A view of the land where the new River Club development is located. (David Harrison)

On 3 February 2024, I wrote a scholarly opinion piece, backed up by many reliable sources, about the corporatisation of the development process in South Africa. I referred to this as the “mallification” of our cities, but this analysis is relevant to all large-scale developments, not just your traditional shopping mall.

I made specific reference to the Amazon-linked development in Observatory, Cape Town, which is a perfect example of how the general public has been hoodwinked by dubious claims of job creation and international investment linked to these developments.

Time and again, politicians who back these types of projects have failed to take into account independent research that shows the benefits of these developments are more questionable than developers’ curated press releases make them out to be.

For instance, two economists conducted an independent study in France which found that, while online shopping from e-commerce companies such as Amazon created 33 000 jobs between 2009 and 2018, it also led to the destruction of 114 000 jobs during the same period.

In other words, the expansion of online commerce giants (e-malls) such as Amazon destroyed about 80 000 jobs in France in only 10 years.

Dozens of other studies throughout the world have shown that big-box wholesale stores such Walmart (US) and Makro (South Africa), as well as online shopping giants such as Amazon and Shein, are net job destroyers. They wipe out local jobs and crush local businesses while helping rich corporations extract more and more capital from poor communities and developing countries.

This process of “extractivism” is not only a mining problem but also a wider development problem. Numerous studies show that corporate giants such as Amazon increase levels of inequality and poverty while making a handful of people filthy rich.

James Tannenberger, a key investor and trustee of Liesbeek Leisure Properties Trust (LLPT), the private developer of the Amazon development, took issue with this, calling my rendering of the above presentation of scholarly research “malicious and defamatory untruths and distortions”.

He claims my article is part of a “smear campaign”, even though every single claim I make is backed up by irrefutable evidence for which I provide hyperlinks.

Starting off with his own diversions, Tannenberger asserts that his colleague Jody Aufrichtig is not the site’s developer, merely a minority shareholder. On the face of it, this might seem true.

The developer is not an individual, but a corporate investment vehicle — Liesbeek Leisure Properties Trust. But this seems to disguise the role of the trustees. Aufrichtig, as a shareholder in the development, is also an LLPT trustee representative, one of its key spokespeople, and deeply involved in every aspect of the project including acting as LLPT’s primary representative in court applications. You don’t have to take my word for it. Check out LLPT’s trust registration documentation or have a look at how LLPT’s “Twitter/X” handle presents Aufrichtig’s role:

Next, Tannenberger undermines my credibility by claiming that, “Transnet disposed of the rights to use and develop the site in the [sic] 1990”, not in 2015, retaining only “bare dominium” of the property.

Transnet might have leased out the property in 1990. (The information is not publicly available.) More importantly, however, public documents indicate that in 2000, Transnet agreed to a 75-year lease of the property to the forerunner of Liesbeek Leisure Properties PTY (LLP), which was then led by the politically connected developer Frederick Robertson.

The parastatal offered a low R35 000 a month rental based on an under-valuation of the property at R3.5 million. It repeated this process in similar terms in 2008, even giving LLP an option to buy the property for that depressed valuation.

A Noseweek investigation found that, in doing so, it ignored a competing tender which offered to pay Transnet R3.08 million per month, based on a valuation of the land at R103 million. The Noseweek investigation warned that the manner in which this lease was constructed could result in Transnet deposing the property for hundreds of millions less than it was worth.

This is exactly what took place.

