Making vaccination mandatory may be beneficial, given that the government has a responsibility to protect its people; but it does raise the issue of whether forcing individuals to receive a compulsory vaccination would interfere with their rights.

The emergence of the Covid-19 Omicron variant and a possible fourth wave of infections has put the insurance industry, which has already lost billions to provisions related to the pandemic, on tenterhooks.

In a bid to try to mitigate costs, some companies have implemented a pricing differential, meaning those who are unvaccinated against the virus will pay higher for their cover.

“From a risk point of view it makes sense,” said Leza Wells, chief product actuary at FMI, a subsidiary of Bidvest Life. “We’ve seen the statistics, unvaccinated people are at a higher risk. It looks like insurers are following one by one and that’s likely where the industry is going to go.”

According to the National Institute for Communicable Diseases, 87% of patients admitted to hospital in Tshwane were not vaccinated against Covid-19 and unvaccinated people are more likely to die from the disease than those who have been vaccinated.

From 1 December, Momentum Life Insurance has introduced an underwriting for new clients taking up cover to distinguish between the vaccinated and unvaccinated.

“Data does suggest that there is more risk if you are not vaccinated,” said Jenny Ingram, head of product development at the insurer, adding that the new direction that the industry is taking allows for those who are vaccinated to get life insurance at normal pre-pandemic terms.

The insurance industry has lost R2.6-billion to Covid-19 provisions, according to KPMG SA’s 2021 South African Insurance Industry Survey, which also found that the pandemic had curtailed insurers’ appetite for covering certain risks.

“The knock-on effect and the interconnectedness of risks emanating from Covid-19 were astonishing. We would expect much introspection and re-evaluation by insurers of their risk appetites and capacity,” KPMG said.

“The next few months hold challenging moral decisions for insurers as they debate employee vaccine mandates, vaccine premium adjustments for policyholders and other repricing policies. The contribution of the insurance industry to the stability and financial soundness of the South African economy demonstrates the capital strength, resilience and ability of the industry to adapt, innovate and show up when it matters.”

There is a lot of potential in providing risk cover in South Africa, Ingram said, adding: “So we don’t really support the idea of walking away from insuring risk. It’s what we do and we need to find new ways to allow for the fact that the world has changed. The South African market is still very lucrative for insurance.”

