Commuters using minibus taxis will not see tariff increases just yet as taxi associations refrain from fare increases despite rising fuel costs.

The government’s flagship taxi recapitalisation scheme, relaunched three years ago, had a twofold objective of removing ageing and unsafe vehicles from South African roads and providing the taxi industry with a raft of economic empowerment interventions.

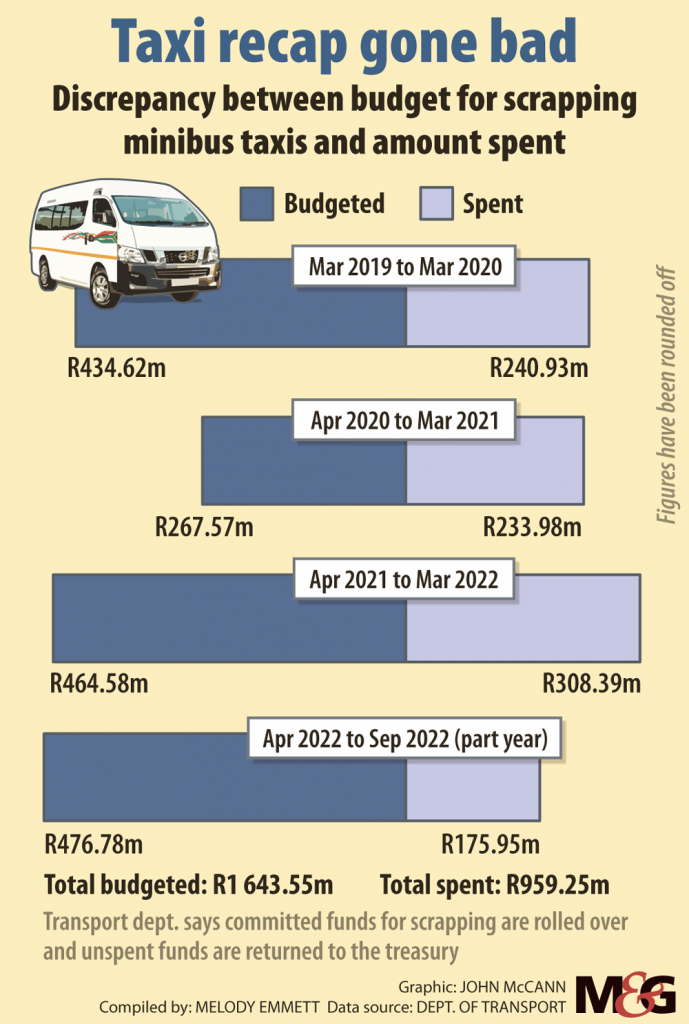

It has failed on both fronts yet more than R1 billion has been spent in just three years.

A recent government gazette signed by Transport Minister Fikile Mabalula gives drivers of illegally converted Toyota panel vans until 31 January next year to hand over their vehicles to the TRSA for scrapping or have them impounded.

All the millions

In 2019, public funds were used to establish Taxi Recapitalisation South Africa (TRSA). A private company, Anthus Services 84, was offered a five-year contract and 40% shareholding in the new entity as the administrator and manager of taxi scrapping for the department of transport.

A 60% shareholding in the company was given to the South African National Taxi Council (Santaco), ostensibly as a channel to empower the taxi industry as a whole.

Only 7 560 taxis have been scrapped since March 2019, 12% of the target of 63 241.

This is an alarming shortfall when compared with the 53% of target — 72 653 of the 135 894 unroadworthy vehicles estimated to be working at the time — achieved from October 2006 to September 2018, when the original programme came to an end.

The TRSA gets a tranche of scrapping funds from the transport department, which are replenished after scrapping allowance disbursements are accounted for.

The acting director general of the treasury, Ismail Momoniat, responding by text message while overseas, said the department’s annual report should give an account of public funds spent on the recapitalisation programme.

But the figures provided by transport department spokesperson Lwaphesheya Khoza for the amounts transferred and spent on the recap programme do not match the figures in the department’s annual reports over the past three years or those given by the TRSA’s spokesperson, Soraya Ebrahim.

In response to the Mail & Guardian’s questions, the TRSA said it had received just more than R1 billion from the department and spent R995 369 100, which covered the 12% of the scrapping target achieved.

But according to the department’s figures, the total budget provided for scrapping since the relaunch is R1.65 billion or almost R600 million more. A total of R959 247 500 has been spent on scrapping since the relaunch, R38 million less than the TRSA claims to have spent.

