In July, the IRFA joined regulators and industry leaders at the Africa Pension Supervisors Association (APSA) Conference in Marrakech. The discussions were clear-eyed and practical: Africa’s retirement systems must simultaneously widen coverage and strengthen adequacy, modernise supervision, and channel more local capital to productive

investment—without compromising member protection. That agenda now meets its implementation lab at the IRFA 2025 Conference in Cape Town from 24–26 August 2025, where trustees, principal officers, and service providers will move from principles to practice. The programme at the Cape Town International Convention Centre (CTICC) is purpose-built for this moment and for our community.

From Marrakech to Cape Town: A coherent reform arc

APSA Marrakech (10–11 July 2025) foregrounded the realities we all know: low pension coverage across the continent (with the informal sector particularly underserved), the need to mature risk-based supervision (RBS), and the urgency of Africa-relevant sustainability standards and decision-useful data. Delegates also emphasised practical steps to mobilise local currency capital into assets that support growth and resilience—housing, infrastructure, climate adaptation and SME finance—so long as fiduciary guardrails and reporting remain robust. These priorities culminated in a Marrakech Declaration that lays out a common reform pathway for supervisors and industry alike.

The declaration’s pillars mirror IRFA’s own agenda: deepen and modernise regulation; embed risk based supervision (RBS); foster regulator–industry–development-partner collaboration; protect members’ purchasing power; integrate responsible and sustainable investment with African-relevant definitions; enable cross-border portability; and accelerate inclusion—particularly for informal workers through digital rails and simple, trusted products. That alignment is not accidental; it is the product of years of engagement between IRFA and supervisory peers, and it sets up Cape Town as the forum for “how” rather than “why.”

IRFA 2025: Designed for implementation

The IRFA 2025 theme—“Building Resilience: Leading Change for Positive and Lasting Impact”—captures both our obligation to members and our opportunity to shape capital markets for the better. The programme is built around three pillars: Investing for Economic and Social Impact, Operational Resilience for Stability, and Landscaping for Future Reforms—each translating the continental agenda into boardroom decisions and day-to-day practice.

To make those conversations decisive rather than declaratory, we are introducing a judicial-style plenary, “Leading with Resilience: A Judgement on Progress,” facilitated by Judge Dennis Davis and joined by IRFA leadership and key stakeholders. Panellists will present arguments on each pillar, undergo cross-examination, and work toward a consensus “verdict” before opening to the floor for real-time testing and refinement. It is an intentionally demanding format—and exactly what is needed now.

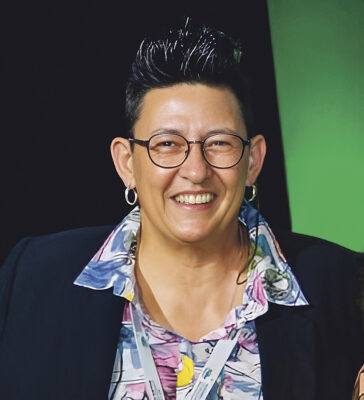

Alongside, we will host a focused panel on the sector’s persistent hurdles—coverage gaps, low preservation, regulatory complexity across markets, and the operational capabilities required to steward member assets responsibly. Confirmed contributors include APSA’s Zareena Camroodien, UN PRI’s Tendai Matika, and IRFA’s Nancy Andrews, moderated by IRFA President Geraldine Fowler—a line-up that underscores the bridge between supervisory priorities and trustee practice.

What we learnt at APSA—and how IRFA 2025 will operationalise it

• Risk-Based Supervision (RBS) is now an operating discipline. Supervisors showcased dashboards, early-warning indicators and “heat maps” that sharpen oversight of funds, administrators and service providers. At IRFA 2025, sessions will go beyond concept to the “how-to” of risk scoring, thematic reviews and data architecture—so boards can anticipate rather than react.

• Coverage and adequacy must advance together. Without adequacy, coverage disappoints; without wider participation, adequacy leaves too many behind. Our Cape Town programme will explore digital micropensions, auto-enrolment pathways, and preservation mechanisms that are affordable, portable and trusted—particularly for informal workers whose incomes are irregular.

