget, “it would pose a significant risk to the in-year and medium-term fiscal projections”, according to the policy statement.

Packirisamy said: “There will be higher demand for social expenditure. So while, in the near term, the fiscal consolidation and debt stabilisation numbers look good. The budget is just the promise.” It is also still not clear to what extent the government will continue to support Eskom, Packirisamy noted.

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)Further details about Eskom’s debt relief will be announced in the main budget in February 2023.

The government still needs to figure out how much the power utility will need to restore it to a sustainable financial position. The government also needs to discuss the structure of the debt relief programme with Eskom’s lenders.

With these three line items, permanent basic income support, the wage bill and Eskom’s debt, still up in the air, the risks to the medium-term fiscal outlook are still quite high, Packirisamy said.

Carmen Nel, a strategist at Matrix Fund Managers, was also circumspect, saying there may be too much optimism embedded in treasury’s fiscal projections.

“This may be merely a placeholder budget, albeit on the bullish side of the risk distribution, given significant events between now and the February 2023 budget statement,” she said.

“Importantly, the ANC elective conference in December would affect the politics of the February budget, which may have constrained the ability and willingness to be more explicit on certain expenditure or revenue items.”

In his speech, Godongwana stressed fiscal prudence.

With the global economy slowing, inflation climbing and financial markets more volatile, debt-service costs are estimated to be close to R6-billion higher this year than projected in the February budget.

“Moreover, the possibility of a major price correction in financial markets is a significant risk. This will affect fiscal revenues,” Godongwana said.

“It is for this reason that the medium-term strategy needs to maintain a prudent approach to fiscal policy. We need to decrease our debt burden and debt service costs by reducing our annual deficits. This will stabilise the public finances and reduce fiscal risks.”

The government will focus on rebuilding fiscal buffers, which means it will continue to exercise restraint in response to short-term spending pressures. “Even though there will be some room to increase social expenditure,” Packirisamy said, “the treasury will still be cognisant of fiscal discipline.”

The main opposition Democratic Alliance (DA) slammed the medium term budget, saying Godongwana provided no relief from rising living costs and failed to outline prospects for economic growth.

The greatest failing of the statement was its silence on how the government will address the plight of the vulnerable as they battle to survive relentlessly upward spiralling costs, DA legislator and head of finance Dion George said in a statement.

George said the bailouts to state-owned entities crowded out spending that could have fuelled economic growth and created jobs.

Cosatu’s comment on the mini budget was: “Considering that the South African economy has been stagnant for over a decade and the country is experiencing periodical riots because of desperation and hopelessness; this budget was not bold enough.”

[/membership]