Striking oil: Richards Bay is the proposed site for a new refinery. The Central Energy Fund is in talks with Saudi Arabias Aramco to develop the $10-billion project. (Hoberman Collection/Universal Images/Getty Images)

Global oil giant Aramco, owned by Saudi Arabia, will meet the Central Energy Fund (CEF) to discuss building a 300 000-barrels-a day new oil refinery and petrochemical plant in South Africa. But environmental experts have questioned whether the investment will meet the country’s energy and climate-related challenges.

The deal is expected to be discussed next week during a meeting between Aramco — the world’s largest oil company, which is set to become the largest initial public offering (IPO) on record — and CEF officials, when an Aramco delegation arrives in the country. The IPO is expected to be concluded by December 5.

The CEF’s Jacky Mashapu confirmed this week that the government is in talks with Aramco to build a giant crude-oil refinery at Richards Bay. The refinery, which is expected to be completed in nine years, would be the largest in the region.

The project, which is anticipated to cost $10-billion to develop, will most likely be funded through a combination of loans and equity. A pre-feasibility study is expected to be completed next month.

“It will be premature to know who would be potential partners and what stake they will be willing to take,” Mashapu told the Mail & Guardian. The CEF said the new refinery would service both local and regional markets, including SADC.

Energy experts say that in the absence of an updated liquid fuels policy, it is hard to assess what role the new refinery could play. An investment this large, which would have a lifespan of several decades, would also have to be assessed in terms of the effect on climate change.

Energy policy issues that would arise include whether a new pipeline from Richards Bay to Gauteng would need to be built; if existing refineries, including the emissions-intensive Sasol, would need to be retired to make way for the new refinery; as well as if the global move to electric vehicles could make the refinery redundant over its decades-long life.

