Effective management of the JSE continues to attract money.

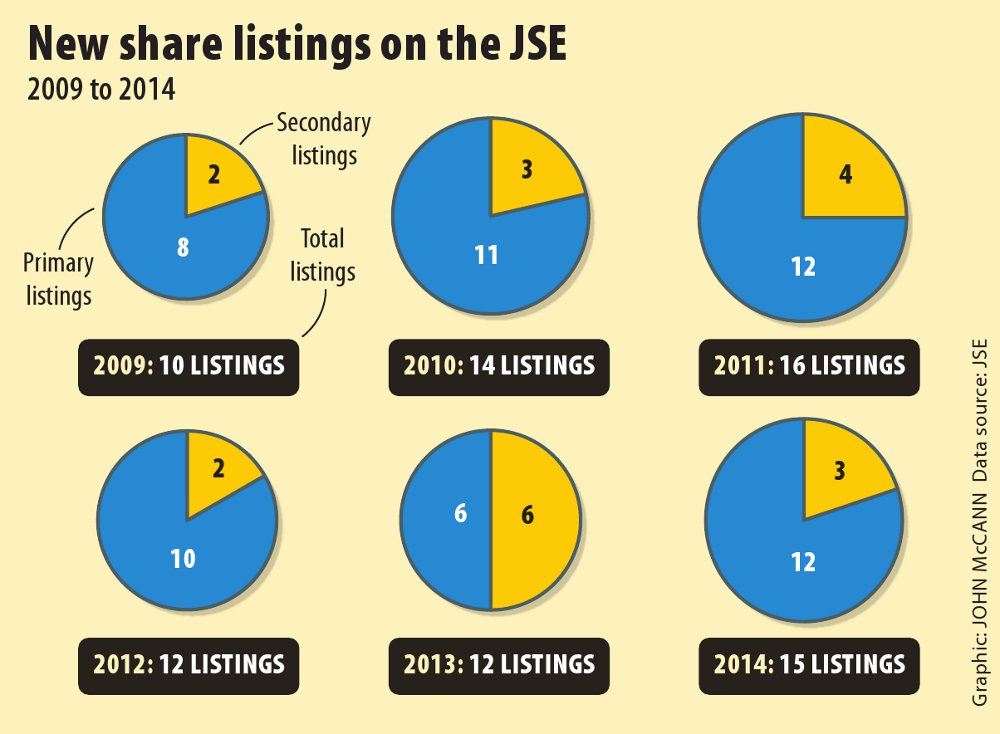

There has been a flurry of new listings on the JSE — 15 companies this year so far, compared with 12 last year — and more initial public offerings (IPOs) appear to be in the pipeline.

Andrew Hannington, the chief executive officer of Grant Thornton, a tax and advisory company that helps companies to list, said they had seen an “uptick in listings that we have not seen before”. “We are definitely seeing greater interest. There are more clients knocking at our door saying: ‘Are we ready for listing?'”

Grant Thornton is advising about five medium-sized companies that are looking for a primary listing on the stock exchange, according to Hannington.

Data supplied by the JSE shows that the bulk of the new listings were on the main board (10) and five were on the AltX, the market for small and medium-sized companies.

With the all share index at the 50 000 point level, it was cheap to raise capital, he said.

“Companies are also encouraged by the long-term upward trend of the JSE, and the fact that there is a lot of liquidity around.

“We [South Africans] pay our insurance premiums and pensions, so lots of financial institutions are still looking to invest and legislation makes it difficult to invest offshore.”

Pension funds

Donna Oosthuyse, the director of capital markets at the JSE, said: “It’s not a well-known fact but, while there are R3.9-trillion assets in the financial banking sector, there is 1.8 times that in nonfinancial institutions, like pension funds, namely R6.9-trillion, and they need somewhere to invest.”

Despite some correction in the market, the JSE has shown a long-term upward trend, with the FTSE-JSE all share trading at an overall price to earnings (PE) ratio of 16.75 and the FTSE-JSE industrial 25 index showing a PE ratio of 21.19, indicating that there is a great deal of money out there.

Wayne McCurrie, the senior portfolio manager of Momentum Asset Management, said the fact that the JSE was expensive attracted companies.

“Companies list when a market is expensive so they get a good price for the assets they are selling,” he said.

Hannington said listings offered good opportunities for shareholders and for company staff to invest.

New listings the world over dried up after the 2008 financial crisis but this year the JSE is beginning to show positive activity, which could surpass the 16 listed in 2011.

Significant listings

But the JSE has seen some significant listings during the past few years. There was Life Healthcare in 2010, Rand Merchant Holdings in 2011 and Glencore Xstrata last year.

