Mad dash: Most of the sudden influx of prospecting applications are for lithium, but include dozens of other critical minerals. Pictured here is the SA Lithium Mine near Umzumbe. Photo: Supplied

Famous for its Blue Flag beaches and tourist attractions, KwaZulu-Natal’s South Coast is abuzz with critical minerals mining applications and plans for a small harbour development.

Information collated by Oxpeckers shows 13 prospecting applications have been submitted to the department of minerals and petroleum resources by seven companies since 2023. Eleven of these applications include lithium, classified as critical for both the energy and transport sectors.

To harness the region’s coastline, stretching 170km from Scottburgh to Port Edward, and inland to Harding, it has also been earmarked as one of the beneficiaries of Operation Phakisa’s small harbours development. Operation Phakisa, approved by the cabinet in 2014, is aimed at unlocking the economic potential of the country’s oceans.

The South Coast, with its three marine protected areas, the annual Sardine Run and proximity to South Africa’s busiest port, Durban, already makes a generous contribution to the region’s economy through job creation and tourism revenue. It has seven of the province’s nine Blue Flag beaches, an international recognition of their high standard of water quality and environmental management.

Speaking at the Umdoni municipality investment conference in Scottburgh in June, Public Works and Infrastructure Deputy Minister Sihle Zikalala said plans are on track for the construction of a small harbour in the Ray Nkonyeni district municipality.

The multi-million rand development is set to include a boat launching site, as well as fisheries and related facilities that differ from the activities of commercial harbours. The public works department told parliament in May that the development was at the essential studies and stakeholder negotiations stage, which will be concluded in the 2025-26 financial year. This will be followed by the proclamation of the harbour and then by direct implementation, including securing the site and rehabilitating the slipway.

Harbour development

Mashimane Maphumulo, a researcher at the University of KwaZulu-Natal, said although there’s probably no correlation between the proposed small harbour and the surge in mining development in the area, it is not a far-fetched idea that the government could expand the services for the small harbour beyond fisheries and tourism to incorporate mining services.

“Presently, small harbours are mainly for two activities — fisheries and tourism — but the mining industry can benefit from the development that will take place around the small harbour. For instance, there is a talk around the discussion of expanding the road network between Durban to Port Shepstone because they are anticipating that the traffic volume will increase,” he said.

While working on his research on small harbour developments, Maphumulo had noted that the public participation process is not happening as it should and is merely a cosmetic exercise, an issue also highlighted by South Coast communities in the mining sector public participation processes.

“I discovered in the process of this study that the public participation processes have not been done by the government. The government just decided to develop a particular area without consultation with the public and the feeling that I got was that public participation is done as a cosmetic exercise, not necessarily wanting to hear the views of people about the project, because they run all these internal processes and developmental stages without contacting the public,” he said.

Maphumulo said mining developments also negatively affect the proposed harbour development, which aims to boost existing industries.

“The South Coast is loved for its pristineness and its clean environment. Now you’ve got this development in the small harbour and everyone in the tourism sector and fisheries are appreciating it, and are eagerly awaiting it, but it’s going to be affected negatively by the mining industry,” he said.

Mutually beneficial: Mashimane Maphumulo, academic at the University of KwaZulu-Natal, told Oxpeckers that the mining industry could benefit from development around the small harbour. Photo: Supplied

Mutually beneficial: Mashimane Maphumulo, academic at the University of KwaZulu-Natal, told Oxpeckers that the mining industry could benefit from development around the small harbour. Photo: Supplied

Prospecting applications

The prospecting applications include a mix of industrial minerals (dimension stone), ferrous (iron-rich) and non-ferrous metals (lithium), energy commodities such as coal and precious metals and minerals such as gold, diamonds and platinum.

The district has one operating lithium mine, SA Lithium’s Highbury Mine, which Oxpeckers investigated in 2024.

Oxpeckers, through the Promotion of Access to Information Act, submitted a request for all prospecting licence applications held by the minerals and petroleum resources department for lithium and/or other commodities in KwaZulu-Natal, along with their environmental impact assessments. The request was refused with the department stating that the work involved in processing the request would “substantially and unreasonably divert the resources of the department due to the huge volume of the information involved”.

According to the department, “Prospecting right applications are for the purpose of conducting mineral exploration. Once granted, the holders then embark on an exploration programme which can lead to either positive discovery of the mineral or negative outcome.”

It noted that exploration is a risky exercise which depends on geology and technology.

Safe surrounds: Ian Harbottle, director of one of the applicants, AFLI Exploration, said that any mining activity by the company will not impact the environment. Photo: Supplied

Safe surrounds: Ian Harbottle, director of one of the applicants, AFLI Exploration, said that any mining activity by the company will not impact the environment. Photo: Supplied

AFLI explorations

One company wishing to prospect for lithium, AFLI Explorations, has a total of five prospecting applications from Umzinto to Hibberdene.

