In the Mail & Guardian this week

COMMENT

During this interminable period of local and global stagnation, thanks to Donald Trump, with no prospects of an upturn in the short to medium term, South Africa desperately needs the “radical economic transformation” repeatedly promised by the ANC. But Finance Minister Pravin Gordhan’s deficit-cutting measures denude the state of any Keynesian stimulation at a time when private investment is sickly and corporations are hoarding cash.

His midterm budget reveals how foreign credit rating agencies’ threat of a “junk” rating has maximum power, just before they follow through with a dreaded downgrade. Under their thumb, Gordhan felt compelled to adopt a deficit target for 2018 of just 2.5% (down from 3.9% last year and 3.4% this year).

These agencies are nothing if not erratic, for recall that in 2008 they gave Lehman Brothers and AIG top rating just as they declared bankruptcy, and in 2009 Moody’s upgraded South Africa’s national credit rating when the treasury’s budget deficit rose to more than 6% of gross domestic product (GDP), because then the International Monetary Fund (IMF) was encouraging overspending to halt another Great Depression.

Within a month, Standard & Poor’s Konrad Reuss will probably be the first to announce a downgrade of South Africa but the government already suffers junk bond status, measured by the interest rate paid to international investors on major countries’ state bonds, which is now nearly the highest in the world at 9%. The agencies’ blackmail relies on a downgrade causing intense capital outflows and a resulting rise in interest rates, as the South African Reserve Bank desperately attempts to attract funds back.

Before the 2008 crash, the last such major episode was in 1997-1998 when crises in Thailand, Indonesia, South Korea, Malaysia, Brazil and Russia caused flight from rand investments. That forced the then Reserve Bank governor, Chris Stals, to raise interest rates by 7% within two weeks in mid-2008, amid a 40% JSE crash.

For bankers, an even more frightening episode was in 1985 when, with a foreign debt of $13-billion coming due for repayment, PW Botha’s Rubicon speech — his refusal to implement major reforms to the apartheid system and release Nelson Mandela — catalysed a catastrophic reaction by international lenders such as Chase Manhattan’s Willard Butcher.

Botha’s response was to shut the JSE temporarily, to default on foreign debt and, most importantly, impose the “financial rand” capital controls to keep funds from escaping.

The finrand stayed in place until March 1995.

With the rand now the most volatile major currency (falling furthest since 2011, when it was R6.30 to the dollar, to a low of R17.90 in January, but zigzagging back to R13.50 last week), Gordhan and the Reserve Bank should consider the need to reduce currency vulnerability once junk is declared.

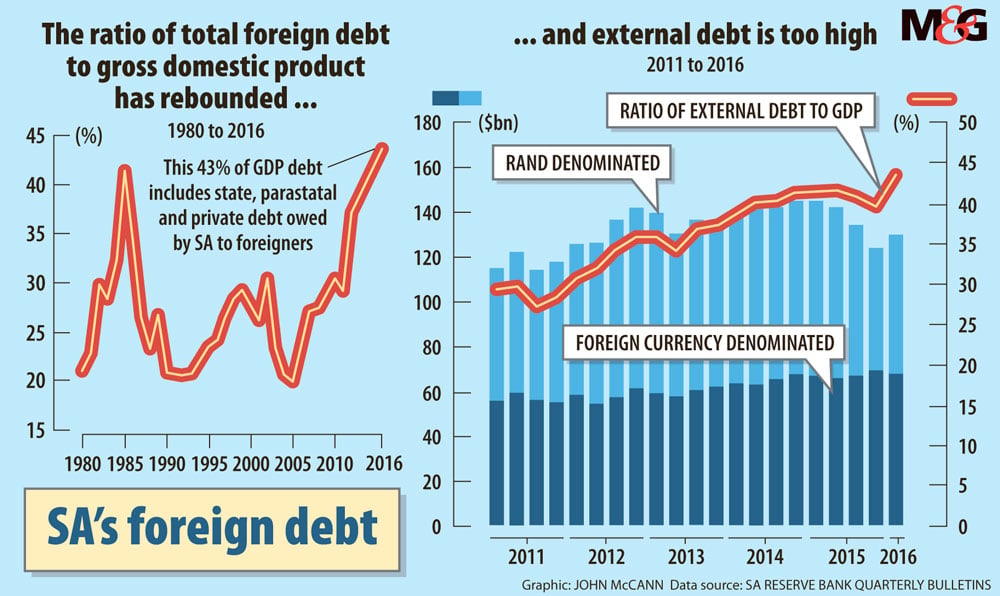

One reason is foreign debt. Just before Botha’s 1985 crisis, debt hit 42% of GDP, but today it is more than 43%, a modern national record.

