Urban bliss: Recently built houses at Siyathemba, a suburb of Kathu, accommodates people moved out of Dingleton, where Kumba Iron Ore wants to mine. (Oupa Nkosi)

A mere 300km from the border of Namibia lies a small town that’s growing exponentially — it is home to some of South Africa’s highest earners, at times surpassing those in Johannesburg and old-money Stellenbosch.

Driving into Kathu, two hours from Upington, one can’t miss the gigantic excavators that mark this as a mining town. It is the heart of the Gamagara local municipality, which has the third-highest average taxable income in the country, according to the latest data released by the South African Revenue Service.

Analysis of the personal income tax records released by Sars in December for 2017-2018 shows that the average taxable income in the City of Johannesburg is nearly R440 000 a year. This is followed by the Stellenbosch municipality at R414 000 and then, surprisingly, Gamagara at slightly less than R380 000.

According to an assistant manager at one of the main garages in Kathu, the town is built on mines. “There are many small and big iron ore-rich mines. Some of them have popped up in the last few years. Everyone lives around here, from the mine bosses to the workers,” he said. “If people don’t work in the mine, they work in small business like ours or at Checkers.”

In this very dry area in the Northern Cape, palm trees line the main road. The streets are clean and every second vehicle is a bakkie — not the cheap kind either. At the first turn into the town is a sprawling mall — there are two, on either side of the town.

One of Kathu’s residents laughed when he said there was even a place described as the “Sandton of Kathu”, where one of the biggest private education groups, Curro, built a school less than five years ago.

“The big mine bosses who live here have bought up land and are building big homes there. It’s really fancy,” he said.

At the Gold Estate are men in khakis and red golf shirts, teeing off in the early morning. Book a room in one of the guest houses in the estate and it will cost you a cool R1 200 a night. Two hours away is Upington and the average rate for a room is R700 a night.

Municipal spokesperson Kamogelo Semamai said property is expensive in Kathu. “I think your analysis is correct. Gamagara falls within the bracket of the highest income earners in the country. The main influence is the mining; Anglo American is one of them. In the past five years, these mines have done quite well and the economy in this area boomed,” he said.

Semamai said possibly 70% of the population works for the 14 mines in the area.

Besides mining, another industry is slowly growing — solar power generators.

Obakeng Ramonne works for a power producer and said they had completed the building phase of the plant he works on.

“Most of the people who work here earn quite a lot of money because these mines pay very well. But a lot of people don’t know what to do with it. There are great opportunities here and we are a great mix of abelungu and Batswana,” he said.

But not everyone is revelling in the success of this town. A 10-minute drive out of Kathu leads to the eerily deserted town of Dingleton, where Kumba Iron Ore wants to mine.

Houses, shops and a hotel are being demolished. Many of the people have been moved to the newly built Siyathemba suburb in Kathu. But a handful of people remain, refusing to be moved without “proper compensation”. One of them is Jan de Koker, who has lived in Dingleton for 15 years. He said he was waiting for Kumba to finalise his agreement and pay for suitable accommodation for him and his family.

Another former Dingleton resident, Erica Leshepe, complained that, although they had been moved from her home and paid more than R100 000, Kathu was too expensive.

“I used to have a little restaurant and I used to pay about R2 000 for the rental of the space. When I moved to Kathu, I could not find a place for less than R15 000 a month,” she said.

Who SA’s average taxpayer is

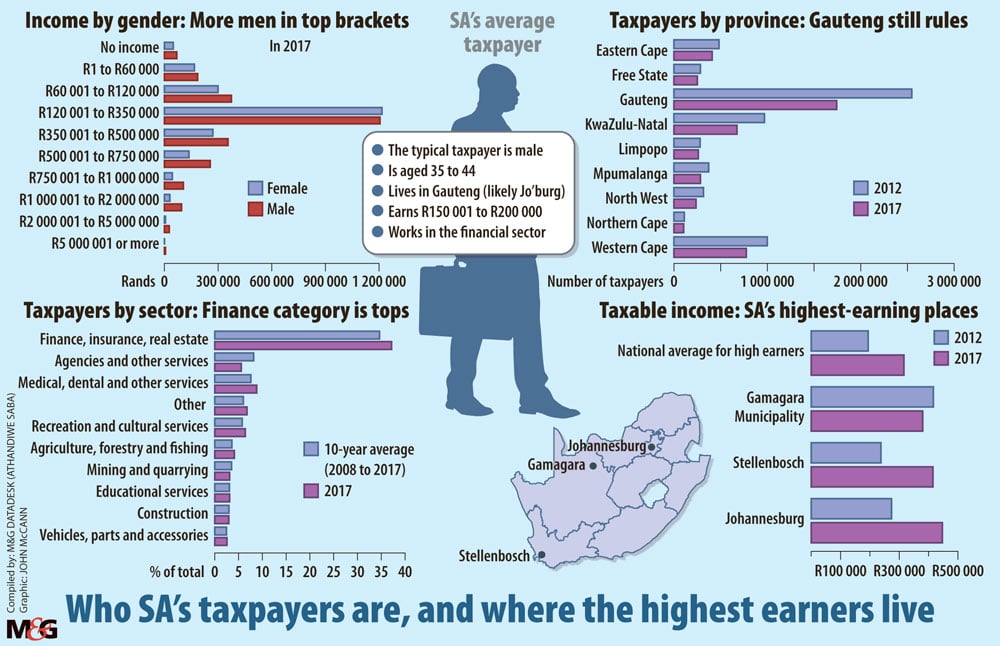

The Mail & Guardian’s analysis of personal income tax data from theSouth African Revenue Service (Sars) for 10 years from 2008 shows that the average taxpayer is a man in his late 30s living in Gauteng and most probably in the City of Johannesburg (See graphic).

According to Sars, the number of men assessed made up 54.7% of the total.

In 2017-2018, the financial sector, which includes insurance and real estate, employed the largest number of assessed individual taxpayers. In the period from 2008 to 2018, this sector is followed by a category named “agencies and other services”, which includes auctioneers, wool and mohair brokers, and betting agents, then the medical, dental and other health and veterinary services.

The 10-year analysis also shows that women only outnumber men taxpayers in the R120 001 to R350 000 tax bracket. Out of the 6 847 people who fall in the R5-million plus tax bracket, only 880 are women. — M&G Data Desk