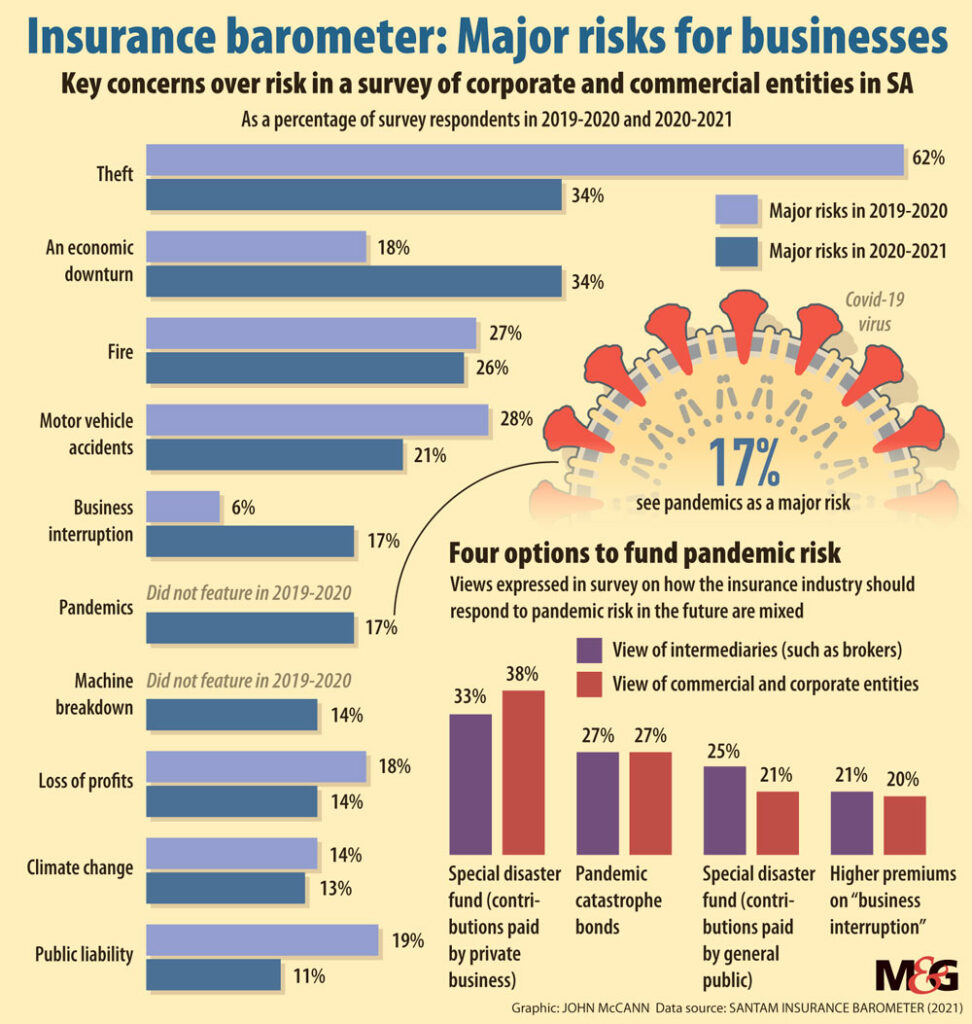

The Santam Insurance Barometer for 2021 showed that on a number of risks ranging from motor-vehicle accidents, burglary and hijacking, 16% of those surveyed were concerned about pandemics.

‘No sense in excluding pandemics from insurance’

But for Wells, insurance is there for people in times of need and it makes no sense to exclude pandemics.

“We were quite glad as a company that we were able to pay out when people were in need,” she said. “I hope we do not get there, on the life insurance side, where we have to exclude these types of events.”

With Covid-19 cases increasing as the festive season approaches — a time that will no doubt lead to the spread of the virus — insurance companies have set aside provisions for a possible fourth wave.

“We are quite confident in our ability to meet whatever claims as a result of the fourth wave. At the start of July this year, there was a total provision of just over R2-billion for the group. So, we do think that we are adequately prepared and the group is well capitalised,” said Ingram, adding that Momentum had paid just over R3.4-billion in Covid-19 death claims to date.

Reinsurers have also suffered, noted Ingram, because a lot of “our risk is insured with them and some of them have mentioned that the Covid-19 pandemic has wiped out 10 years of profits for them”.

FMI recently released its 2020 claims report in which it highlighted that minor infections, which Covid-19 falls under, were the leading reason for income protection claims. These accounted for 31.2% of all claims paid.

FMI’s portfolio is roughly 60% income protection rather than life insurance and that is what most of its claims went to, said Wells. Provisions have been made for the fourth wave although its effect is not expected to be greater than the previous ones.

“The impact will be around 40% of wave three, that’s what the industry is predicting. But I think this new variant now brings another twist,” said Wells.

The pandemic has “shown that the insurance industry is well positioned to deal with crises”, Wells says. “It’s a pretty robust industry, and there’s a need for it. Despite all the hardship, I think we are positive about the future.”

(John McCann/M&G)

(John McCann/M&G)

Pandemic proofing the insurance industry

The sector is hanging its hope on vaccinations being able to manage the pandemic “and so I think the pricing around vaccination is probably going to have to come into play to avoid restricting benefits,” said Wells.

Ingram added that to protect the insurance industry, the evidence that vaccines do save lives needs to be taken seriously and that the health sector needs to be improved so it can cater to the general population because “we are not safe unless everyone is safe”.

“We need to make sure that we get our pricing right and make allowances for pandemics in the future in some elements of the pricing,” she said.

“I think as a country and as an insurance industry, we’ve learned a lot about what to do when the next one comes around,” she said.

Anathi Madubela is an Adamela Trust business reporter at the Mail & Guardian

[/membership]