Saving means different things to different people. For some, it’s contributing to a retirement fund; for others, it’s stashing money in a bank account or setting some aside for a rainy day. No matter how you look at it, all these views have 2 things in common:

Firstly, they involve resisting the temptation to spend all your money right away; and secondly, they show an understanding that the future matters – and it’s worth planning for.

Economics ties these ideas together nicely. It defines saving as the part of your income that isn’t spent right away on goods and services, but instead set aside for the future. In other words, saving means choosing to delay spending today so you’ll have resources tomorrow. That deferred spending may go into a bank account, an investment portfolio, or a retirement annuity – but at its core, it’s about planning for the future and being intentional with money.

Now that we’ve covered the basics, let’s look at 2 ideas closely linked to saving: saving culture and saving habits.

Culture is the shared way of life within a group – like their values, beliefs, customs, and behaviours. So, a saving culture is the collective attitude a society holds toward saving money. Habits are the automatic actions individuals take – like the things they do regularly, often without even thinking about it. A saving habit is a personal, consistent routine of setting money aside instead of spending it.

In South Africa, it’s often said that we have a poor saving culture and weak saving habits. In simple terms, that means our societal attitudes and individual behaviours around saving may need some work. Before diving into whether this reputation is fair, it helps to first understand what strong and weak saving cultures look like. Here are a few examples:

| Strong savings culture | Weak savings culture |

| Teaching children to save their allowance or pocket money. | Living from payday to payday. |

| Prioritising saving before spending. | Feeling pushed to show success by spending money on flashy cars, designer clothes, holidays, etc. |

| Spending less and planning for the future. | Failing to prioritise long-term financial planning. |

| Saving helps you take control of your finances and reach your goals. | Relying on debt instead of savings. |

| Saving is ‘fashionable’. | Saving is not ‘fashionable’. |

So, what shapes saving culture?

Research shows that many things shape how we think about saving – like family, community, religion, education, government policy, and the broader economy. A good example is the 2-pot retirement system, which shows how laws can influence behaviour and mindset. Similarly, saving habits are shaped by financial education, income, access to banking tools, social influence, personal goals, and workplace policies.

That’s why Nedbank’s #GetMoneyFit campaign speaks to a problem most South Africans know all too well – feeling financially stretched and not knowing where to start. The campaign offers a way forward, showing that small, consistent steps, like budgeting, tracking spending, or setting up automatic savings, can really add up over time. It’s all about building financial resilience, 1 practical habit at a time.

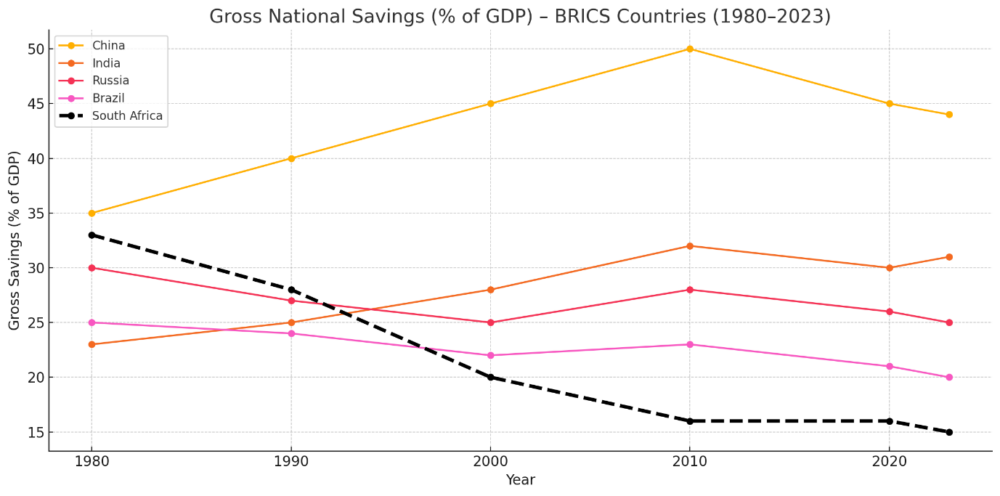

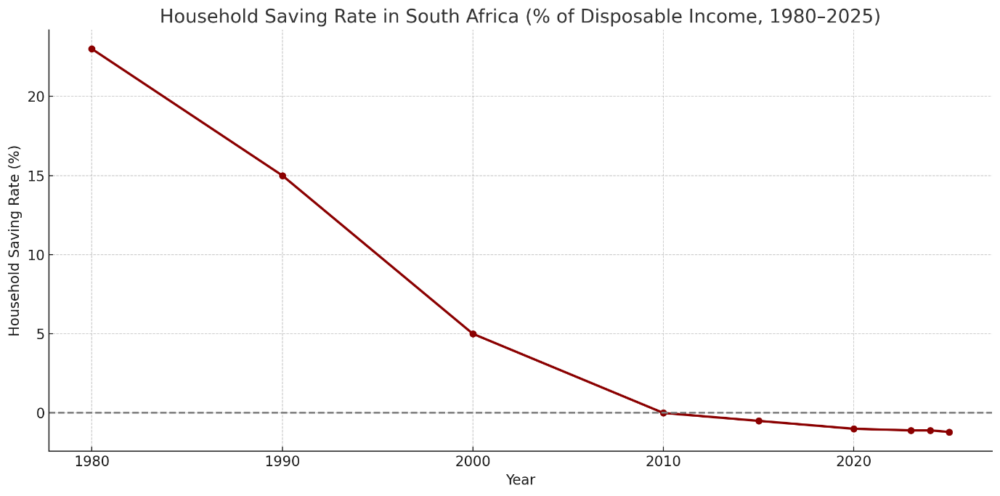

Let’s go back to the idea that South Africa has a poor savings culture – and unfortunately, the data backs it up. According to the National Credit Regulator, Statistics South Africa, and the South African Reserve Bank (SARB), household saving is worryingly low. On average, households save just 0.3% of their income. In the first quarter of 2025, this figure dropped to -1.20%, down from -1.10% the year before. And since 2015, household savings have been negative. So people are spending more than they earn, which is a clear warning sign of financial stress.

