Consumers are angry that the government is treating them like a cash cow instead of fighting corruption and improving its fiscal discipline. File photo by Dwayne Senior/Bloomberg via Getty Images

In a win for landlords and consumers, South Africa’s leading grocery retailers have been given until 2026 to phase out exclusive lease agreements which critics say have had the effect of stifling competition in the sector for years.

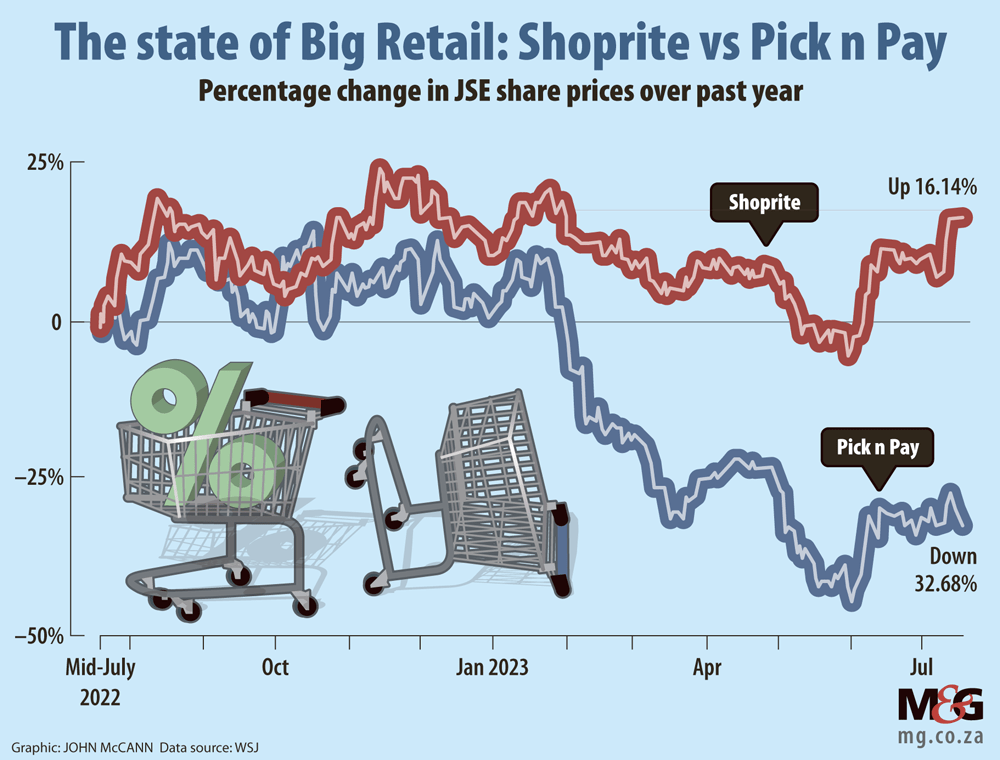

The Competition Commission recently gave the country’s biggest retailer, Shoprite, as much time as its rival Pick n Pay to phase out its agreements.

An exclusive lease agreement is generally a long-term one between a landlord and a tenant granting the latter exclusive rights to operate in a specific shopping centre.

A four-year inquiry by the Competition Commission culminated in the Grocery Retail Market Inquiry report released in 2019, which found there was no need for the exclusive deals that Shoprite, Pick n Pay, Spar and Woolworths had with their landlords. It said these lease agreements lasted for 10 to 40 years.

Analysts say phasing out such agreements would increase competition for grocery retailers in malls and shopping centres, to the benefit of consumers.

“This is a step in the right direction,” said Makwe Masilela, of Makwe Fund Managers. He said the change meant it was possible, for instance, to find a Spar, Shoprite and Pick n Pay in one centre, something that had not been possible for years.

One of the country’s biggest shopping centres, Mall of Africa in Johannesburg, has both a Checkers and Pick n Pay grocery outlet, as does Cape Town’s Canal Walk, something unheard of until recently.

“Retailers benefited hugely from these exclusive lease agreements because if it was a mall in a certain area, then that supermarket was guaranteed that people would only buy groceries from them and whether the service was up to par was another story because people don’t have a choice but to go to that particular supermarket. There was no competition,” Masilela said.

The exclusivity agreement also affected small and medium-sized businesses and speciality stores, including butcheries, bakeries, delicatessens, liquor stores and stores that sell 15 or fewer product lines.

“Phasing out these lease agreements will definitely increase competition because now you can have butcheries, fruit and veg stores and bakeries and you will still find a Pick n Pay or a Shoprite at a shopping centre,” Masilela said.

David Shapiro, of Sasfin Securities, said the phasing out of the exclusive agreements would benefit smaller retailers who were previously muscled out of the grocery space by the sector giants.

“The timeframe to phase out exclusive lease agreements by 2026 is appropriate — can you imagine how many leases they must have? How many stores? … But, in the long run, it’s going to open up competition,” he said.

Shoprite’s Supermarkets South Africa portfolio has 1 916 stores under the Shoprite, Usave, Checkers, Checkers Hyper and LiquorShop brands.

According to a University of Cape Town research paper, the practice of including long-term exclusives in lease agreements stems primarily from a landlord’s need to secure funds to finance the construction of shopping centres.

(John McCann/M&G)

(John McCann/M&G)

It says credit providers are more inclined to finance a shopping centre if they are satisfied the venture will be successful and enduring.

“Integral to the assurance of such attributes in a shopping centre scheme is the presence of large retailer tenants that are historically successful and have ‘pulling power’ — the ability to attract foot traffic into the centre — and can ‘anchor’ the centre for an extended period of time,” the paper says.

“It is evident from these considerations that it is the lessor who ‘needs’ the supermarket more than the supermarket ‘needs’ the lessor.

“The supermarket lessee is thus in a strong bargaining position, as it is mindful of its appeal to both consumers and shopping centre landlords alike, and this may result in pressure being placed on the landlord to accede to the demands of the supermarket lessee, and for the supermarket lessee to abuse this powerful position it finds itself in.”

According to analysts, landlords are more than happy to abandon exclusive lease agreements because they have space that needs to be filled.

Masilela says that even without the lure of a heavyweight single anchor tenant with a long-term lease, landlords will not struggle to secure financing for future projects if they can present, for example, three giant tenants such as Shoprite, Pick n Pay and Spar to potential investors.

In addition, landlords will not be forced to pander to the demands of a single anchor tenant taking advantage of the fact that the centre needs their presence to thrive.

“At some point, the landlords were at the mercy of these retailers. As a landlord you wouldn’t want Shoprite to go so you end up bowing to their demands,” Masilela said.

“Now, when there is competition, landlords can have better control of the demands from retailers.”

Shapiro weighed in: “If, for example, they don’t want to pay rent, the landlords have the opportunity to get rid of them and lease the space to another retailer. In the long run, it’s the right way to go.

“It’s better for competition, for the landlord and for the consumer.”