Local link: Tokyo Sexwale

A trio of companies embroiled in the state capture saga “paid” R235-million towards the Guptas’ bill for Optimum Coal Holdings.

But, bizarrely, they claim to know nothing of the three deposits into a Bank of Baroda account between December 2015 and April this year that account for nearly 10% of the Optimum purchase price.

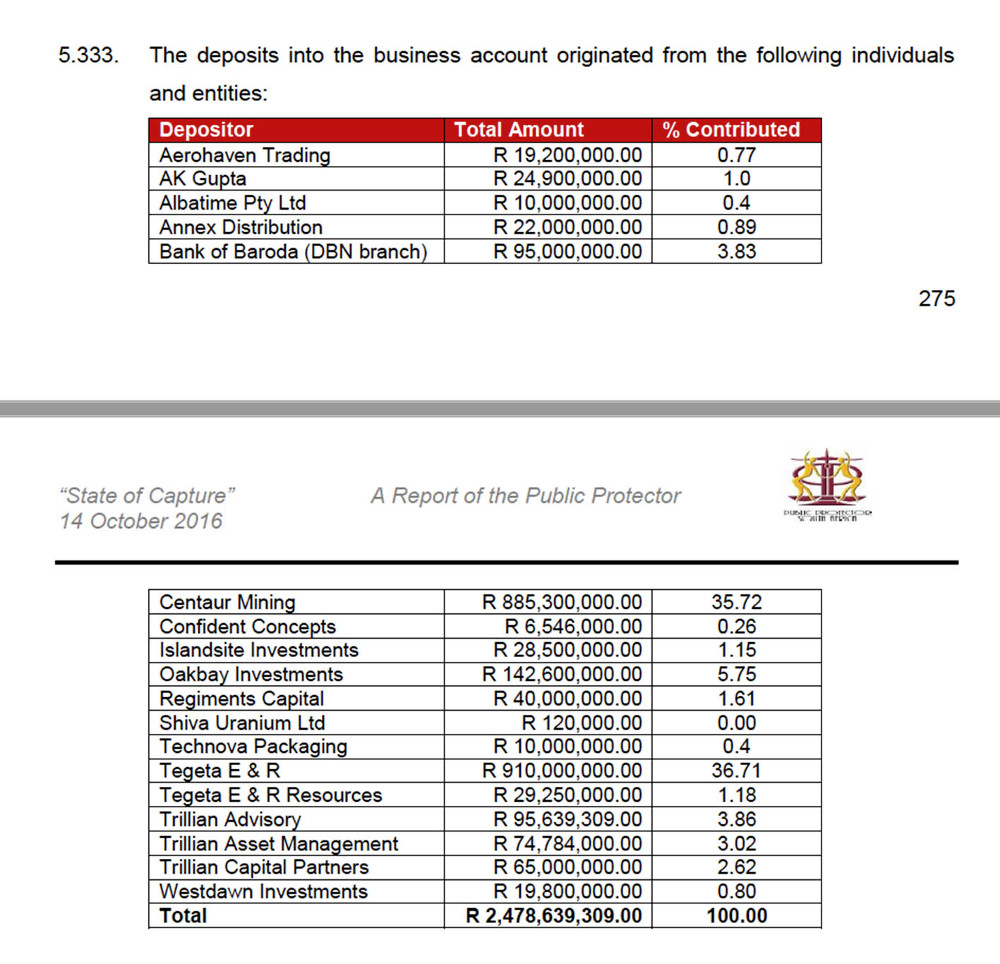

Details of the payments by Trillian Capital Partners (TCP), Trillian Advisory and Trillian Asset Managers are recorded in the public protector’s State of Capture report released by court order on Wednesday.

- Read Thuli Madonsela’s full ‘State of Capture’ report HERE

The companies are subsidiaries of Trillian Holdings of which Gupta associate Salim Essa is the sole owner. Essa holds a majority stake (60%) in Trillian Capital but the company has previously said that he is “not involved in the day to day running” of the company.

Trillian has repeatedly denied any Gupta links and on Friday morning Tokyo Sexwale, non-executive chairperson of Trillian Capital Partners, announced advocate Geoff Budlender SC as the independent investigator who will be looking into allegations of state capture against the company. This includes that it’s chief executive among others had prior knowledge that Nhlanhla Nene was to be fired last December.

The Mail & Guardian and amaBhungane previously reported on an email trail between Eric Wood, the chief executive of Trillian Capital Partners, and Essa in the weeks before Nene’s firing. Those indicated that they had prior knowledge of the appointment of Nene’s replacement, Des Van Rooyen, as well as the appointment of Van Rooyen’s advisor, Mohammed Bobat.

The state capture report details how bank records showed three payments of R65-million, R74-million and R95-million being made into an internal Bank of Baroda account. The money, among a string of deposits from mainly Gupta-linked companies, was then transferred to the family’s Tegeta Resources.

Tegeta is the company that bought Optimum amid much controversy when it emerged that Mosebenzi Zwane, the minister of mineral resources, had travelled to Switzerland and Dubai, allegedly to assist the controversial family with this deal.

Details of his trips were included in this week’s state capture report, but the minister has legal action pending, having argued that he had not been given an opportunity to respond to the claims against him.

Trillian comments

In response to questions about these deposits, Trillian Capital sent a written statement saying there were “no adverse findings” in the PP report against the Trillian group and neither do they have any interest in either Tegeta or Optimum. “Trillian reiterates, as in its statement issued to you earlier, that no money has ever been transferred from Trillian to a Gupta account or Gupta-owned company. If required they will submit the bank statements to the public protector for inspection.”

Meanwhile, Regiments Capital, a company currently involved in a court battle with Wood, a former founder of Regiments, is also listed as a depositor for an amount of R40-million. The company “categorically” denied having made either the payment nor ever granting it as a loan to Tegeta.

“In fact, Regiments has never had any business relationship with the said mining company. We are willing to subject ourselves to any scrutiny to verify this fact.” See Regiments’ full comment below.

Neither Trillian nor Regiments were approached for responses to this by the PP, they say.

The 335-page report also contained harsh comments against the conduct of the Bank of Baroda over the 32 “suspicious” deposits that should have set off red flags, including that of money laundering.

Eric Wood, Tokyo Sexwale and Salim Essa.

“All the money favoured Tegeta,” the report states. At the time Tegeta was raising the more than R2-billion required for their purchase of Optimum. The M&G has requested comment from Bank of Baroda and will update this article should it arrive.

Regiments Capital: Full comment

Following the release of the “State of Capture” report by the Public Protector, Regiments Capital categorically denies that it contributed R40-million towards the purchase of Optimum Coal Mine. Nor did we ever grant a loan to the company.

In fact, Regiments has never had any business relationship with the said mining company. We are willing to subject ourselves to any scrutiny to verify this fact.

The Office of the Public Protector did not approach our company to hear our side of the story before the “State of Capture” report was finalized on 14 October. We were therefore not aware that we were going to be named in the investigation.

However, we welcome the proposed judicial commission and we shall participate in the process wholeheartedly. We have always run our business above board and in line with the laws and regulations of the country.