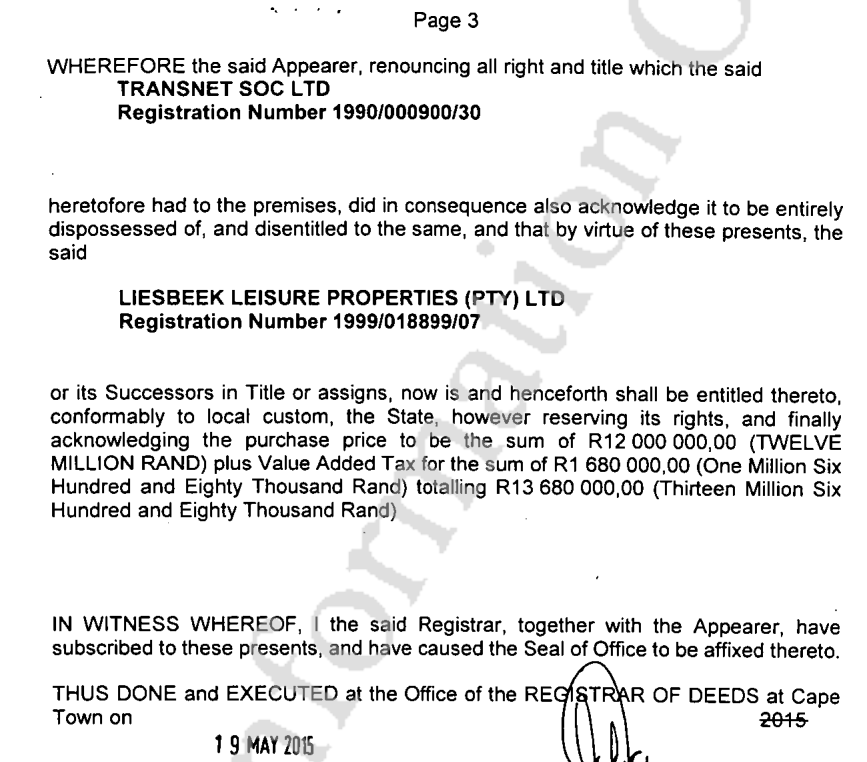

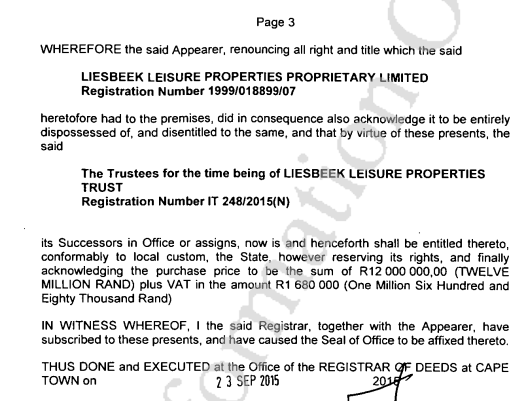

In 2015, Transnet sold the property to LLP (which had been taken over in 2014 by Aufrichtig and his business partners Nicholas Ferguson and Adrian van Deventer) for R12 million plus VAT.

LLP then turned around and sold the property only three days later to LLPT (a trust formed the day before by Aufrichtig and Ferguson along with Tannenberg and two other trustees from Zenprop). How much was the sale price? R12 million plus VAT. Here are excerpts from the relevant title deeds as proof:

[Image 1]

[Image 2]

I will let the reader decide whether Transnet’s disposing of 14.8 hectares of prime land in Cape Town for a paltry 12 million is ethical or just another corrupt land deal, fleecing the taxpayer of valuable public property. Transnet could have chosen not to sell, at least not for such a low price. We should be questioning how such an appalling deal was able to go through against the public interest.

Tannenberger makes other flawed claims as well. These are well-worn talking points from LLPT press releases that are often thoughtlessly regurgitated in the media. The development “fixes environmentally degraded land”, “creates jobs” and “recognises indigenous heritage”. However, we should always be wary of trusting the word of developers and their spokespeople who are financially motivated to present a certain narrative.

Legitimate independent investigations show that the Amazon development will environmentally degrade the site even further, destroy countless local jobs and sabotage intangible heritage on sacred indigenous land.

What is more, Tanneberger’s colleague Aufrichtig has been caught red-handed in what whistleblowers have shown is fraud. The court judgment that he cites so approvingly has been induced through an unlawful hijacking of an indigenous group with the backing of Aufrichtig.

Once again, don’t take my word for it. Go read the court application yourself where incontestable proof of fraud is provided.

Let us, then, make sure we hold developers accountable for their actions. Let us also make sure we hold our public representatives in government accountable for their cosy relationship with property development tycoons.

Ultimately, it is our taxpayer money which is subsidising their profitable endeavours.

Jared Sacks is a PhD candidate in the department of Middle Eastern, South Asian and African Studies at Columbia University in the US.