South Africa’s poultry sector is recovering from a devastating outbreak of bird flu and has capacity to meet local consumer demand. (Madelene Cronje)

South Africa’s poultry sector is recovering from a devastating outbreak of bird flu and has capacity to meet local consumer demand — as long as inoculations for avian influenza continue.

The department of agriculture rolled out mass inoculations earlier this month to protect the industry from highly pathogenic avian influenza (HPAI) outbreaks.

In 2023, millions of birds had to be culled, hampering production and driving up poultry and egg prices.

The inoculation campaign kicked off with the vaccination of 200 000 broiler breeders at poultry producer Astral. The birds represent 5% of the company’s total breeding stock, the department said.

Industry experts have welcomed the inoculation drive.

“We had two cases of HPAI in the country, but both were contained and did not spread with minimum losses in terms of production,” said Izaak Breitenbach, the chief executive of the South African Poultry Association. “We still have an additional one million birds per week slaughter capacity. We currently slaughter about 21.5 million birds per week.”

That number reflects normal production levels, which may rise slightly toward December because sales typically increase in the second half of the year. Breitenbach said the industry also has the capacity to exceed this demand if needed

“The industry can cover an increase in demand of about 10% with local production in the short term and probably more in the long term.”

Agriculture economists said the success rate for the inoculations will depend on how well future outbreaks are contained.

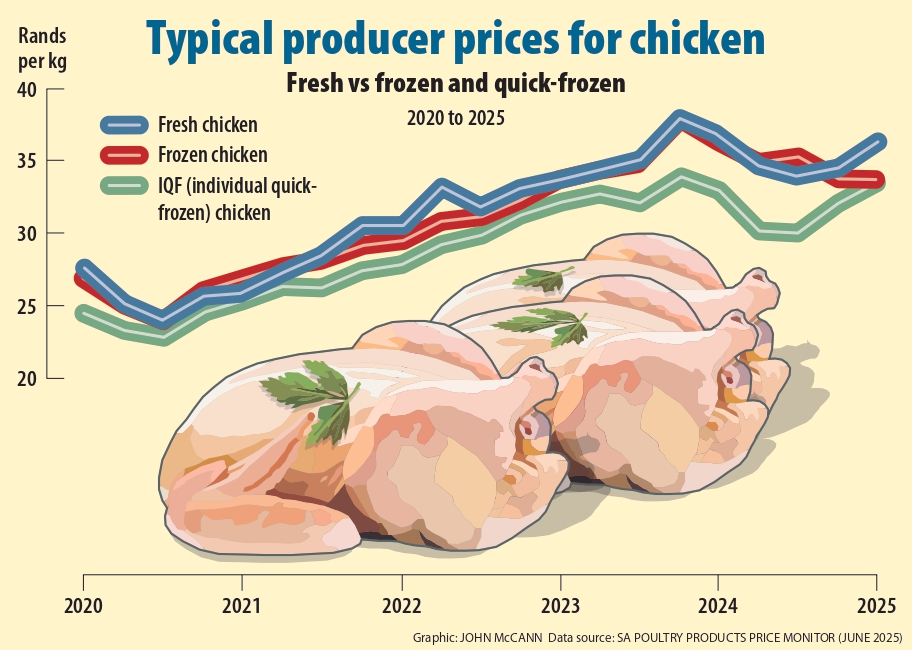

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

“There are great expectations that South Africa’s recent efforts to vaccinate poultry against avian flu will lessen the likelihood of another devastating outbreak similar to the one that occurred in 2023. Particularly in light of the seasonal influenza outbreak, which usually starts in April and peaks in September each year,” said Thabile Nkunjana, of the National Agricultural Marketing Council.

“However, the initial vaccination is reportedly for at least 200 000 broilers, which is extremely small compared to the size of the industry as a whole. As a result, there is still a chance of an outbreak related to South African poultry production, as well as a current risk of disruptions in the poultry supply, which frequently results in prices that have a negative impact on consumers nationwide, particularly the poor.”

The layer side of the poultry industry, which raises chickens specifically for egg production, is still producing at lower levels comparable to those before the 2023 outbreak, Nkunjana noted.

“If an outbreak were to occur, the industry would likely experience the same level of pressure as it did in 2023, and egg prices would probably rise once more,” he said.

Experts warned that the cost of bird feed could hamper poultry production.

Prices have increased on the back of climate conditions as well as international supply.

“Initially feed costs rose when world prices increased sharply in the aftermath of the pandemic and associated supply chain challenges, challenging weather in some key production regions and Russia’s invasion of Ukraine,” said Tracy Davids, the executive director for commodity markets and foresight at the Bureau for Food and Agricultural Policy.

“When world prices came down, South African prices stayed higher due to the summer drought of 2024. So, feed costs have increased much more than meat prices over the past five years, making life difficult for all livestock producers, but particularly poultry that use feed very intensively. It’s the biggest cost component in the sector.”

With feed prices declining and the partial lifting of the ban on Brazilian chicken imports earlier this month, the prospects for the sector are looking positive, Davids added.

The ban was implemented after Brazil also reported disease outbreaks, but was lifted to support South African consumers’ food security, alleviate cost pressures, and help stabilise the supply chain, said Nkunjana.