Favourable production conditions for crops, wine grapes, fruit and vegetables will drive the sector's performance.

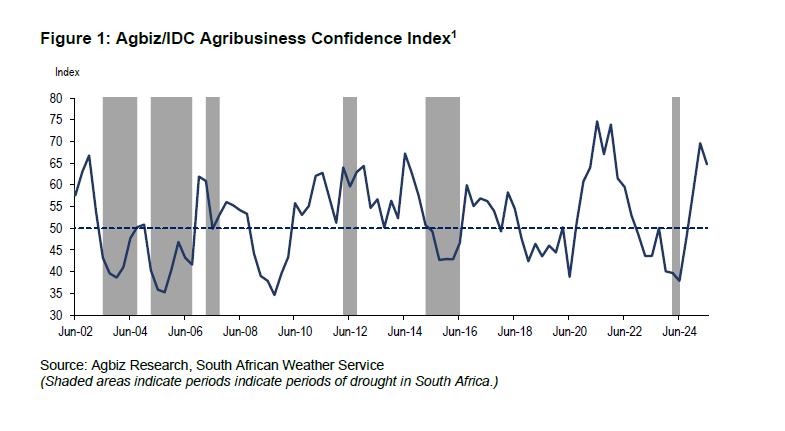

South African farmers and agribusinesses continue to exhibit resilience and optimism. The Agbiz/IDC Agribusiness Confidence Index (ACI) — an indicator of business conditions in the sector — although declining from the high levels it reached at the start of this year, remains at encouraging levels.

After a notable uptick in the first quarter of 2025, the ACI fell by 5 points in the second quarter of the year to 65. Any level of the ACI that is above the 50-neutral point signals optimism.

Regarding the slight decline, most respondents identified the uncertain global trade environment, lingering geopolitical tension and the domestic animal disease challenge as key factors constraining the sector.

Despite the slight quarterly decline, the current level of the ACI implies that South African agribusinesses remain optimistic about business conditions in the country. The better summer rains and improvements at the ports, which have enabled exports with minimal interruptions, are among the positives.

This survey was conducted in the second week of June, covering various agribusinesses operating in all agricultural subsectors across South Africa.

A crucial point to remember when reviewing the index is that sustained optimism, at levels above the 50-neutral market, is fundamental, especially in the long run, for fixed investment in the agriculture and agribusiness sectors.

The ACI also serves as a leading indicator of agricultural growth prospects over time. We can thus expect slightly better farming output data for the second quarter of the year. The favourable production conditions for field crops, wine grapes and various fruits and vegetables will be the primary drivers of the sector’s performance.

Indeed, we are yet to see the full impact of the foot-and-mouth disease that is challenging the sector. This has started to affect sentiment and is likely to continue in the coming months.

In essence, the ACI results for the second quarter of 2025 indicate that the sector’s mood remains upbeat about the recovery this year. Still, the results also show that recovery will probably be uneven as some key subsectors struggle with animal diseases.

Notably, the dominance of geopolitical concerns in respondents’ views illustrates the strong dependence of South Africa’s agricultural sector on export markets and the need to diversify these markets. China, India, Saudi Arabia and Egypt are among the key markets we should target for expansion.

However, as we drive diversification, we must work vigorously to retain access in various markets across the European Union, United Kingdom, Africa, Asia, the Middle East and the Americas, among others.

Also significant are the collaborative efforts between business and government in addressing biosecurity issues in South Africa’s agriculture, as well as efforts to promote more efficient network industries, better municipal management and the implementation of the Agriculture and Agro-processing Master Plan, which is crucial to the long-term growth of the sector.

Wandile Sihlobo is the chief economist of the Agricultural Business Chamber of South Africa.