A quick Google search on the company shows that the current director is Ian Harbottle, who was previously linked to Marula Mining, the holding company of the Northern Cape’s Blesberg Mine. Harbottle resigned as Marula Mining’s non-executive director in July 2023 and has also been linked in media reports to the SA Lithium mine operation in Umzumbe.

Responding to questions sent by Oxpeckers, Harebottle said the AFLI exploration division is a sibling company to the Highbury Mine. He said four of the five applications have been granted environmental authorisation and the prospecting activities will be “minimally invasive with no environmental impact”.

“The chance of actually finding an economically viable resource is extremely low, with the extent of the impact ultimately depending on the size and location of any potentially identified resource,” he said.

Harebottle also mentioned that the company had not received any substantiated complaints about their activities contaminating nearby water sources, including the Umzumbe River, and said Highbury was taking measures to prevent contamination.

“With regular water quality, dust, noise and other testing procedures being carried out across site on a continuous and ongoing basis, we take pride in the substantively positive impact our operations continue to have within the region,” he said.

Community compliance: Another applicant, Grace Followers Trading, said it has secured the go-ahead from landowners. Photo: Aphiwe Moyo

Community compliance: Another applicant, Grace Followers Trading, said it has secured the go-ahead from landowners. Photo: Aphiwe Moyo

Grace Followers Trading

Another of the seven companies, Grace Followers Trading, was granted environmental authorisation for prospecting activities in Umzumbe by the department in April. The company’s basic assessment report and environmental management programme state that the company will explore the proposed prospecting area in three phases: literature review, site observation/field mapping and drilling, which will have minimal impact on the environment.

Grace Followers’s director Mary Phillips told Oxpeckers that it has complied with all requirements of the National Environmental Management Act and environmental impact assessment regulations and is waiting for the go-ahead from the department to start prospecting.

“We will make sure that the interested and affected parties know what our plans for drilling are, such as where we will drill, how we will get the machinery on site, and try not to affect anything. The landowners are also well aware of this and have given us their blessing,” she said.

“Right now, we cannot commence [with prospecting]; we are waiting for the [department] to provide us with the final right that says now we can go [ahead],” Phillips said.

The environmental authorisation has been published and is open for comments or appeal by interested and affected parties.

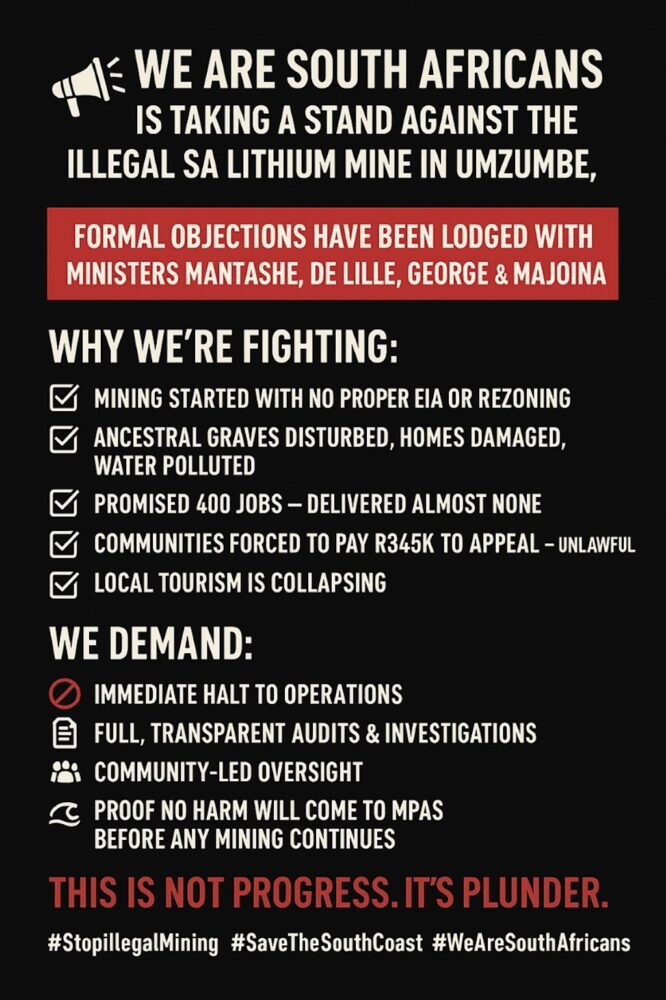

Supporting community: Civil society movement, We Are South Africans, has been supporting the community in Ray Nkonyeni Municipality, who appealed mining rezoning approvals and were reportedly asked to pay a fee to do so. Photo: We Are South Africans campaign

Supporting community: Civil society movement, We Are South Africans, has been supporting the community in Ray Nkonyeni Municipality, who appealed mining rezoning approvals and were reportedly asked to pay a fee to do so. Photo: We Are South Africans campaign

Local communities

In a move to halt the increasing prospecting applications along the South Coast, local community members have formed an action group under the representation of We Are South Africans, a civil society movement based in the Western Cape.

