MYPD blues: The treasury estimates that 26% of total residential electricity sales could go off-grid by 2030

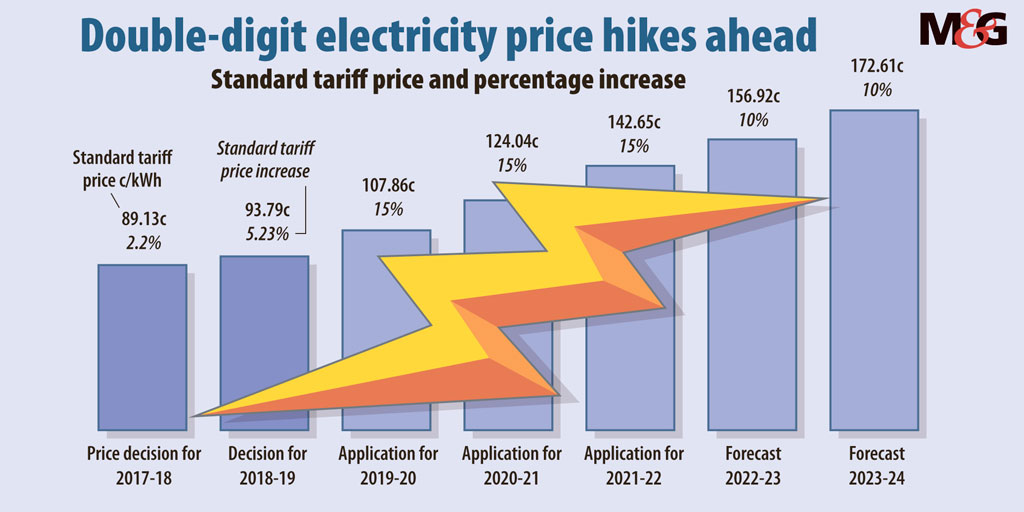

Eskom’s latest request for a 15% tariff hike each year for the next three years, on top of revenue clawbacks, means rising electricity prices are likely to exacerbate its declining sales, energy experts say.

The treasury also expects economic growth to decline if the steep increases are granted and has warned that households and companies will go off-grid to get around them.

Eskom, in its latest multi-year price determination application (MYPD4), recently applied to the National Energy Regulator of South Africa (Nersa) for the 15% increases. At the same time, it has made another regulatory clearing account (RCA) application for the fifth year of the MYPD3 of R21-billion.

The RCA is part of the MYPD methodology and allows Eskom to adjust for the over- or under-recovery of revenue in any year of a tariff decision.

In its latest RCA application, most of the money Eskom is seeking to recover was lost because of declining electricity sales.

Both the MYPD4 and the new RCA application follow a recent decision by Nersa to let Eskom claw back R32.69-billion for previous MYPD3 years. This will be recovered from

tariffs and translates into a 4.4% increase in the coming four years.

According to Eskom, in the MYPD4, it has opted to smooth the implementation of the tariff increases at a rate of 15% each year, even though this means that its revenues will not cover its entire debt commitment costs, resulting in a cash shortfall for the first two years (2019-2020 and 2020-2021) of the MYPD4 period. It will use the money from the previous MYPD3 RCA decisions to mitigate its debt servicing shortfalls.

This “significant sacrifice”, said the utility, was in “the interest of allowing the economy to adjust” to more cost-reflective power prices.

But Eskom’s request has been questioned.

“Eskom can say what it likes about what [increases] it thinks it should have but … if it gets 15% as well as the RCA award, it will drive South Africa to the very brink,” said Chris Yelland, EE Publishers managing director.

Given the already weak economy, more price hikes would continue to drive consumers to use less electricity from Eskom.

“If you were to put up the price … it would make grid supplementation a no-brainer,” said Yelland.

“It would become absolutely inevitable that every single business and a lot of consumers would opt to put in grid supplementation systems, which would reduce Eskom sales dramatically.”

Grid supplementation would mean running a renewable energy system parallel to the grid, allowing consumers to take “as little as possible” from Eskom, Yelland said. Consumers can also opt to go off-grid entirely.

“It [Eskom] simply can’t do this any more. It’s not going to help putting up prices … they will damage their own business.”

Eskom’s sales volume expectations, a key determinant of the tariffs it has applied for, are underpinned by important assumptions on matters such as economic growth.

The utility vastly overestimated economic growth in the previous round of tariff applications and, as a result, the effect it would have on electricity demand. But it says it will avoid this by providing Nersa with an updated forecast during public hearings.

The treasury, in its response to the tariff application, has queried Eskom’s sales forecasts and has outlined what the effect of the price increase could have on the country. It has estimated a 0.1 percentage point decline in economic growth, with particularly harsh effects felt in mining, as well as in the electricity sector itself because of the decline in demand.

Household and firms’ mitigation strategies would adversely affectelectricity sales, with serious consequences for both Eskom and municipalities, the treasury said. Based on “relatively conservative assumptions” of a 10% increase in the next five years, the treasury estimated that 26% of total residential electricity sales could go off-grid by 2030.

On an analysis of 21 listed companies, it estimated that 34% of Eskom electricity sales to mining firms and 8% of sales to industrial firms could go off-grid by 2040.

Eskom said that the process used to calculate sales volume assumptions was “a very rigorous one and a huge amount of effort is put into the process to ensure the compilation of an accurate forecast”. This included testing its assumptions with some of its key industrial customers.

Nevertheless, it noted the treasury’s suggestion that the price elasticity effect of such a high increase “could be more than what was anticipated in the submission”. But the sales variance could be addressed by considering more recent sales forecasts at the time of the Nersa decision, it said.

Eskom had also put an initiative in place to grow sales over and above what was expected to transpire from the market, it said.

It also said in the MYPD4 application that it is working to avoid the death spiral in several ways, including by considering new generation investments carefully to avoid stranded assets and to explore smaller incremental responses.

In addition, it wanted to prioritise growth in “disruptive technologies”, such as renewables, storage and smart technologies, including positioning itself for developments such as e-mobility.

But Yelland questioned how well Eskom could compete in an arena in which the private sector has made big strides.

Private independent power producers, through the government’s renewable energy procurement programme, have in recent years developed and installed almost 5 000 megawatts of green energy. In the same period, Eskom has only built the 100MW Sere wind farm near Vredendal in the Western Cape.

“Eskom has got no specific core competencies that will make it competitively better than independent power producers,” Yelland said.

Eskom also did not have the capacity to cope with the complexity of implementing a myriad smaller projects simultaneously, he added.