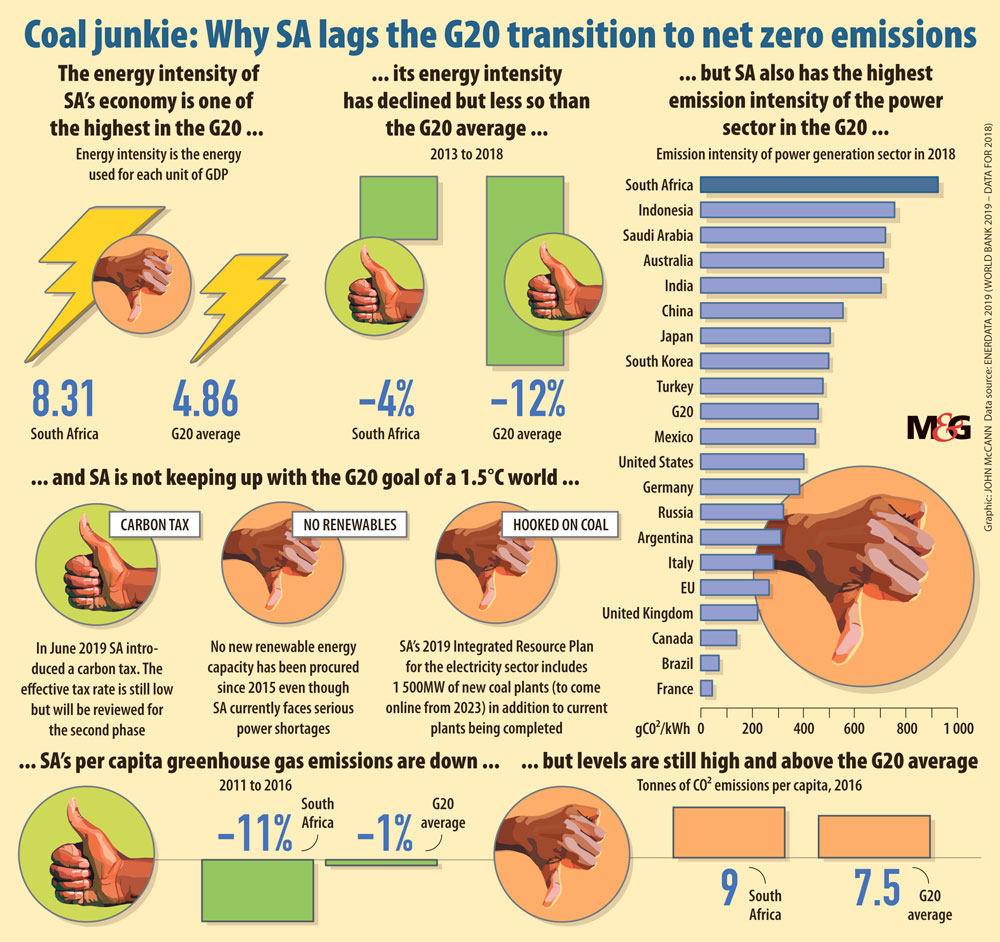

A report in May quantified $25-billion in projects in South Africa that are under way or in the planning phase that add to the risk the country faces as it transitions to a low-carbon economy. One of these investments, identified by the Climate Policy Initiative (CPI) think-tank, is the proposed Aramco refinery. “Advocates for a new refinery in South Africa have used a putative benefit to the balance of payments as a means for advancing their case,” the CPI report said. “However, our analysis shows that even if demand were boosted by a lower oil price, the increase in product imports required to meet demand would not come close to justifying a refinery of that capacity.”

“A decision to proceed with a new refinery would, therefore, need to consider a range of factors impacting its resilience to transition risk, including the size and shape of future export markets, the nature of the competition to supply to

those markets, and domestic policy on fuel economy standards,” the CPI said.

The M&G understands that a delegation from Aramco will meet the CEF and another department of energy subsidiary, PetroSA. The meeting will take place ahead of a mooted visit by President Cyril Ramaphosa to Ridyadh later this month, according to sources familiar with the matter.

Ramaphosa’s proposed trip follows his visit last year to the Gulf nation, during which $10-billion in new investments were pledged. Ramaphosa said at the time the investments would be channelled towards energy.

“Any investment of this size should be considered carefully in a broader energy and climate policy context, and we should ensure that it meets the country’s broader development goals, in terms of employment, environmental impact and balance of payments, and in terms of longer-term risks to the economy,” said Andrew Marquard of the energy systems analysis group at the University of Cape Town (UCT).

“We need to understand carefully what impact this megaproject will have on the existing liquid fuels sector, and what additional infrastructure investments it will require, for instance, additional pipeline capacity. A new refinery will almost certainly lead to retirement of existing capacity.”

Marquard said a new refinery would have to be evaluated against “the global shift in transport rapidly away from liquid fuels and towards electric vehicles, a shift which is being driven both by climate policy and by technology change.

“South Africa will not be an exception, and our energy models indicate that this shift will lead to a significant decline in liquid fuels demand, starting from the late 2020s. Without taking this into account, there is considerable risk that such an investment will become a stranded asset. Who will be taking this risk?”

Marquard said that, from a climate point of view, the two most important initiatives in the transport and liquid fuels sector will be to “move away from the emissions-intensive coal-to-liquids process, and incentivise the electrification of transport. Any such investment needs to be considered carefully in these contexts.”

South Africa has the second-largest refining capacity on the continent after Egypt, producing more than 700 000 barrels a day, according to the department of energy. This is not enough to meet demand and the shortfall is made up with imports.

Two of six refineries that produce synthetic fuels (from coal and gas) are owned by Sasol and PetroSA. Other major refineries include Sapref, which is jointly owned by BP and Shell; Enref in Durban; Chevron in Cape Town; and Natref at Sasolburg, which is 64%-owned by Sasol Oil and 34% by TotalSA.

“A refinery of this scale would go a long way towards modernising oil refining in South Africa, but with that would come the near certainty of at least two, maybe more, of the current oil refineries becoming redundant [and] shedding employment,” said Harro von Blottnitz, also of UCT’s energy systems analysis group.

This would also commit South Africa’s transport sector to continued greenhouse gas emissions [GHG] but, if this refinery were to compete head-on with Sasol’s fuels production, forcing it into closure, then these emissions would be reduced, according to Von Blottnitz.

(John McCann/M&G)

(John McCann/M&G)

“For South Africa to make a fair share to the global GHG reduction effort, accelerated decarbonisation of the electricity sector would create some emissions space for sectors [in which it is] more costly to decarbonise — such a refinery might eat into that space,” he said.

“Ultimately though, to what extent electric vehicles will erode the future viability of such a refinery, is a key uncertainty for investors. If Aramco wants to take that risk, fine — South Africa’s CEF should be very careful not to take it on.”

The University of Cape Town’s Dave Wright, an energy expert from the chemical engineering department, said investments into new oil refineries in South Africa is in line with Aramco’s partnerships with energy companies and governments around the world. He says the biggest demand for crude oil in Africa is in South Africa and Egypt; therefore, it makes a lot of sense for Aramco to be investing in the country.

Thando Maeko is an Adamela Trust business reporter at the Mail & Guardian