Clair Taylor, of We Are South Africans, said the movement is representing members of the communities who wish to remain anonymous because of threats to their livelihood: “We are working with community members, anonymously, but representing them due to the intimidation they have been receiving and also the fraud occurring for them to appeal.”

Residents of the Ray Nkonyeni municipality submitted an appeal against mining rezoning approvals and were reportedly asked to pay R345 000. “This is an excessive and ethically troubling demand, when it should be free to appeal. It shifts the legal burden on to vulnerable communities and undermines their right to accessible, fair administrative processes,” said We are South Africans.

In a press release, and letters addressed to the departments of minerals and petroleum resources, forestry, fisheries and the environment, water and sanitation as well as tourism, the affected communities are also calling for the cessation of mining at the Highbury Mine in Umzumbe and an investigation into the granting of its mining licence.

Oxpeckers approached the KwaZulu-Natal department of economic development, tourism and environmental affairs’ spokesperson, Sinenhlanhla Mthembu, for comment on the surge in prospecting licence applications.

Although she did not comment on questions relating to community concerns surrounding these developments and biodiversity concerns, Mthembu said: “The department supports all economic developments that occur within the ambit of the law and that consider all applicable environmental requirements.”

The Ugu district municipality was contacted for comment and directed all media queries to Ray Nkonyeni local municipality’s Nomusa Zulu, who was unreachable and had not responded to a query sent by Oxpeckers via email.

Closed roads, open questions: The entrance to the SA Lithium Mine, which Oxpeckers visited in 2024. Photo: Aphiwe Moyo

Closed roads, open questions: The entrance to the SA Lithium Mine, which Oxpeckers visited in 2024. Photo: Aphiwe Moyo

Critical minerals

The national government recently approved and published Critical Minerals and Metals Strategy South Africa, a roadmap to leverage the mining of critical minerals in a manner that “promotes inclusive growth, industrial development, job creation and economic transformation”. Lithium is listed under the minerals with “moderate criticality”.

Critical minerals, according to the roadmap, are defined as “minerals that are essential for the overall economic development, job creation, industrial advancement and contribution to national security”.

Responding to questions from Oxpeckers, the minerals and petroleum resources department media desk said additional factors that influence the criticality of minerals and where they stand on the list of declared minerals are underlying market conditions, technological advancement, substitutability, recycling and geopolitical factors.

Responding to whether an increase in lithium mining operations in KwaZulu-Natal would result in an upgrade for lithium on the critical minerals list, should the proposed prospecting activities have successful outcomes, the department said: “Increased domestic production of lithium could result in lithium being upgraded from moderate criticality to high criticality on the list.”

Two lithium mines visited by Oxpeckers in the Northern Cape in 2024 have reportedly halted operations, leaving the Highbury Mine in Umzumbe as the only operating lithium mine.

Ancient discovery: In 2019 a group of divers spotted a coelacanth, long thought to be extinct, on the South Coast. Photo: Bruce Henderson

Ancient discovery: In 2019 a group of divers spotted a coelacanth, long thought to be extinct, on the South Coast. Photo: Bruce Henderson

Coelacanth concerns

The prehistoric coelacanth was spotted by divers along the South Coast more than five years ago, indicating that there may be a population of the rare and ancient fish outside of the Sodwana Marine Protected Area, where 33 have been identified.

Henk Stander, chief technical officer at Stellenbosch University’s Aquaculture Unit, confirmed that the fish species is mainly found off the coast of KwaZulu-Natal, specifically within the iSimangaliso Wetland Park, a World Heritage Site.

Stander said that although the sighting of one coelacanth along the South Coast does not mean there is a population of the species, there is a strong possibility that there might be — and mining in the area could affect them.

“Mining activity, especially lithium mining, along the coast of South Africa could negatively impact the coelacanth population. Specifically, oil and gas exploration and potential pollution from mining operations could pose threats to their habitat and survival,” he said.

A mineral rush concentrated in one area once a company has succeeded in its prospecting activities is not uncommon, said Marcena Hunter, the Global Initiative against Transnational Organised Crime’s director of extractives.

She said a red flag to look out for during a mining rush is companies applying for multiple smaller concessions.

“I think you would need to look and see who is filing the prospecting rights and if there’s any corruption or land grabbing concerns linked to the mining rights explorations or what foreign companies might be linked to them,” she said.

This investigation is part of the Oxpeckers #PowerTracker investigative series titled ‘The human cost of energy in Africa’.