Heads of state Vladimir Putin

South Africa is the nation that stands to benefit the most from the Brics’ New Development Bank, which will grant it access to cheaper money for infrastructure projects as well as a crisis fund, which will double its emergency credit line in the event of a balance of payments crisis.

But the cash-strapped country will have to find creative ways to get the funds it needs to contribute to the bank. And with nations such as China and Russia in the mix, geo-political concerns abound.

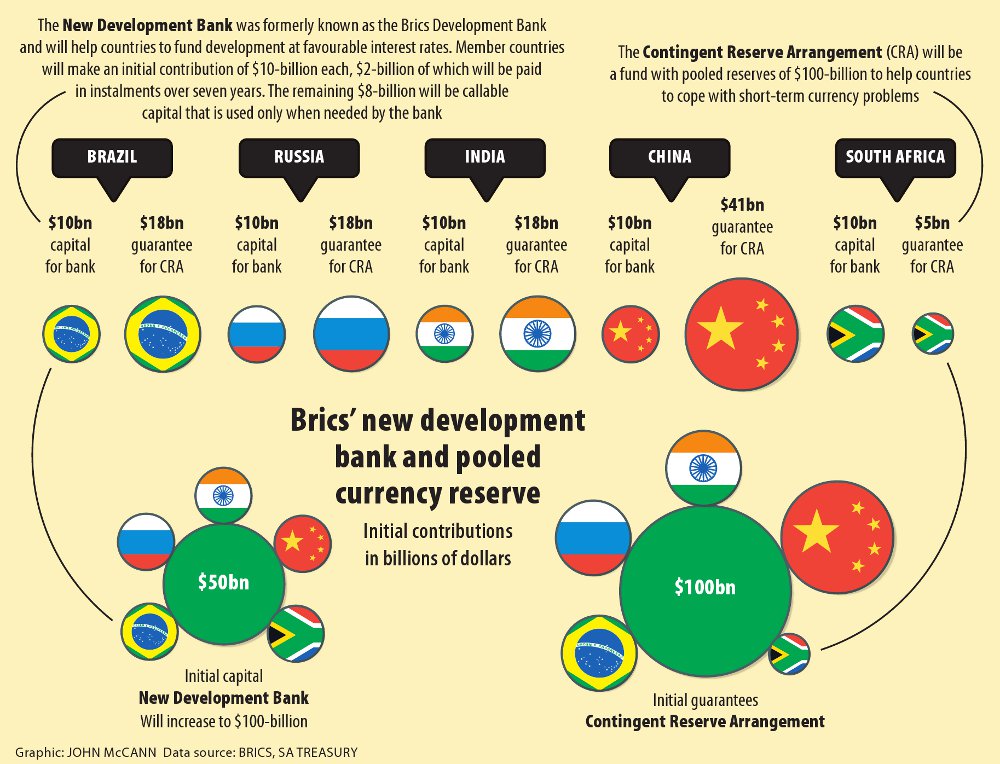

Two distinct developments came from the Brics summit in Fortaleza last week, one being the announcement of the long-awaited Brics bank. In addition, a crisis fund, known as the contingent reserve arrangement, will operate much like the International Monetary Fund, on which member countries, in return for their contributions, can draw when in need.

The New Development Bank will offer funding for infrastructure and sustainable development projects and will be authorised to issue maximum capital of $100-billion, of which $50-billion will be issued initially.

How the funding might be raised is not entirely clear and how it might be used appears equally complex.

One well-placed observer said the bank is likely to issue its own bonds, borrowing at the rates of those in China, the financial powerhouse of the Brics (Brazil, Russia, India, China and South Africa) grouping, which raises the prospect of more competitive borrowing for those accessing its capital.

Interest rates

Tradingeconomics.com reported earlier this week that the interest rate on China’s 10-year government bond was last at 4.32%, almost half of South Africa’s 7.97%. The website showed equivalent rates of 11.54% for Brazil and Russia at 9.03%, and India’s rate was 8.69%.

South Africa, like every other Brics nation, will contribute $10-billion initially and $20-billion in total. Each country will pay $2-billion in pre-agreed instalments over seven years and the remaining $8-billion will be “callable capital”, which means it will only have to be physically contributed if the bank’s board of governors decides the institution needs to strengthen its capital resources.

It’s a government guarantee, but is as good as tier-one capital in this context. “Even then, it is highly unlikely that the bank will need all of the $8-billion in one fell swoop,” treasury spokesperson Jabulani Sikhakhane told the Mail & Guardian.

The seven instalments making up South Africa’s $2-billion contribution will be provided for in the budget, as is usual with contributions to other multilateral institutions, Sikhakhane said.

But a source close to the developments said the funds could come into the fiscus from a number of sources, including the Development Bank of Southern Africa (DBSA) and the Industrial Development Corporation (IDC), and possibly even from the country’s foreign exchange reserves.

