A significant number of municipalities that deposited funds with VBS tended to be relatively rural.

VBS Mutual Bank allegedly broke the law by accepting deposits totalling around R1.5-billion from municipalities, which may now have to wait up to seven years before getting back only a fraction of the funds placed with the institution.

Disciplinary action, as well as criminal proceedings, is also to be lodged against those responsible – from the bank and the municipalities – for the funds ending up with VBS.

The Hawks are also set to get involved in the investigation into the bank’s dealings.

Details of this and VBS’ alleged activities relating to municipalities are contained in court papers, as well as a report recently presented to Parliament and a reply to a Parliamentary question.

VBS Mutual Bank is at the centre of a massive and ongoing fraud saga.

At least R1.5-billion was allegedly looted from it and used by executives who bought, among other items, luxury vehicles.

On March 11 VBS was placed under curatorship, and SizweNtsalubaGobodo Advisory Services (Proprietary) Limited, represented by Anoosh Rooplal, was appointed to deal with this.

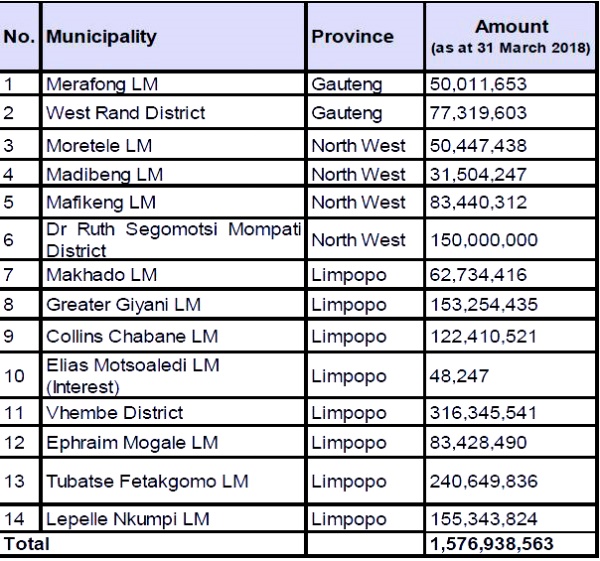

Fourteen municipalities from three provinces – Gauteng, the North West and Limpopo – deposited funds with VBS.

Courtesy of News 24

On Tuesday the DA’s Western Cape spokesperson on finance, Dennis Joseph, issued a statement that no provincial departments or municipalities had invested at, or borrowed money from, VBS.

“Mutual banks such as VBS are not utilised for government investment or borrowing in our province. Any investment made is done in line with the Public Finance Management Act,” he said.

“Furthermore, the VBS scandal reiterates the importance of investing in commercial banks which have a more onerous regulatory framework than mutual banks which have a more relaxed regulatory framework.”

Up to 7-year wait for fraction of deposits

Last month a response to a parliamentary question posed to the minister of cooperative governance and traditional affairs (Cogta) said that a preliminary report from the South African Reserve Bank on the curatorship process “revealed that the available equity cannot cover the deposits”.

“The stakeholders (National Treasury and Cogta) were advised to work with the assumption that it is highly unlikely that the municipal deposits will be recovered. Where possible they could receive about 10% of their deposits once the process is concluded in about five to seven years’ time,” it said.

High-level investigations

The response said that the municipalities, as well as the provinces, had started investigations into what had transpired.

“[These] will inform the disciplinary actions as well as criminal charges to be instituted against responsible official and/or political office bearer responsible for placement of funds with VBS Mutual Bank,” it said.

The Reserve Bank had also started a forensic investigation into the saga and a report on the preliminary probe would be handed to the Hawks and also made public once it is completed.

‘Little left for illegal municipal deposits’

According to a report by National Treasury dated April and which was presented to Parliament, since 2003 the Municipal Finance Management Act (MFMA) had only allowed municipalities to bank with commercial banks.

This was to try and ensure that municipal funds were safe and readily available for spending based on what was prioritised in budgets.

“Municipalities may get between 10c and 40c on the rand on their deposits… There may be little left for municipalities, who deposited illegally,” the report said.

It said there were more than 13 000 depositors with their “life savings” in the bank and they would be focused on.

“National Treasury sent an email in August 2017 advising municipalities that the MFMA did not allow for funds to be deposited with a mutual bank,” the Treasury report said.

“In late 2017, VBS Mutual Bank tried to interdict Treasury from engaging with municipalities. Subsequent to the email communication, VBS accepted approximately R1-billion in further deposits from municipalities. It is not immediately apparent if these were rolled over, or new deposits.”

A significant number of municipalities that deposited funds with VBS tended to be relatively rural.

The report said that VBS had effectively broken the law in accepting deposits from municipalities.

‘VBS actively flouted the law’

“VBS actively flouted the law, and focused on municipal deposits which comprised almost 75% of all its deposits. Despite being aware of the restrictions on municipalities, VBS continued to accept new municipal deposits even after it started engaging with Treasury on phasing out its past municipal deposits in order to comply with the MFMA,” it said.

“An initial assessment indicates that it accepted R1-billion more in deposits after August when an email was sent by the MFMA help desk advising municipalities that they were in breach of the law.”

The report said that VBS had “ignored the basic fact that municipal deposits” were short term in nature.

“VBS management did not appear to consider that municipalities (if they are to deliver) should be spending all their funds within a municipal fiscal year… and that these municipalities would need to access their cash to make payments a few months after been deposited,” it said.

Sequestration proceedings

An application to try and have the estate of Robert Madzonga, VBS’s previous chief operations officer and the group executive officer of its main shareholder Vele Investments, provisionally sequestrated is set to be heard in the Johannesburg high court on Tuesday.

Provisional sequestrations are also to be brought against Tshifhiwa Matodzi, the former chair of VBS’ board of directors and also the director and chairperson of Vele; Malusi Ramavhunga, VBS’ chief executive officer; Phillip Truter, the bank’s chief financial officer; and Phophi Mukhodobwane, VBS’ general head of treasury and capital management. — Fin 24