• Define “sustainable” in African terms—and fix the data. APSA delegates supported an Africa ESG Taxonomy and an ESG Information Hub to curb greenwashing and make disclosures decision-useful rather than burdensome. IRFA 2025 will convene asset owners, managers, service providers and standard-setters to stress-test taxonomy prototypes against real mandates and reporting cycles.

• Mobilise local currency capital—prudently. Case studies in Marrakech showed pooled vehicles and co-investment platforms lowering transaction costs and improving diversification. We will examine fiduciary tools—mandate design, governance checks, performance reporting—that allow funds to back real-economy assets while protecting members’ interests.

• Stay ahead on the risk frontier. Cyber risk, fraud, operational resilience and conduct require prevention over cure; liability-aware investment and clear member communication matter especially in volatile, inflationary contexts. Expect practical guidance—from tabletop exercises to disclosure exemplars and benchmarking approaches.

What trustees and service providers will gain in Cape Town

Against this backdrop, IRFA 2025 offers a curriculum for action. Under Investing for Economic and Social Impact, we will examine instruments and structures—green energy platforms, social housing vehicles, and SME finance—that match long-dated liabilities and deliver measurable development benefits without diluting fiduciary standards. Under Operational Resilience, we will translate supervisory heat-maps into board risk dashboards, test business continuity practices, and align conduct expectations across the value chain. And under Future Reforms, we will debate portability, auto-enrolment, micropension design and financial literacy—all with an eye to feasibility and member trust.

This year’s format is also built for useful networking and concentrated work. Delegates register on Sunday, 24 August, with a welcome cocktail that evening—followed by two full working days on 25–26 August. We have designed the timetable to maximise contact with peers and speakers while leaving space to engage exhibitors and session sponsors who can help translate ideas into implementation.

A bridge to APSA: shared priorities, complementary roles

IRFA sees APSA not as a parallel track, but as a complementary one. Supervisors can only succeed if trustees and executives have the skills, systems and incentives to deliver; industry can only deliver if supervisory frameworks are clear, proportionate and enforced. In Cape Town, APSA voices will be on stage precisely to ensure that reforms travel well between policy rooms and boardrooms, across borders and into operations. Our joint priority is to build a member-centric system—widening access, protecting purchasing power, and allocating capital to investments that build resilience and jobs.

Why this matters now

Only a small minority of Africans have formal pension coverage; yet the potential to unlock long-term domestic savings for development is enormous if we include informal workers at scale and preserve savings more effectively. The prize is not abstract: better retirement outcomes for millions of households and more stable, deeper local capital markets. Our measure of success for IRFA 2025 is therefore straightforward—do trustees and their partners leave with the tools, partnerships and confidence to act within their fiduciary mandates for the benefit of members?

Join us in Cape Town

The IRFA 2025 Conference is our sector’s chance to convert continental momentum into practical outcomes. It is a forum for rigorous debate, yes—but also for building the capabilities, standards and coalitions that will carry us into 2026 and beyond. I look forward to welcoming you to the CTICC from 24–26 August for a programme that is as ambitious as the challenges we face—and as focused as the members we serve.

Geraldine Fowler “IRFA President Geraldine will be moderating the panel discussion addressing sector challenges.”

Geraldine Fowler “IRFA President Geraldine will be moderating the panel discussion addressing sector challenges.”

IRFA 2025 Conference to Tackle Pension Sector Resilience in Judicial-Style Panel Discussion

The Institute of Retirement Funds Africa (IRFA) is set to host a groundbreaking judicial-style panel discussion at its upcoming 2025 Conference, aimed at driving meaningful change within Africa’s retirement sector. The session, titled “Leading with Resilience: A Judgement on Progress,” will bring together industry leaders to assess existing challenges and chart a forward-thinking path for pension provision and sector governance.

With the conference theme, “Building Resilience: Leading Change for Positive and Lasting Impact,” IRFA seeks to position the retirement sector as a proactive force in governance, advocacy, and collaboration. The panel discussion, designed to move beyond traditional discourse, will actively examine successes, identify areas in need of radical reform, and define actionable commitments.