Equity injection

A recent equity injection will allow the DBSA to grow its balance sheet to R90-billion, but the IDC is likely to be in a better capital position to contribute to the capital funding of the bank. Yet releasing liquidity from the institution would require that shares be sold. This could involve the sale of shares in “mature” investments such as its holdings in fuel giant Sasol.

The $100-billion pooled capital could then be used to raise debt in the global market and potentially double the amount at relatively low rates. It is expected that China’s financial muscle could act as significant leverage.

Asked about whether the bank will issue bonds or not, Sikhakhane said the treasury can only say that “it is normal for similar multilateral institutions to increase the size of resources available for lending by raising debt”.

“If the cost of borrowing is lower, you might be able to fund some higher-risk players,” the source close to the Brics bank said. “The bank’s job is to take higher risk.”

Razia Khan, regional head of research in Africa for Standard Chartered, said the vision is that the capital is not just limited to a Brics country and that as other members join and contribute, “that could be leveraged off and could end up with as much $350-billion”.

Potentially, South Africa’s private-sector institutions and state-owned enterprises such as Eskom or Transnet could look to the Brics bank for financing, the source said.

Crisis fund

The contingent reserve arrangement, pooling $100-billion in total foreign exchange reserves, is of the most significance to South Africa, which will contribute just $5-billion in guarantees but will be able to access $10-billion – twice its contribution – should the need arise.

This is substantially more than the contingent credit line currently offered by the International Monetary Fund (IMF). At the time of writing, South Africa holds a quota in the IMF equal to special drawing rights of about $2.9-billion. Although the country can also access funds through many other credit facilities such as a standby arrangement, a flexible credit line and an extended fund facility.

The $20-billion that China will be able to draw down on, despite its $41-billion contributions, is small fry in comparison with its foreign exchange reserves of almost $4-trillion. But for South Africa, with foreign exchange reserves of little more than $50-billion, the assistance the reserve offers is an additional 20% in order to buffer the impact of a potential domestic economic crisis.

Speaking from London, Standard Chartered’s Khan said the 20% backstop measure is a big plus for South Africa – the country putting in the smallest amount to the reserve. “It’s the advantage that comes from being the smallest member of the group. Perhaps the one that has to put in the least stands to gain the most. That is a big win,” she said.

According to the treasury, each of the Brics countries will be able to obtain up to 30% of its maximum accessible funding based only on a decision by other members.

“Any additional amount will only be available in conjunction with an IMF arrangement for the country. The foreign exchange reserves will not need to be transferred into the pool, but will act simply as a guarantee until a member nation needs to draw down on it,” the treasury said.

Although shareholders other than Brics countries will be introduced to the bank over time, it has been decided that the Brics member countries will retain a majority shareholding of no less than 55%.

South Africa will play an active role in the management of the bank and also use it as an alternative source to finance its infrastructure build and regional integration initiative. This will be aided by the bank’s regional centre, which will be based in South Africa.

Geopolitics concern

A prominent concern, however, is that of geopolitics, as China emerges as a global superpower and Russia comes under the spotlight for backing separatists in Ukraine following the seizure of the Crimea.

Although the rates offered by the bank are expected to be competitive, the problem may lie in bureaucracy.

A political risk analyst based at the University of Pretoria, Mzukisi Qobo, said: “The institution has huge ambitions, and the countries have different sets of interests and norms. These are countries that are not natural partners.”

He said the Brics countries have varying geopolitical challenges and that the New Development Bank in particular could play into those interests. “The major countries, in this case Russia and China – their interests are going to loom large,” he said. “Russia has a geopolitical ambition to project itself as a re-emerging power and to reclaim its lost glory of the Soviet empire.”

For China, having the bank’s head office in Shanghai is important to its hopes to develop the city into an international financial centre that competes with New York, Qobo said, noting that the bank also offers China a way to enlarge its footprint, especially in Africa and India.

Speaking to the M&G from Argentina, Lyal White, director of the Centre for Dynamic Markets at the University of Pretoria’s Gordon Institute of Business Science, said that Brics as a multilateral forum of powers should have spoken up about developments in Ukraine involving Russia at the summit, which Russian President Vladimir Putin attended.

“It’s almost as if they ignored it,” White said.

Economic rationale

He said the initial idea behind the bank was based on an economic rationale that incorporates the new leading economies that are coming to the fore. But now most world economies are performing poorly – with the exception of China, he pointed out.

“China has put in the lion’s share of the [contingent] reserves, so it has the most leverage. Brics is totally irrelevant without China because of its size and performance,” White said.

Although the Brics bank may be seen as an alternative to the IMF and the World Bank, White warns that these institutions are still valuable: “I think all these things needed to be reformed, but they should not be abandoned.

“Why propose a new world order of financial architecture when we can simply tweak and change the others?”

Although lending rates may not necessarily be cheaper than other development banks, conditionality is likely to be different from that imposed by the likes of the World Bank – and it may be more enticing for emerging economies, said Khan.

White said Brics would best operate as a bridge between the developed and emerging economies and not simply as opposition to the Western world.”The Brics bank has huge ambitions, and the countries have different sets of interests and norms. They are not natural partners”