This 43% of GDP debt is the “national” South African debt to foreigners. It includes state, parastatal and private debt — but since currency management is the Reserve Bank’s responsibility, it becomes a crucial problem for the current account balance… already around 5% in deficit. This debt burden fell to 20% of GDP in 2005 but rose because of corporate profit outflows, World Cup 2010 imports, and foolish, corrupt megaprojects. For example:

- The World Bank’s biggest-ever credit was for $3.75-billion so Eskom could build Medupi in 2010, with a generous bonsela to the ANC’s Chancellor House investment firm through Hitachi;

- In 2013, the Chinese government lent Brian Molefe (then Transnet chief executive) $5-billion mainly for Chinese-made locomotives to serve a new line to Richards Bay, which the National Development Plan hopes can export 18-billion tonnes of coal (the climate be damned); and

- Now Molefe as Eskom chief executive is borrowing $5-billion from the Chinese Development Bank, presumably to beef up reserves, to buy nuclear reactors from China or Russia or both.

With foreign debt of $135-billion and foreign reserves less than $50-billion, if South Africa suffers another currency rout, the repayment burden will rise further and an emergency loan will be needed.

Lending candidates for such loans include the IMF and the closely related Brics (Brazil, Russia, India, China, South Africa) contingent reserve arrangement (CRA), resulting in extreme austerity. After the first $3-billion loan, the CRA requires South Africa to suffer IMF dictates to get the next $7-billion in Pretoria’s quota allowance.

Aside from repaying foreign debt, the most important outflows are to foreign shareholders of multinationals. Those regularly amount to more than R150-billion a year in legal profits and dividends, plus an average of R300-billion in tax dodges, known as illicit financial flows.

What can be done?

On October 27, at a Wolpe Lecture at the University of the Witwatersrand, Indian political economist Prabhat Patnaik proposed that, given globalisation’s failures, South Africa and similar countries should consider “delinking”, better insulating them from world financial chaos by imposing tighter capital controls.

Financial Times columnist Wolfgang Münchau explained the logic of capital controls earlier this year: “The point is to prevent hot money flowing in during the good times and to stop it from draining out in the bad times. This is not yet a subject of polite conversation among policymakers.”

But among social activists it is, especially because delinking from intellectual property regulation, such as the rejection of pharmaceutical corporations’ monopoly patent rights on Aids medicines, raised South Africans’ life expectancy by 10 years over the past decade.

Moreover, capital controls were successful reimposed in countries as diverse as Malaysia (1998), Argentina (2001), Venezuela (2003), Cyprus (2013) and China (2016).

Another delinking strategy is the 10% protective barrier imposed last year by Trade Minister Rob Davies against the ongoing dumping of Chinese steel.

Facing vast overproduction, China exports its surpluses of several hundred millions tonnes a year. That bankrupted the second-largest steelmaker in South Africa, Evraz Highveld, last year. Also under threat is the world’s largest steelmaking firm, ArcelorMittal SA, which claims to need a 40% tariff increase against imports for its local subsidiary to survive.

With commodity prices for South Africa’s main raw material exports — coal, platinum, gold and iron ore — at extremely low levels compared with their peaks in 2011, Patnaik also advocated “import substitution”.

Successful from the 1930s to the 1970s as the main economic strategy of non-Western countries, the point was to halt unnecessary merchandise imports and replace them with locally made goods. In South Africa, such imports rose since 2011 from R550-billion (not including oil) to R700-billion a year.

Delinking by itself won’t solve matters. According to Patnaik, “delinking must be accompanied by an expansion of the home market through redistributive policies. Otherwise it could become merely a kind of beggar-my-neighbour policy.”

With so many wealthy South Africans taking their money abroad, the “rogue unit” at the South African Revenue Service would have been a useful weapon against capital flight.

Those concerned with state capture by the Guptas should also look at the way the ratings agencies and financiers behind them desire extremely harmful economic linkages to the West and the other Brics, and compel a discussion of delinking in even polite company.

As Münchau concluded: “Free movement of capital surely cannot be sustained as a point of principle when the economic costs are so devastating. Capital controls were common in our pre-Thatcherite past. They might come back.”

Patrick Bond is professor of political economy at the University of the Witwatersrand’s school of governance. This article also appears on theconversation.com