South Africa's economic slowdown is 'largely self-inflicted'

Months into a destructive platinum strike and gloomy economic data, should Africa’s most developed economy be reaching for the Valium?

Although first-quarter gross domestic product (GDP) figures were negative and subsequent data shows an economy under severe pressure, alongside flagging business confidence, experts believe a recession is not assured.

Nevertheless, weak growth expectations mean South Africa will be unable to meaningfully address the country’s chronic problems of inequality and unemployment unless policy implementation, such as the roll-out of the National Development Plan, begins in earnest, economists said this week.

This is in line with remarks by Reserve Bank governor Gill Marcus earlier this week. She said, although a recession is unlikely, South Africa’s slowdown is “largely self-inflicted”.

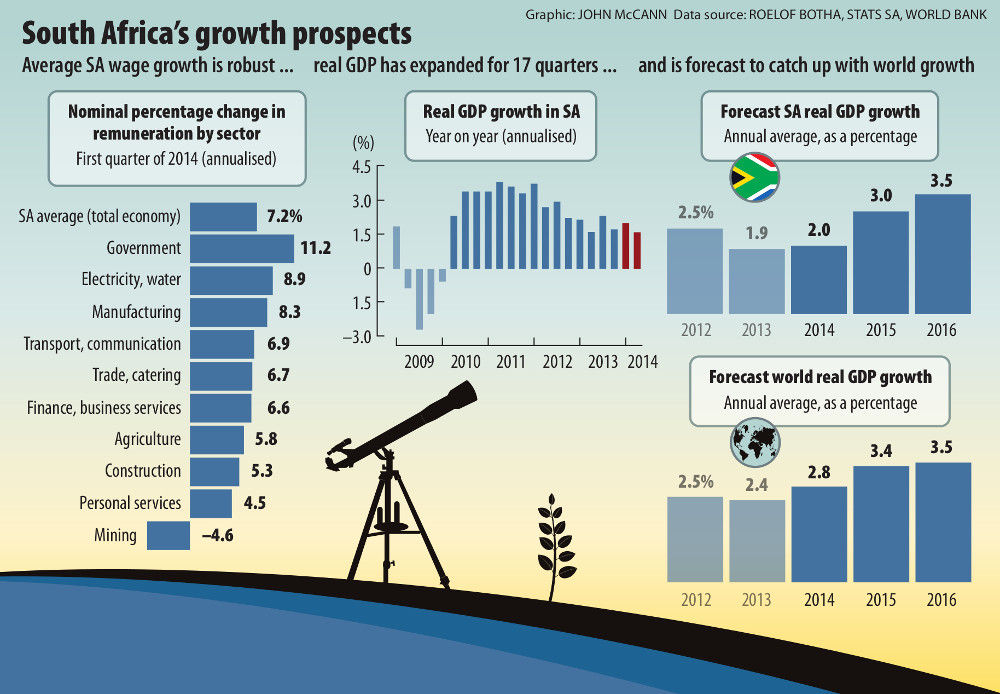

Declines in April’s manufacturing output by 1.5% year on year, and the World Bank’s revision of South Africa’s growth forecast to 2% this year, due in part to labour disputes and constrained electricity supply, compounded the bad news.

Positive growth prospects

Roelof Botha, economic adviser to PwC, said that, although very damaging, the platinum strike is unlikely to sink the economy into a recession.

A number of different data sets suggest positive growth prospects for this year, he said.

“On a technical level, it should be pointed out that the well-publicised negative GDP growth rate in the first quarter of the year is misleading, as it compares this quarter with the last quarter of 2013, when robust growth of just below 4% was recorded,” Botha said.

South Africa’s composite leading business cycle indicator, released by the Reserve Bank, provides a sense of the direction of the future business cycle.

Although it has declined in recent months, that of the country’s major trading partners was 5% higher during the first quarter of this year compared with the same quarter last year. This, along with a more competitive exchange rate and a sustained economic recovery in Europe, augur well for nonmining export growth this year, Botha argued.

Wages in many sectors of the economy remain resilient, he noted, with labour remuneration growth recording real positive gains in the past year. The public sector led the way with above-inflation increases between the first quarters of 2013 and 2014.

‘Economic lethargy’

Meanwhile, the JSE has taken the “economic lethargy” in its stride, with the all share index reaching record highs of more than 50 000 in May, Botha said.

Allowing for “a little luck” in the platinum talks, an end to the strikes could mean that, in the third quarter of the year, miners working to make up for lost production could potentially cause a rebound in GDP figures, he said.

Stanlib chief economist Kevin Lings said a slip into a technical recession – two consecutive quarters of negative growth – is going to be “a close call”, as a number of sectors in the economy are losing momentum alongside the declines seen in mining.

But a protracted recession for the year as a whole is not likely, said Lings. Although GDP shrank in the first quarter by 0.6%, on an annual basis the economy grew 1.6%, he noted. Even if the economy grew at 0% for the rest of the year, South Africa would still achieve 1.1% growth, he pointed out.

But if the strike continues well into the third quarter, given the linkages of mining to other sectors in the economy, a protracted recession is conceivable, Lings added.

Loss of momentum

The loss of momentum in economic activity means it will be difficult to grow beyond 2%, he said, insufficient to deal with the real pressures facing the country, namely unemployment, inequality and poverty.

For the outlook to improve, firmer policy commitments from the government are required, said Lings, notably the implementation of the National Development Plan and speeding up the delivery of infrastructure – especially from key parastatals such as Eskom and Transnet.

Economic performance will be considered by ratings agencies Standard & Poor’s and Fitch, which both pronounce on their respective credit ratings for South Africa on June 13.

Stanlib expects “some downgrades”, noted Lings, whether they are reductions in the country’s domestic credit ratings or changes in the ratings outlook from neutral to negative.

To ratings agencies, that growth has slowed will not be as important as the reasons for the slowdown, and whether these factors are domestically driven rather than a result of global events that are outside authorities’ ability to control, said Lings.