Paul Hutchinson is a sales manager at Investec Asset Management

Given the compelling reasons for investing offshore, which include diversification benefits, reduced emerging market and currency risk, and maintenance of “hard” currency spending power, how best should investors go about investing offshore?

The answer depends on investors’ personal circumstances, risk profile and longer-term financial planning objectives. We therefore suggest that investors consult a professional financial advisor who can help identify investment solutions that address their specific requirements, which may include:

Investing in an FSCA-approved collective investment scheme (unit trust fund) that includes offshore assets

Examples are the Investec Diversified Income, Cautious Managed, Opportunity, Equity and Value funds. A Regulation 28-compliant multi-asset or balanced fund is allowed to invest up to 30% in international assets. By making use of this type of fund, investors are effectively appointing a professional money manager who has the time, experience and access to information to decide when and how much to invest offshore on their behalf, and into which assets. Given relative valuations, most South African multi-asset funds are close to the 30% offshore limit, and therefore the key decision is to select a manager who has a proven long-term track record and capability of investing offshore.

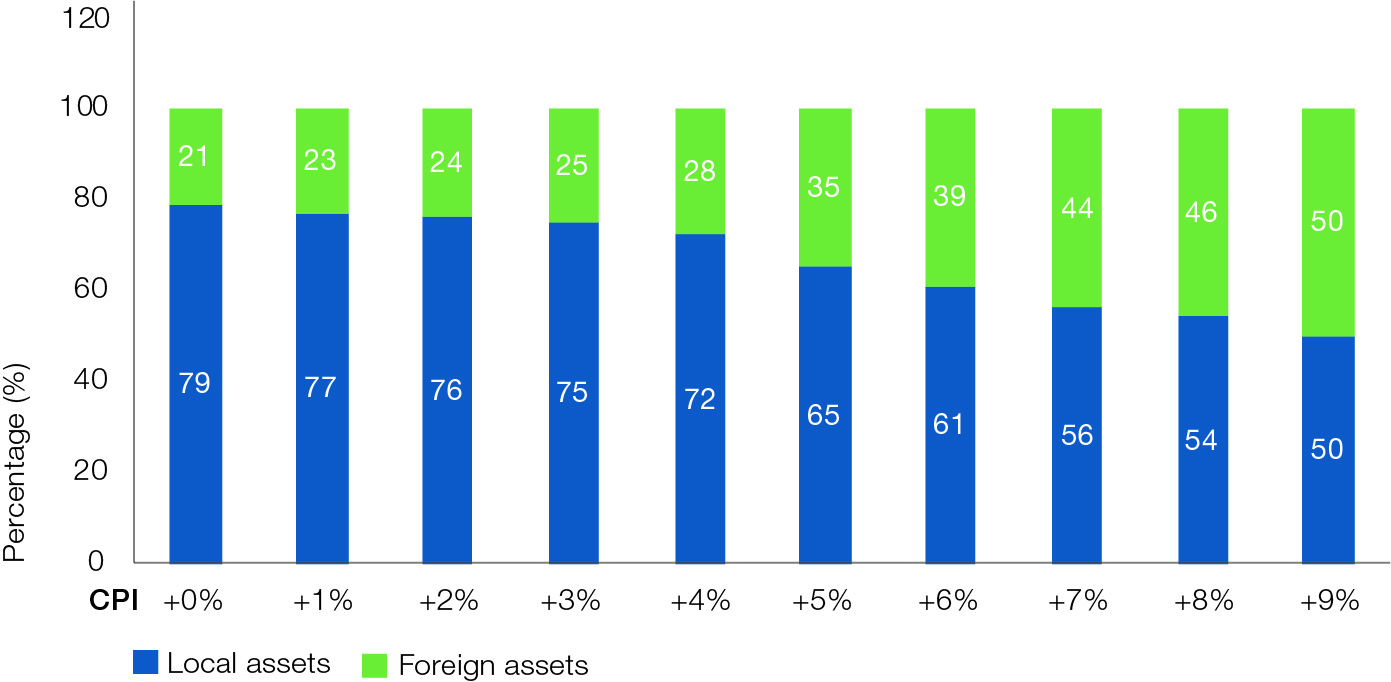

As a subset of this option, a worldwide flexible fund, such as the Investec Worldwide Flexible Fund, is potentially a more efficient investment solution as it is not constrained by geographical or asset class limits. While the optimal strategic allocation to foreign assets differs depending on each investor’s personal circumstances, for many it could be at least a third of their assets, as illustrated in Figure 1 below.

