Sweet talk: The market is watching to see whether Mark Cutifani lives up to his word. (Mark Wessels/Reuters)

Newly appointed Anglo American chief executive Mark Cutifani has gone back to the drawing board, adopting a strategy that is diametrically opposed to that of his predecessor, Cynthia Carroll, in a bid to bring returns to disgruntled shareholders.

Whereas Carroll spent her tenure looking for new, and as it turns out expensive, acquisitions, Cutifani plans to cut $3.5-billion in costs by 2016 to increase the return on capital employed to 15% from the 8% it is at present.

He plans to do this by improving efficiency and reviewing operations, which he started in April when he took up his new position.

Cutifani will report back next month on Anglo American's progress and he has already shown his resolve by selling the group's holdings in a Brazilian iron ore project and the Pebble Limited copper project in Alaska, which has been dogged by protests over its impact on the environment.

The markets did not react immediately after Cutifani's presentation of the company's interim results in London in July.

It appears from conversations with analysts that they are waiting to see whether he is going to deliver on his promises and on the outstanding 90 projects he is reviewing.

Profits down

The company reported in July that group operating profits were down 15% at R3.3-billion. However, he said at the presentation that, "adjusting those earnings for price movements and foreign exchange movements, our underlying performance is about 10% better than we were at this time last year, so there has been an improvement."

Anglo American has had its fair share of problems, many of them in South Africa.

The most recent was the undisclosed settlement involving 23 miners suffering from silicosis, most of them from the President Steyn mine in the Free State.

In the first half of the year, the company also had to contend with talk of increased mining taxation, debate about the nationalisation of the mines, and labour unrest in the platinum sector, in particular, which is already struggling with very poor margins as a result of low prices.

All of this would not have inspired investors or helped performance.

The government objected in particular to the loss of jobs that would result from the closure of some shafts by Anglo Platinum (Amplats).

Strain evident

The strain between the mining sector and the government — and Anglo American and Minister of Mineral Resources Susan Shabangu in particular — was evident at February's global mining indaba in Cape Town.

As the Mail & Guardian was going to print, strikes over efforts by Amplats to cut 4 800 jobs (reduced from initial plans to lay off 14 000 miners) continued at the Thembelani mine near Rustenburg.

Then there is the general decline in commodity prices, offset somewhat locally by the weak rand and delays at some of Amplats's other operations, including the Minas-Rio iron-ore project.

Peter Major of Cadiz Corporate Solutions summed up the view of many in the market: "I am not really interested in what Mark Cutifani said, because he virtually always says the right things. But we have heard lots of CEOs [chief executives] presenting their plans for change. As a fund manager I just want to see him successfully implement his plan. Then we all benefit."

Another fund manager agreed, saying Cutifani talks a good game but only time will tell whether he and his team can cut costs and make the company a leaner machine.

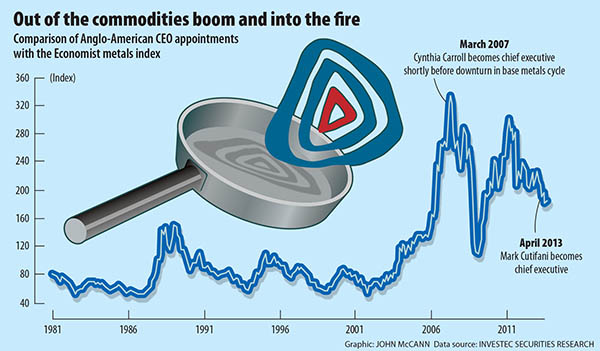

The restrained response to Cutifani's new plan is not without reason. In the past 10 years, Anglo has had three chief executives, all with different strategies.

Restructuring local businesses

Tony Trahar restructured and disposed of some local businesses in 2000.

Unfortunately, this was at a time when other resource companies were buying commodities to serve growing infrastructure demand.

Then Caroll came in at the top of the commodities boom and started trying to catch up by making a number of acquisitions.

But the prices were at a premium and, although some may turn out to be beneficial in the long term, what she paid for them alarmed both the market and shareholders, who were not seeing returns.

In fact, between 2007 and 2012, Anglo American's total capital employed had reached $55-billion, while return on capital had dropped from 37% to 13%.

Enter Cutifani. At the July presentation of the company's annual results, he said capital spending had to be reduced and that, over the past eight quarters, only 11% of Anglo's business units had managed to achieve their budgets, a performance he described as "unacceptably poor".

