Illicit: Tobacco farmers want the price of cigarettes to be fixed so that smokers know that if they are paying less than R28 for a box of 20, then the product is illegal. (Michael D Kock)

The Black Tobacco Farmers’ Association is calling for the government to introduce a minimum price for cigarettes in a bid to stop the illegal tobacco trade.

Because manufacturers and retailers can decide on the price of cigarettes, these differ from brand to brand and from shop to shop.

“In our view, the minimum price level must be R28, so that consumers know that any packs on sale for less than R28 are illicit,” said Jabulani Tembe, secretary for the farmers’ association.

“We are actively involved in the fight against illicit tobacco traders because they are a direct threat to our future. We are law-abiding, tax-paying citizens, earning an honest living.”

The association, which was formed in 2018, represents black farmers in Limpopo, Eastern Cape, KwaZulu-Natal, North West and Mpumalanga. They sell their tobacco to Limpopo Tobacco Processors, which sells it on to British American Tobacco South Africa (BATSA), which manufactures cigarettes.

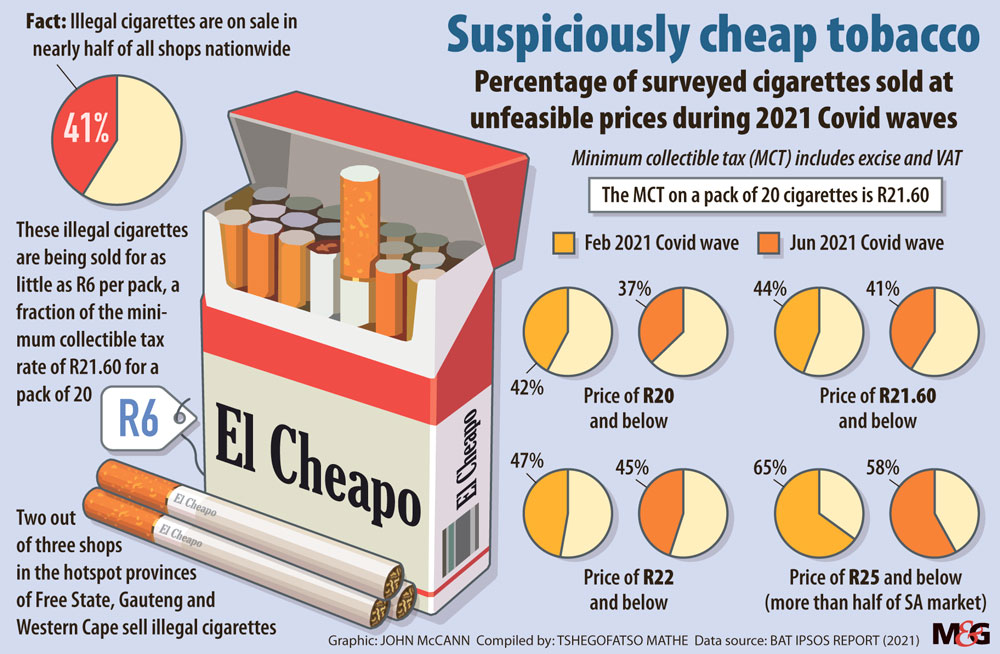

Illicit cigarettes are those sold without paying an excise tax of R18.39 plus 15% VAT ascribed to every pack of 20 cigarettes. The two taxes form the minimum collectible tax (MCT), which, Tembe said, is the most important issue in the conversation about illegal tobacco. He said the MCT on a pack of 20 cigarettes is R21.60 and “the only way people can be selling cigarettes below that price is if they do not pay tax”.

Johnny Moloto, the general manager at British American Tobacco South Africa, which is fighting the same fight for themselves and the farmers they work with, added that the MCT excludes any costs such as production, distribution and profits.

Moloto, quoting the Ipsos report that came out early July and which the company commissioned, said that because players in the illegal trade sell a packet of cigarettes for as little as R6 do not pay these taxes.

The report points to companies such as Gold Leaf Tobacco as the culprits. But the South African Tobacco Organisation (Sato), which represents Gold Leaf Tobacco, said it does not sell illegal cigarettes.

Raees Saint, the chairperson of Sato, said their products retail for anything from R24 to R28 for a pack of 20.

“Gold Leaf Tobacco maintains the highest standards of care in its manufacturing process to ensure full compliance with all legislative requirements,” said Saint.

The Fair Trade Independent Tobacco Association (Fita), which represents companies such as Best Tobacco Company, Carnilinx and Folha Tobacco Manufacturers, said that some of their members sell a pack of cigarettes for R26 to R30. Some of the BATSA’s cigarettes go for R30.79 to R57.

Fita’s Sinenhlanhla Mnguni said their members cannot buy tobacco from local tobacco farmers because of the anticompetitive nature of the industry. He said farmers are discouraged by the multinationals from supplying local independent cigarette manufacturers with tobacco.

Moloto said farmers were being affected by the illegal trade because legal volumes were declining. “It means we are buying less local leaf year on year, impacting the ability of tobacco farmers to earn a decent income from their hard labour.”

British American Tobacco South Africa is a part of the South Africa Tobacco Transformation Alliance, which has 197 commercial farmers and 182 “new era” farmers, including those from the Black Tobacco Farmers’ Association.

Tembe said it was frustrating that South African Revenue Services (SARS) was doing so little about the illegal trade. “We appreciate the fact that there have been some confiscations of illicit products, but there is so much more SARS can do. One example is the use of production counters at cigarette factories. All manufacturers have been told to use them so that SARS can track how many cigarettes are produced by each manufacturer.”

But Lekan Ayo-Yusuf, the director of the Africa Centre for Tobacco Industry Monitoring and Policy Research at the Sefako Makgatho Health Sciences University, said evidence has not shown that farmers are affected by the illicit cigarette trade.

He said the number of tobacco farmers has reduced significantly since 1996. The illegal trade only increased after 2010, when the number of tobacco farmers had already more than halved. In 2011, there were 140 tobacco farmers and the number increased to 175 in 2014 and it has not dropped since then.

“Yet, illicit trade is on an all-time high [30% to 35% in 2017],” said Ayo-Yusuf.

Most of the increase in the illegal market occurred from 2010 when the real taxes increased at an average rate of just under 2% a year.

“The big tobacco companies like BAT [British American Tobacco] has itself to blame, as it created a perfect storm for the illicit market by increasing cigarette prices at rates higher than the rate at which excise taxes were raised,” Ayo-Yusuf said. This “provided the incentive for increased demand for legal and illicit low-price cigarettes”.

(John McCann/M&G)

(John McCann/M&G)

SARS said the tobacco and cigarette industry is estimated to be worth R30-billion a year and is supported by nearly eight million adult tobacco users. It is estimated that the industry employs more than 100 000 people and contributes about R17.2-billion in excise duty and VAT a year.

The revenue service said it has combined its efforts with other departments such as home affairs to try to fight the sale of illegal cigarettes. An illicit trade intergovernmental task team was established in 2019 to develop a nationally coordinated response to the problem.

SARS’ Beyers Theron said that based on SARS customs enforcement statistics, customs officials carried out 1 150 seizures of cigarettes in the 2020-2021 financial year with an estimated value of R219 870 354 and R92 182 of seized tobacco, with duties and VAT estimated at more than R163-million.

This was up from last year’s seizures, which had a value of R103.5-million.

[/membership]