Figure 1: Optimal blend for 3-year investment horizon

Source: BNP Paribas 4Q 2015

A Regulation 28-compliant multi-asset high equity or other domestic fund that is limited to 30% offshore exposure may therefore not be the most efficient solution. In fact, an unconstrained investment mandate improves the return characteristics of a multi-asset (balanced) portfolio at only marginally higher risk.

Investing in an FSCA-approved rand-denominated international unit trust fund

Examples include the Investec Global Multi-Asset Income Feeder Fund, Investec Global Strategic Managed Feeder Fund and Investec Global Franchise Feeder Fund, which invest directly into their respective underlying funds. By doing so, investors do not make use of their individual offshore allowance. Rather, they invest in rands and when they disinvest, the proceeds are paid in rands. While investors benefit from being invested in funds that only hold offshore assets, they remain exposed to South African political risk.

Investing in a foreign-domiciled international unit trust fund that is registered in South Africa

Examples are the Investec Global Multi Asset Income Fund, Investec Global Strategic Managed Fund and Investec Global Franchise Fund. By doing so, investors invest directly into an FSCA-approved offshore fund in its dealing currency e.g. dollars, pounds or euros. Having completed the fund’s application form, investors effectively instruct their bank (local or international) to make payment to the fund’s bank account. When disinvesting, investors will then also receive the proceeds in the fund’s dealing currency.

Many South Africans have favoured rand-denominated international funds because of the perceived complexity of applying for tax and Reserve Bank clearance to invest offshore directly. However, now that investors can invest up to R1-million annually in an international fund without the need for any prior approvals, they can access foreign-domiciled international funds with relative ease and thereby diversify away South African political risk.

In addition to the annual discretionary allowance of up to R1-million, investors also have a foreign capital allowance of up to R10-million per calendar year (a total sum of R11 million). Investors need to obtain foreign tax clearance from the South African Revenue Service when they wish to utilise their annual foreign allowance of R10-million. Reserve Bank approval is only required when investors wish to transfer funds offshore in excess of the maximum total sum of R11-million per calendar year.

The following table provides a summary of the means by which a South African investor can obtain offshore exposure:

|

SA unit

trust funds |

Worldwide

flexible funds |

SA feeder unit

trust funds |

Foreign

domiciled funds |

| Offshore exposure |

0 – 25% |

0 – 100% |

95 – 100% |

100% |

| Use of investor’s offshore allowance |

No |

No |

No |

Yes |

| Use of Manager’s offshore allowance |

Yes |

Yes |

Yes |

No |

| Does Investec have offshore capacity |

Yes |

Yes |

Yes |

N/a |

| Investment currency |

Rand |

Rand |

Rand |

$, €, £ |

| Disinvestment proceeds currency |

Rand |

Rand |

Rand |

$, €, £ |

| Exposure to SA political risk |

Yes |

Yes |

Yes |

No |

| Investment requirements |

Application form, FICA documentation, proof of payment |

Application form, FICA documentation, proof of payment |

Application form, FICA documentation, proof of payment |

|

| Investec core funds |

Investec Diversified Income, Cautious Managed, Opportunity, Equity and Value Funds |

Investec Worldwide Flexible Fund |

Investec Global Multi-Asset Income, Global Strategic Managed and Global Franchise Feeder Funds |

>R1mn < R11mn annual allowance: application form, FICA documentation, proof of payments and SARS tax clearance |

| Investec Global Multi-Asset Income, Global Strategic Managed and Global Franchise Funds |

Paul Hutchinson is a sales manager at Investec Asset Management

The information contained in this press release is intended primarily for journalists and should not be relied upon by private investors or any other persons to make financial decisions. All of the views expressed about the markets, securities or companies in this press comment accurately reflect the personal views of the individual fund manager (or team) named. While opinions stated are honestly held, they are not guarantees and should not be relied on. Investec Asset Management in the normal course of its activities as an international investment manager may already hold or intend to purchase or sell the stocks mentioned on behalf of its clients. The information or opinions provided should not be taken as specific advice on the merits of any investment decision. Telephone calls may be recorded for training and quality assurance purposes. Investec Asset Management is an authorised financial services provider