In the honeymoon phase

Major said Cutifani is fortunately still in the honeymoon phase.

"The first year is the honeymoon for shareholders — in fact, more like the first three to six months — and then shareholders want to start seeing returns."

Looking at the performance of some of the acquisitions during Caroll's tenure, such as Minas-Rio, which cost $5.5-billion, and the Alaskan copper, gold and molybdenum project, which will see Anglo American write off $300-million after selling it back to Northern Dynasty, Cutifani said Anglo had taken action to address shareholder concerns about its holdings in South Africa, not delivering on operating performances and the allocation of capital, and was addressing them.

"They [Anglo] don't have bad assets; they have a nice spread," said Major. "What they need to do now is run the assets they have and not buy anything new for a while."

Albert Minassian, a metals and mining analyst for Investec, said in a note that the company was generally pleased with Anglo's first-half results, which were better than expected.

He said they were predominately a result of a "modest surprise in platinum, and to a lesser extent diamonds, and coking coal" in the first half of the year.

Questionable

He said, although "the purchase and development of Minas-Rio and the long-term planning of the platinum business are questionable", Investec was against the sale of Minas-Rio.

"If Minas is successfully delivered, it would enhance Anglo's growth," he said.

Minassian said if Minas delivers during its revised time, and if 100% of it is retained, Anglo American stands a chance to outperform BHP Billiton on an aggregate volume basis from 2015 onwards.

"Comparing Anglo to BHP on an output weighted price base shows that at least part of BHP's outperformance had to do with the fact that its asset portfolio faced better prices than Anglo's."

Analysts are concerned about an oversupply of iron ore, to which Anglo American has a lot of exposure through companies such as South Africa's Kumba Iron Ore, which contributes nearly half of Anglo American's profits, and copper.

In its half-year statement, it was said that Kumba contributed an estimated $579-million to Anglo American's half-year earnings.

Problems at Kumba

Kumba is not without its problems, however. Costs at its flagship, Sishen Iron Ore, continue to move in the wrong direction, partly because of its mining of waste, a necessary but dilatory step Kumba says it must do in order to build long-term flexibility into the mine.

Minassian said Investec is upbeat about platinum, saying "prices will recover over time", but an oversupply of iron ore, uncertainty about Chinese demand for commodities and possible interference by the South African government limiting "miners' ability to control their costs and scope for independent decision-making could have a big adverse affect on investor confidence".

He was referring to government intervention over job losses at Amplats, the downsizing of which was intended to save the company money.

Cutifani said at the mining lekgotla in August, in his capacity as Chamber of Mines president, that there had been "internal engagement between government and mining".

He said that the ongoing tension between the government and the mining sector, combined with a 10% drop in production, has led to a 30% destruction of value between 2007 and January 2013.

Frank approach to getting Anglo assets in gear

So what has Mark Cutifani, Anglo American's chief executive, accomplished in his first few months?

He has been praised, particularly by the financial press, for his frankness about some of the challenges facing the company, with foreign media reporting that he informed analysts at the July presentation in London that "we need to get our arses into gear".

One mining expert said the company Cutifani inherited was in a "shambles".

This is considered an overstatement by some, but the former AngloGold Ashanti chief executive is credited with turning around that struggling company in a short time by winding down a loss-making hedge book.

He has certainly been presented with an enormous challenge. He said the review of the group's 95 operations and projects was well under way and should be completed by November.

In late September, Anglo American said it was satisfied with progress on the Minas-Rio iron ore terminal and expects the first exports to begin in late 2014.

A number of delays

The project has seen a number of delays. It will have an initial capacity to mine and ship 26.5-million tonnes of ore.

Cutifani, who started in April, had said that he felt there was a greater need for Anglo American to explore its commercial potential.

In May, it was announced that the group was to open sales hubs in London and Singapore to "strengthen their relationship with customers in Asia and Europe".

The company said it was bringing together the commercial activities of its current locations where the businesses are based, namely Australia, South Africa and Brazil, among others.

Although thermal coal is handled in London, a team in Australia is handling most of the coking coal market.

The bulk of South Africa's coal exports go to Asia. Cutifani has said that Anglo is not considering a wholesale sell-off of assets.

"We have a very strong platform of assets to work from, the quality of those assets surprised me on the upside.

"It's not about making wholesale or radical changes at the operating level but about introducing a much more disciplined approach to planning and execution and delivery of the objectives we have."