Judge Dennis Davis

Judge Dennis Davis

Esteemed legal expert Judge Dennis Davis will facilitate the session, joined by the Institute of Retirement Africa’s President Geraldine Fowler, Vice President Amanda Khoza and Head of its Legal and Technical committee Nancy Andrews, as well as the anticipated participation of the Government Employees Pension Fund (GEPF)—a key stakeholder whose insights are considered integral to shaping a resilient pension framework in South Africa and across the continent.

The discussion will revolve around the three core conference pillars:

• Investing for Economic and Social Impact,

• Operational Resilience for Stability, and

• Landscaping for Future Reforms.

Each panellist will present arguments addressing one of these pillars, followed by an interactive cross-examination led by Judge Davis. The session will then transition into a consensus-building dialogue before opening to audience participation, allowing real-time verdicts on critical sector issues.

IRFA’s commitment to fostering a robust and future-proof pension landscape is reflected in this innovative approach to sector discourse. By integrating judicial-style deliberation with audience engagement, the panel aims to yield tangible outcomes that influence policy, investment strategies, and operational frameworks.

With retirement security and long-term sustainability at stake, the IRFA 2025 Conference is poised to be a pivotal moment for industry leaders, stakeholders, and policymakers invested in shaping Africa’s pension sector for generations to come.

Building Resilient Futures: Leading Change for a Lasting and Positive Impact

The Institute of Retirement Funds Africa (IRFA) annual conference will be held from 24th-26th August this year under the theme of “Building Resilient Futures: Leading Change for a Lasting and Positive Impact.” This timely theme of the conference to be held at the Cape Town International Conference Centre underscores the urgent need for leadership, collaboration, and innovation in building a retirement ecosystem that not only safeguards individuals’ futures but actively contributes to Africa’s socio-economic development.

Speakers at this year’s conference will focus on three crucial “pillars”

Investing for Economic and Social Impact: Retirement Funds as Catalysts for Change

Africa faces significant developmental challenges—unemployment, inequality, inadequate infrastructure, and environmental vulnerabilities. Yet, within these challenges lie powerful opportunities. Retirement funds, with their long-term investment horizon and vast capital pools, are uniquely positioned to drive socio-economic transformation across the continent.

Social and infrastructure investments made by retirement funds can create enduring impact—from financing clean energy projects and affordable housing to supporting small and medium-sized enterprises (SMEs) that are the backbone of African economies. Engaging young people in these discussions is essential. Africa’s youth population is growing rapidly, and their inclusion in financial education and planning conversations is key to unlocking long-term impact.

Educating youth about how pension systems operate and how their contributions can shape their futures—as well as the future of their countries—can build a new generation of financially literate citizens who understand the power of collective investment.

Landscaping for Future Reforms: Shaping an Inclusive Retirement Landscape

Impactful retirement reforms can ensure that the retirement system becomes more inclusive, with broader coverage that reaches previously underserved populations, including informal workers and young contributors. Policymakers, trustees, fund managers, and educators must work together to ensure these changes are implemented effectively and equitably.

Central to this transformation is the need for financial literacy and retirement education. Greater financial literacy and retirement education reinforces the importance of starting early—particularly when it comes to saving for retirement. Beginning savings for later years, in one’s 20s or early 30s can significantly improve retirement outcomes, reduce dependency on state resources, and create a more resilient social fabric.

The Broader Impact: Retirement Industry as a Socio-Economic Engine

Ultimately, the retirement industry is not just about individual savings. It is a critical pillar of national economic development. Retirement funds represent some of the largest pools of capital in South Africa and also Africa and can be leveraged for nation-building.

Whether it’s through funding green energy projects, supporting social housing, or investing in transport and healthcare infrastructure, these funds hold the power to reshape Africa’s future.

As we look to the future, one thing is clear: Africa’s resilience will be built not only in policy rooms and board meetings but in classrooms, townships, and households—where financial knowledge is shared, early habits are formed, and a shared vision for prosperity takes root.

APSA’s Zareena Camroodien will highlight challenges at this important session.

APSA’s Zareena Camroodien will highlight challenges at this important session.

Addressing Sector Challenges, a crucial discussion

Africa’s retirement industry faces persistent hurdles, including low pension coverage, particularly in the informal workforce, and inadequate savings and preservation due to low contribution levels and pre-retirement fund access. Experts will explore strategies for mobilizing domestic capital for development, enhancing governance and trust, and integrating Environmental, Social, and Governance (ESG) principles into pension fund investments.