At the national level, our gross savings are about 16% of gross domestic product (GDP) – far behind high-saving emerging economies like India, where the rate is closer to 33%. Among BRICS countries, South Africa ranks lowest in gross savings. Sadly, all this evidence shows that South Africa has a poor savings culture.

So, what’s holding us back?

Changing how we think about money is a big part of building a new savings culture. It means letting go of the idea that saving is only for the rich or super-disciplined, and starting to believe that anyone – at any income level – can build strong, lasting money habits. That’s what financial fitness is all about.

However, there are 5 major roadblocks that continue to hold back South Africa’s savings culture and personal savings habits. To make these challenges easier to relate to – and harder to forget – let’s be inspired by South Africa’s iconic wildlife: Just as the Big 5 animals are powerful and hard to ignore, these financial obstacles are deeply rooted and difficult to overcome. From living beyond our means to low financial literacy and systemic barriers, each of the Big 5 represents a different challenge standing in the way of building a stronger savings culture.

The big 5 roadblocks to saving in South Africa

1 Oversized lifestyle – The elephant in the room

Many South Africans spend more that they earn – often to keep up appearances or meet social expectations. Credit is frequently used to fund lifestyles that aren’t sustainable. Add to that the burden of ‘black tax’ and other social obligations, and it’s easy to see why saving gets pushed aside. Lifestyle inflation quietly consumes income before saving even has a chance.

2 Lack of financial literacy – The lion’s den

Far too many people across income levels, age groups, and communities don’t understand how money, saving, and debt work. Without that basic financial knowledge, saving feels confusing or intimidating. And just like a lion, money can’t be tamed if you don’t understand it.

3 Easy access to credit – The cheetah trap

Credit cards, payday loans, and ‘buy now, pay later’ schemes make it much easier than ever to borrow money. And while credit may offer short-term relief, it often gets in the way of long-term financial planning. Like a cheetah, it’s fast – but if you can’t keep up, it’ll leave you behind.

4 Income instability – The buffalo barrier

Millions of South Africans are dealing with job insecurity, informal work, or low wages. When survival is a daily concern, the idea of saving can feel out of reach. Like facing down a charging buffalo, the pressure is immediate and overwhelming.

5 Weak Saving Systems – The rhino gap

Too many communities – especially in rural and underserved areas – don’t have access to simple, trustworthy, and rewarding savings tools. Without inclusive financial products, user-friendly apps, or support systems, even the most motivated savers are left stranded. A system with gaps can’t protect its people – just like a rhino without its horn.

Who (or what) will save us?

To overcome these Big 5 financial roadblocks, we need more than awareness – we need action, support and strategy.

In nature, the Big 5 are powerful – not just because of their size or speed but also because of how they dominate their environment. Similarly, these financial barriers don’t just appear – they are systemic, persistent, and deeply embedded in our social and economic landscape.

So, how do we counter them?

In fitness, you can’t outrun a bad diet. And in terms of money, you can’t build wealth without the right habits and support. That’s where getting ‘money fit’ comes in. Like a good coach, the right tools and strategies help you stay on track and focussed on the bigger picture.

To overcome the savings obstacles, we all need powerful allies – ones the strength, precision, and purpose to take on each challenge. If the Big 5 represent the wild, untamed forces working against a savings culture, then it’s time to call in our champions: the 3 Musketeers. They may not come with claws or horns, but they’re armed with tools that are just as powerful: knowledge, action and access.

Where the Big 5 block the path, the 3 Musketeers cut through. Together, they fight for a future where saving isn’t the exception – it’s the norm.

And they do so with these 3 swords:

1 Financial literacy – The wword of knowledge

Knowledge is power. Financial education helps people understand how money works, build confidence, and make informed choices about saving, debt, and budgeting. It’s the foundation for a smarter, more secure future.

2 Behavioural nudges – The sword of action

Sometimes, knowing isn’t enough – we need a little push. From automated transfers to savings challenges to gamified apps, behavioural nudges help turn good intentions into lasting habits.

3 A supportive financial ecosystem – The sword of access and trust

No one saves in isolation. Access to inclusive, safe, and rewarding financial tools – whether it’s a bank account, stokvel, or mobile app – makes saving easier and more appealing. When the system works for everyone, more people are empowered to take control of their financial future.

In the end, saving is not just about rands and cents – it’s about the emotions, beliefs, and meaning we attach to money. For some, money means security. For others, it’s about spontaneity, status, giving, planning – or even being carefree. These ‘money personalities’ influence how we earn, spend, save, and borrow – often without us realising it.

To truly build a strong savings culture, we need more than financial advice and digital tools. We need to understand our unique relationship with money and not be so hard on ourselves when we stumble on our savings journey. Financial health isn’t about being perfect – it’s about being aware, kind to ourselves, and intentional with every rand.

1 step at a time. 1 habit at a time. That’s how we succeed at saving – and how we #GetMoneyFit.