Big spenders: Vodacom says it will invest R800 million in its network in KwaZulu-Natal, including rolling out full fibre broadband, expanding its coverage in deep rural areas. (Waldo Swiegers/Bloomberg via Getty Images)

Should Vodacom be granted permission to invest in Maziv, which owns and controls Dark Fibre Africa and Vumatel, SA’s largest fibre-to-home operator, it could leave the sector with too few leading players — to its detriment.

The telecommunications industry has seen much mergers-and-acquisition activity initiated in the last 18 months but most of it was dissolved before it reached the competition authorities, as in the case of Telkom and MTN. Other deals were scuppered by the competition watchdog.

Last week, the Competition Commission barred the merger between Vodacom and Maziv because it could lessen competition in the fibre market. Vodacom planned to take a 30% stake in Maziv, which is worth an estimated R13 billion. However, the telecom giant also put in an option of increasing its stake to 40%.

Vodacom and Maziv will challenge the commission’s decision at the Competition Tribunal.

Peter Takaendesa, portfolio manager and head of equity at Mergence Investment Managers, said Vodacom would have known acquiring a con- trolling stake may be an issue, hence the minority shareholder option.

“But, should regulations change, I wouldn’t be surprised if they try to gain control of the fibre business if they were to be allowed to get that 30 to 40% they’ve been targeting,” Takaendesa said.

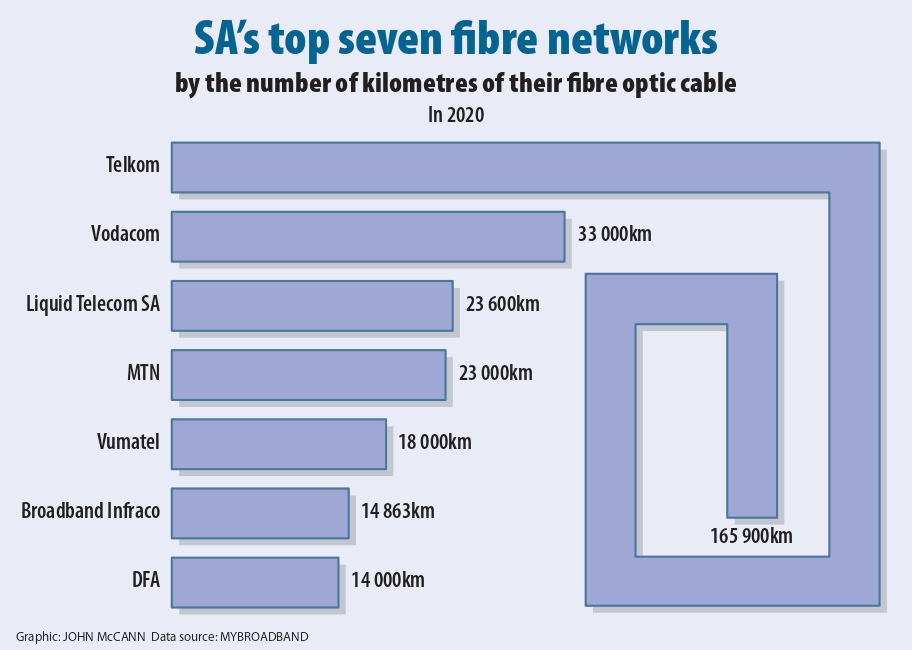

Vodacom has 33000km of fibre connected to 165000 homes and businesses, its annual results for the year ended 31 March say.

Maziv has 35 000km of fibre, Pieter Uys, the strategic investments head of JSE-listed investment holding company Remgro, told the Mail & Guardian. Maziv is owned by Community Investment Ventures Holdings, which is owned by Remgro.

Combined, Maziv and Vodacom’s fibre assets would be roughly 68 000km, beating MTN’s 27 500km, but far less than Telkom’s 170 000km of fibre and legacy lines which reach more than a million homes.

This would effectively create a two-corporation Telkom and Vodacom domination in the fibre market.

“A market where two telecoms are giants is a concern. As part of this deal, Vodacom will contribute its fibre [to Maziv] and that becomes a much bigger business. In telecoms size matters,” Takaendesa said.

Vodacom dominates South Africa’s mobile sector and it would have the lion’s share of the fibre sector should the competition authorities approve the deal. Vodacom would merge its fibre assets with those of Maziv and have its infrastructure available on an open-access basis to internet service providers (ISPs), he said.

(John McCann/M&G)

(John McCann/M&G)

The company had 45.51 million subscribers as of September, compared with runner-up MTN’s 35.88 million, followed by Telkom with 18.02 million subscribers.

“If the transaction is allowed, Vodacom and Remgro will put a lot of money into the fibre business and grow it much faster and, obviously, Telkom, not wanting to be left behind, will also accelerate their investment into fibre to avoid los- ing out,” he added. “Without proper intervention or regulation, that mar- ket will end up just looking like the mobile market, where two players are the only sustainable players.”

The danger of having a few players dominate a market is illustrated by the high cost of data.

In its Data Services Market Inquiry report in December 2019, the Competition Commission said MTN and Vodacom must reduce their mobile data prices by 30 to 50%.

“We find price-based competition is inadequate, the challenger networks of Cell C and Telkom Mobile are unable to effectively constrain the two first movers, and that Vodacom has substantial market power, with MTN to a lesser degree.”

Prohibiting the Vodacom-Maziv merger, the commission said it would result in the loss of direct competition between them in the areas where both have deployed fibre. Its investigation had shown that fibre players tend to reduce prices in areas where more than one network provider has deployed fibre.

The commission also raised concerns that after the merger, Vodacom would implement measures effectively shutting out competitors. Uys rejected this: “[Vodacom] will not control the company, the same way they cannot make products that favour themselves. This company will still be held by 70% other shareholders.” He said the two companies were willing to commit to an open-access model which would allow other ISPs access and eliminate discriminatory behaviour.

“Maziv will also buy Vodacom’s existing fibre. That fibre is just used by Vodacom, it’s not open access, it’s not open to MWeb or others to also use. So, that is a potential positive from the deal — taking the closed fibre and opening it up to competition for the whole market,” Uys said.

Under an open-access model, the fibre network operator provides infrastructure that can be used by any number of licensed ISPs. For example, Maziv’s Vumatel can act as a fibre network with Cell C as an ISP.

The push towards fibre

Vodacom said the proposed transaction sought to accelerate fibre reach, network quality and resilience, fostering economic development and helping to bridge the digital divide.

Once the matter is at the Competition Tribunal, Vodacom says it intends to showcase the public interest and pro-competition advantages the transaction would have. Uys said the merger could connect a million households in lower-income areas to fibre, creating 10 000 jobs.

Takaendesa disagreed.

“For Vodacom, their controlling shareholder Vodafone has been doing this in other markets — getting exposure to fibre assets because mobile service revenue, excluding handsets, is not growing,” he said.

“Even in SA, growth in mobile is between 2% and 5%, max. Most of the mobile operators are looking at how they can play in the fibre market to improve growth rates.”

Organisation for Economic Co-operation and Development broadband statistics show growth in mobile broadband subscriptions slowed from 29% in the four years prior to last year, to 17% in that year. The offset is largely due to growth in fibre subscriptions, which represent 38% of all fixed-line subscriptions across member countries.

Mobile operators are on the hunt for new revenue streams from the fibre, mobile money and insurance sectors, Takaendesa noted, “to offset the slowdown in their core mobile revenue”.