These issues and other will be covered in a crucial panel discussion at the IRFA conference by expert speakers.

Additionally, this panel discussion will tackle regulatory complexity and harmonization across African markets, improving operational efficiency, advancing investment diversification, and adapting to demographic shifts.

Panellists include:

• Tendai Matika (UN PRI) – Providing insights on responsible investment, ESG integration, and stewardship.

• Zareena Camroodien (APSA) – Offering expertise on pension regulatory harmonization, capacity-building, and cross-border collaboration.

• Nancy Andrews (IRFA) – Presenting IRFA’s perspective on governance, trustee education, and member empowerment.

• Moderator: Geraldine Fowler (IRFA) – Steering panel discussions with industry insights and engaging facilitation.

With Africa’s retirement sector at a crossroads, the IRFA 2025 Conference aims to drive meaningful change, ensuring pension sustainability and financial security for future generations. Industry professionals, policymakers, and stakeholders are encouraged to participate in shaping a resilient and forward-thinking retirement landscape.

This event promises to be a vital platform for collaboration, knowledge-sharing, and reform in the retirement sector not just in South Africa but across the continent.

Seeiso Matlanyane, Head of Equities

Seeiso Matlanyane, Head of Equities

Global Reach, Local Edge

At the 2025 Institute of Retirement Funds Africa (IRFA) Conference, Prescient Investment Management will present under the theme “Global Reach, Local Edge”, showcasing how global ambitions can be grounded in local strength. Bastian Teichgreeber, Chief Investment Officer, and Seeiso Matlanyane, Head of Equities, will lead the session, offering insights into how Prescient delivers global equity returns through a systematic, rules-based investment process, all while amplifying South Africa’s competitive advantages.

With the offshore investment allowance for retirement funds now at historically high levels, the temptation for local investors to shift capital abroad has never been stronger. Global markets offer depth, liquidity, and opportunity. Yet, this privilege is not without its tensions. A wholesale reallocation of assets away from South Africa risks weakening the very capital markets and institutions that pension funds rely on to meet their long-term obligations.

This paradox presents a strategic inflection point for the retirement industry: How can we embrace global diversification without abandoning local development? How can South African asset managers remain relevant and competitive in a globalised investment arena?

Prescient’s approach to this conundrum lies in harnessing the power of systematic investing. Their model-driven process enables precise asset allocation in global markets, where efficient pricing and deep liquidity demand disciplined execution, while simultaneously allowing capital to remain rooted in South Africa via portable alpha strategies. These techniques allow investors to extract global returns by synthetically replicating offshore exposure, while physically retaining and rotating capital in local instruments. The result is dual exposure: access to the world’s best return opportunities and continued support for local job creation, liquidity, and capital formation.

Moreover, Prescient will highlight how the firm’s cost-efficient model provides natural insulation against the potential crowding-out effect by global managers that is now reshaping the local asset management landscape with aggressive fee compression and scale-driven strategies. Large global managers benefit from economies of scale, but Prescient’s technology-enabled processes and in-house research capabilities have allowed it to compete on both price and performance, delivering value not just to pension funds, but directly to pensioners.

The presentation will also delve into the risks and rewards of global equity investing in a world increasingly shaped by geopolitical fragmentation, supply chain reconfiguration, and monetary policy divergence. With macro conditions still uncertain – rising protectionism, volatile energy prices, and uneven economic growth – Prescient argues that a consistent, unemotional, data-driven process is the most effective way to navigate this complexity.

Crucially, the conversation will return to stakeholder alignment. Prescient will emphasise that retirement outcomes are not just a product of return generation – they are a function of thoughtful capital stewardship. Pension funds can and should be a force for local economic resilience, even as they pursue global opportunities.

Through “Global Reach, Local Edge,” Prescient will demonstrate that the goals of global diversification and local empowerment are not mutually exclusive. Rather, when executed through a deliberate and principled investment philosophy, they can be mutually reinforcing. Thus, as the theme as this year’s conference, “Building Resilience: Leading Change for Positive and Lasting Impact”.