US Pesident Donald Trump. (Photo by Chip Somodevilla/Getty Images)

South Africa’s risk of exclusion from the African Growth and Opportunity Act (Agoa) may have been heightened by US President Donald Trump’s reaction to the Expropriation Act.

Economists and political analysts said this week that even before the Expropriation Bill was signed into law last month, the country was at risk of being bumped out of Agoa, which gives some African states preferential trade access to the US market, because Washington perceives South Africa as being aligned with its “enemies”.

Agoa expires in September 2025. But the 35 African countries that benefit from it have been lobbying the US for its renewal for another ten years.

The Expropriation Act allows for the expropriation of property with nil compensation under certain conditions, and on condition that this is “fair and just” and “in the public interest”. The Constitution remains unchanged as the apex law enshrining private property rights. Should a case arise of nil compensation, property owners can challenge it in court.

Chris Hattingh, the executive director at the Centre for Risk Analysis, said this week that the US could argue that the Expropriation Act is a deterioration ofprivate property rights, which must be upheld for a country to benefit from Agoa.

Section 104 of Agoa that deals with eligibility says the US president is authorised to designate a sub-Saharan African country as eligible if he “determines that the country … has established, or is making continual progress toward establishing a market-based economy that protects private property rights, incorporates an open rules-based trading system, and minimises government interference in the economy through measures such as price controls, subsidies and government ownership of economic assets”.

South Africa is also at risk of being deemed not to meet another eligibility clause, namely of being a country that “does not engage in activities that undermine United States national security or foreign policy interests”, Hattingh said.

“I think a big concern on the part of the US isn’t necessarily South Africa’s perceived closeness to Russia and China, but to Iran and Hamas.”

He noted that Trump’s style is to be belligerent in negotiations.

“He likes to come out aggressively, to swing first, and then to see what falls out of the tree, or how other people and countries react, and then he’ll recalibrate accordingly,” he said.

“The fact there are tariffs on close allies and countries closely integrated with the US economy like Canada and Mexico shows that Trump really wants to shake up global trade rules. That could work out well because global trade is full of contradictions and subsidies and states such as China supporting exporters through subsidies.

“If the shake-up is done in a way that eventually global trade is more simplified and more transparent, that’s a good thing. Of course, the negative side is it just results in tariff wars that are especially bad for emerging markets such as South Africa.”

Standard Bank economist Goolam Ballim said the probability of Agoa not being renewed for South Africa holds “a substantial tail risk”.

“Agoa started out as a unilateral agreement. America allowed duty to access a variety of items from South Africa without requiring South Africa to be reciprocal. More laterally, it has developed into some level of bilateral engagement.

“Agoa has been used as a tool to extract some gains and concessions out of South Africa in the United States’ favour, and now we’ve gone to the other extreme, where the US is not going to be doing South Africa any favours.

Ballim added that South Africa stands out as one of the continent’s “big names” and a member of the G20, with some arguing that it has an “outsized voice with respect to its geography and its international presence”.

“If there is a message that Donald Trump would want to send with regard to nations, perhaps orbiting what Donald Trump would consider to be enemies of the US, he’s probably going to use South Africa as an example in his international diplomacy. I think we must expect that it is not going to be any easy ride.

“There’s no sympathetic ear at the White House for South Africa, and Agoa could be one of the sacrificial lambs in the manner in which Donald Trump reframes American multilateralism.”

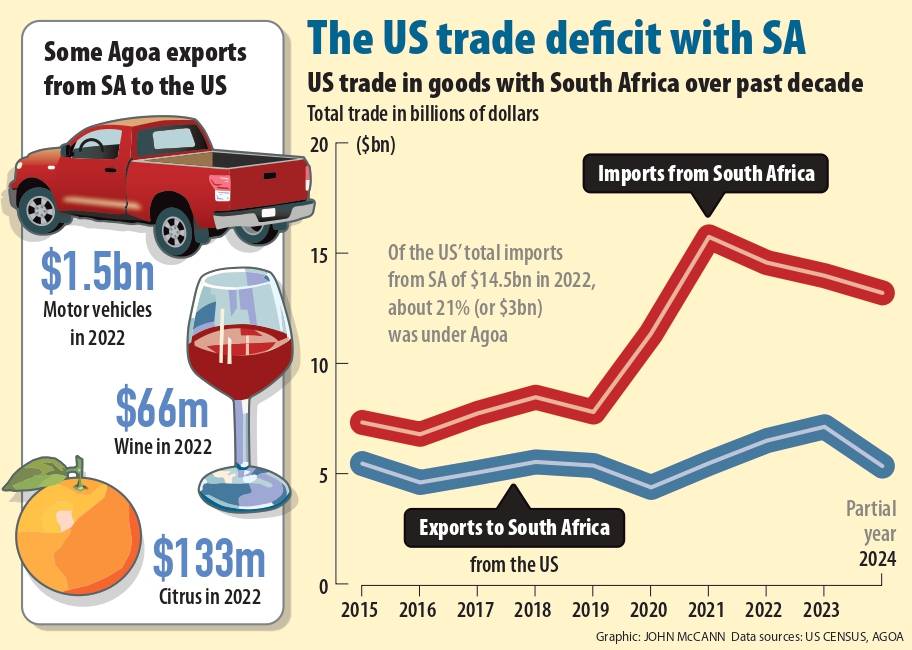

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

He said agricultural and vehicle industries would be most affected.

“Our auto industry relies, generally speaking, quite significantly on exports, particularly BMW and Mercedes. There could be some costs for those sectors in particular.”

Ballim added that Trump’s posture should not come as a surprise in the grand scheme of multilateralism and geopolitics.

“What we are witnessing around the world is almost an attempt where the US is seeking to arrest the decline of its empire,” he said.

“It has clearly dawned on the American administration that the rules and governance that prevailed through much of the Second World War in the modern aftermath of the Second World War is now not necessarily in the United States favour.

“The multilateralism of the last five decades was, you could argue, curated in America’s interest and is now no longer working,” he said.

“If anything, there is now a call for greater representation by the developed and emerging world. It’s a call for recalibrating multilateralism and key multilateral institutions.

“America is responding by almost not contending with the calls for justice in terms of the guiding principles leading the world.

“Instead it is using muscle diplomacy to maintain American hegemony.”

But, said Ballim, this could backfire in the end because the world was slowly and incrementally recalibrating to exclude the US, and the decline would continue even if the US gains “breathing room” in the short term.

Nedbank chief economist Nicky Weimar believes the chances of Agoa being scrapped completely — which would mean no more tariff-free access to the US for all beneficiaries, not just South Africa — is “high”.

“Both Mexico and Canada were in an official, negotiated trade agreement with the US. Trump used his emergency powers to nullify the agreement, then extracted concessions from Mexico and Canada, which led to Trump rescinding the tariffs or placing them on hold,” Weimar said.

“The risk remains that the goals keep shifting and changing, forcing more and more concessions from a country, often relating to factors they may have limited control over.”

According to the US Census Bureau, South Africa exported goods valued at $13.197 billion to the US in 2024, including motor vehicles, precious metals and agricultural exports, so removal from Agoa will hit these sectors of the local economy hard. The US exported $5.344 billion to South Africa, with a resulting trade surplus of $7.852 billion in favour of the latter for the year.