More than half of the new listings since 2009 have been in the property sector. Hannington said they were still seeing property companies coming through. “They have been leading for the last four years.

“I believe we will see more investment as soon as guys see the success of their neighbour,” he said. “When it comes IPOs, some companies don’t want to be the first in the class.” The most significant listing this year has been that of the financial services group, Alexander Forbes.

Other listings in the financial services sector, all in the second half of the year, were Sacoven, an investment company that specialises in natural resources and consumer goods in emerging markets, the Anchor Group and a unit of the PSG Group, PSG Konsult.

Two real estate trusts, Equities Prop Fund and Capital Property Fund, and residential property devloper Freedom Property Fund have also listed since June.

Food companies

Two food companies, Quantum Foods and Rhodes Foods, were the most recent to list.

The listings in the first half of the year were more diverse, including the gas and the oil producer Carmac Energy, Advanced Health in the healthcare and equipment services sector, the real estate trust Safari Investments, the mining company Tharisa and the real estate investment services sector company Visual International Holdings.

Sacoven’s listing is significant because it’s the frst special purpose acquisition company (Spac), which has no assets. These cash-only investment companies can list with the proviso that operating assets are acquired within two years of coming to the market.

There has also been talk of the media company Primedia listing since Roger Jardine, the former head of the construction company Aveng, was appointed chief executive.

The head of the Goldman Sachs Group for sub-Saharan Africa, Colin Coleman, predicted correctly in an interview in January that listings on the JSE would jump for the first time in three years. He attributed it to private equity buyers selling their investments, forcing companies to go to the market for funds.

Difficult growth

Oosthuyse attributes the growth in IPOs to the value being offered by a “well-regulated and well-priced market and high levels of liquidity”.

But she also said that, economically, it was a difficult time for companies wishing to grow. “The reality is that companies come to the market when they need capital to help them grow and, if they are operating in an economy that is stressed, it is harder for them to raise the needed capital.”

McCurrie said the downside of a market with some expensive listings was that it would see an adjustment depending on economic circumstances and data coming out of countries such as the United States, China and Europe.

He said companies currently listing, like those in the property sector that “peaked in the middle of last year”, could “find they have got their timing wrong in a falling market”.

McCurrie does not expect to see any major adjustments to the market. “These kinds of adjustments are normal and have happened previously,” he said.

Trading environment

Oosthuyse said the JSE was working hard to attract new listings and to make the trading environment more attractive.

“It is constantly reviewing its regulations and looking at ways to make listing easier,” she said. The JSE recently made it possible for companies listed on the Australian, London, New York or Toronto stock exchanges for at least 18 months to fast-track a secondary listing on the JSE main board or on the AltX. The AltX was set up for small and medium-sized companies and does not require them to submit a profit history.

“Of the 94 that have listed, 24 of those have gone on to list on the main board,” Oosthuyse said.

“The idea is that, when companies are looking around for funding, they will see the JSE as a potential place to list rather than looking to other vendors.”

She said that, for starters, the “financial services sector is regulated and has deep financial reach”.

Appetite for good products

International companies considered investing on the JSE because they knew there was an appetite for good products and there were sufficient funds in the market to find a buyer for shares.

“We compare and are attractive when compared to other markets around the world.

“We are stable and well regulated, being ranked first among 144 nations for the effectiveness of regulation and supervision by the World Economic Forum for the fifth consecutive year in the Global Competitiveness Report.”

Oosthuyse is upbeat about the future of resources and said “there is still a lot of opportunity”. They are also still seeing listings by property-related companies or funds, and “we are seeing some movement in energy”, she said.

“We have companies that have invested in equity as projects come on line and may want to invest or monetarise investment and spin off one market into another, or spin off into special vehicles,” she said.

African attention

Nicky Newton-King, the chief executive of the JSE, said in an interview last month on CNBC Africa that the JSE was starting to attract more attention from African countries, but the reality was that companies first listed in the country in which they were based before considering a secondary listing.

She said that representatives from the Nigerian Stock Exchange had recently visited South Africa. They had discussions about future opportunities, but Nigeria was still getting an index provider and working on regulations.

McCurrie believes many shares, particularly industrials, are overvalued, which concerns him.

“Some companies are expensive, but then you look at Sasol with a PE of 10, which is not an unacceptable PE at all. [But] the JSE has companies like Aspen with a PE of 33, Naspers at a 90 PE, and Woolworths at a PE of almost 20, which can be regarded as high,” he said.

He warns that local interest rate hikes or positive news from the US, including continued job creation, and the slow European recovery could take a toll on overvalued firms on the JSE, leading to a slight adjustment. But he adds that a well-run company with good prospects will not be affected badly.