Because both the department and the TRSA stonewalled requests for detailed financial statements and figures, the M&G was unable to get to the bottom of the significant discrepancy in the figures.

Ebrahim said unspent funds will be returned to the transport department at the end of the contract, while the department said unspent funds are returned to the treasury.

Asked whether the transport department had returned any recapitalisation funding, and the amounts, treasury spokesperson Xolisa Dodo offered to “refer to the appropriate division” and revert. No response had been received by the time of publication.

Funds Diverted

Meanwhile, unspent funds have been used elsewhere. At the Mini Plenary Debate on the Transport Budget Vote in July 2020, Mbalula announced his intention to draw on unspent recap money and goods and services funds to the tune of R349 million to finance “distressed entities” as part of Covid-19 relief.

The minister was referring to the Debt Relief Finance Scheme, a soft-loan facility aimed at helping small businesses hit by Covid-19 to stay afloat for a period of six months from April 2020.

The TRSA stated that as a private body acting as a service provider to the department, it believed its financials are not required to be a matter of public record and any queries about the use or disbursement of public funds should be referred to the department.

The department ignored numerous requests for audited financial statements.

Where are other taxi operators

On the 60% equity partnership held by Santaco, the TRSA said: “Anthus is the sole shareholder in the TRSA, with 60% equity in the TRSA having been reserved for the Mini and Midbus Taxi Industry. The national department of transport is currently engaging with the industry on the allocation of the 60% share.”

Asked why it has taken so long for Santaco to reap the benefits of its 60% shareholding, Santaco spokesperson Thabiso Molelekwa said various legal requirements had to be met and “the processes of government are not as smooth as we anticipated”.

Without active participation in terms of the 60% shareholding the company could not achieve what it was supposed to achieve, Molelekwa said, adding that “Anthus is operating while the 60% has not been finalised”.

Molelekwa’s explanation states that from the beginning the taxi recapitalisation project was intended to be an empowerment process for the taxi industry over and above removing old vehicles. It should create opportunities through the industry’s value chain and subsidise other initiatives to ease the burden of purchasing a taxi on the side of the operator.

“We continue to pursue the minister and we are hoping that before he leaves office — if he leaves — one of the things that must be in place will be to allow the industry to participate actively. The objectives of the business, and the reason for setting up TRSA in the first place, must be realised.”

Forget scrapping

Meanwhile, taxi owners and consultants in the industry told the M&G they were unaware of any taxis being scrapped over the past four years and that the transport department’s promises of maintaining supportive business networks with major vehicle finance houses, fuel companies and spare parts companies have come to nothing.

The National Taxi Alliance (NTA), which does not recognise Santaco’s authority, dismissed the idea that the latter’s shareholding will benefit the industry as a whole.

“All the money is channelled to Santaco; not a cent will come to us,” said NTA spokesperson Theo Malele.

He said the NTA has repeatedly asked the minister for a taxi scrapping audit because they have no idea where the money is going.

The TRSA pays R141 000 for each vehicle scrapped. Applications are only accepted from operators with a valid operating licence.

“This guy has spent around R450 000 for a vehicle and has not even reached a break-even point for the money he invested,” said Molelekwa.

“You may say it is a golden opportunity to get something, but this is a business. The operator has invested money which he is not likely to recover.”

Too many interests in the taxi industry

For many taxi operators, the scrapping money may be sufficient to secure a bank loan to purchase a new vehicle, but they are unable to sustain the repayments and vehicles are repossessed.

As a result, they see no alternative but to continue driving vehicles, often without operating licences.

Consultants in the industry say operators often have to pay bribes to corrupt officials.

In addition, Malele said municipalities have the right to hold an interest in bus operations. As such, they tend to become referees and players at the same time.

Both Santaco and the NTA are calling on the department to increase the scrapping allowance and issue temporary licences for scrapping purposes.

The NTA goes further, proposing that banks should supplement the scrapping fee.

“There is another equation here,” Malele said. “The banks have been left scot-free when they colluded with unscrupulous retailers that sold these vehicles to unsuspecting taxi operators. They should come to the table.”

Much is at stake. The R50 billion a year industry is the backbone of South Africa’s public transport system, carrying 70% of commuters on 15 million trips each day, with the average household spending 60% of their disposable income on taxi fares.

This story was made possible by the M&G Guardians Project in partnership with the Adamela Trust.

[/membership]