Russia’s aggression on Ukraine has been met by sanctions and condemnations around the globe. (Photo by Phill Magakoe / AFP) (Photo by PHILL MAGAKOE/AFP via Getty Images)

As Russia’s economic crisis escalates, in the wake of a slew of war-related financial sanctions from the West, the Kremlin risks being pushed to a debt default.

If this happens, it will be Russia’s first sovereign default since its financial crisis in 1998, which spread virulently through emerging market economies worldwide — causing various countries’ market indices to plummet.

Now, as Russia’s assault on the Ukraine wins Moscow new enemies, and turns its old enemies even more severe, the fate of emerging market economies is uncertain.

But, analysts say, emerging markets are better shielded than they were in 1998 during the “Russian virus”. And some, including South Africa, stand to benefit from the current crisis.

The risk of a Russian debt default is relatively high, said Momentum Investments economist Sanisha Packirisamy. “About half of their foreign exchange reserves are in US dollars and euros,” Packirisamy noted, adding that a chunk of the country’s reserves are in gold and in Chinese renminbi.

Sanctions have forced the Russian central bank to ban coupon payments to foreign owners of rouble bonds in an effort to shore up markets.

Sanctions

“There is quite a significant risk that there could be a default,” Packirisamy said, especially now considering some of the constraints on the central bank and the big commercial banks.”

Russia’s aggression on Ukraine has been met by sanctions from the United States and Europe. This week, during his State of the Union address, US president Joe Biden doubled down on his reproach of Russia and its president, Vladimir Putin.

“We are cutting off Russia’s largest banks from the international financial system. Preventing Russia’s central bank from defending the Russian rouble making Putin’s $630-billion ‘war fund’ worthless,” Biden said.

“We are choking off Russia’s access to technology that will sap its economic strength and weaken its military for years to come.”

Towards the end of last week, the leaders of the European Commission, France, Germany, Italy, the United Kingdom, Canada and the US announced the imposition of severe measures on key Russian institutions and banks.

Selected Russian banks were removed from the Society for Worldwide Interbank Financial Telecommunication, Swift, the global financial artery that allows for the transfer of money across borders.

The move effectively severed Russia from much of the global financial system, raising concerns that foreign holders of the country’s debt will not be able to receive interest or principal payments.

The nations also committed to imposing restrictive measures to prevent the Central Bank of Russia from using its international reserves in ways that undermine the effect of the sanctions.

Financial crisis

Also last week, ratings agency S&P Global lowered its long-term foreign currency sovereign credit rating on Russia and the country’s long-term local currency rating.

“Russia’s military intervention into Ukraine has prompted strong international sanctions, including on large parts of Russia’s banking system,” S&P said in its ratings action. “We believe that the announced sanctions could have significant direct and second-round effects on economic and foreign trade activity, domestic resident confidence, and financial stability. We also expect geopolitical tensions to drag on private-sector confidence, weighing on growth.”

On Monday, S&P instituted further action, downgrading several Russian banks and placing another 19 on CreditWatch with negative implications.

“In our view,” the agency’s analysts said, “the escalation of Russia-Ukraine tensions, Russian operations in Ukraine, and widening of sanctions against Russia could lead to conditions that eventually destabilise Russia’s economy and financial system.”

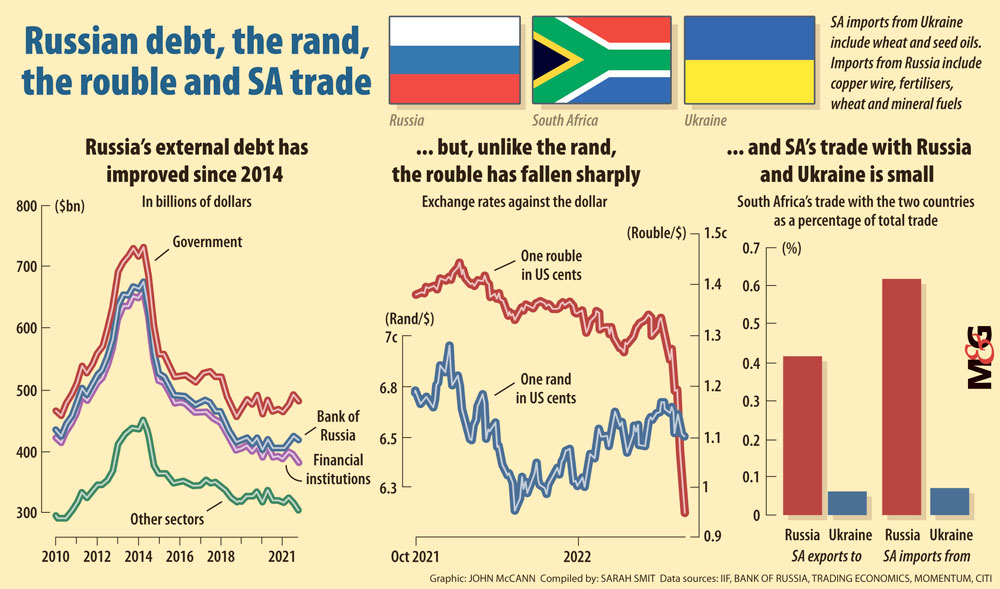

Since Russia stepped up its invasion of Ukraine, and the West tightened its grip, the rouble has deteriorated against the US dollar.

In response to the sanctions, and a sliding currency, the Central Bank of Russia raised its key policy rate to 20% from 9.5%, commanded export-led businesses to sell 80% of their foreign currencies and banned foreigners from selling Russian securities. The central bank also announced that 1.8-trillion roubles were withdrawn from Russian banks at the end of February.

But the central bank’s efforts have seemingly been in vain; by Tuesday one rouble was worth less than one cent and the currency was down 25% yearly.

Contagion

Last week, analysts at Zurich-based asset manager GAM Investments weighed in on the effect of the sanctions — which can create considerable fluctuations in financial markets — on other emerging markets.

“Most encouraging is the lack of contagion to EM [emerging markets] more broadly. Even currencies such as the Polish zloty, which had been quite correlated with the Russian ruble, no longer appear to be, and traditional risk bellwethers such as the South African rand or Turkish lira did not sell off, while the Brazilian real has been very strong,” the GAM analysts said.

To determine the effect of a Russian debt default on emerging markets, Packirisamy said, it is important to consider the weight of the country’s debt allocations compared with other economies.

According to a recent study by the Institute of International Finance on the effect of the recent sanction, Russia’s sovereign debt continues to make up a substantial share of local currency emerging market indices.

On Wednesday evening, MSCI announced it would drop Russian stocks from its emerging markets indices. JPMorgan is also reportedly under pressure to remove Russian stocks and bonds from its emerging market benchmarks, a move that could ultimately benefit other economies, including South Africa.

More than $920-billion is in emerging market exchange-traded funds (ETFS). Russia has a weighting of 2.7% in these ETFs, which means $24.5-billion would automatically flow out of Russian equities and into other emerging markets.

Packirisamy noted that Russia is 4.9% of the JPMorgan’s Emerging Market Bond Index. If it falls off the index, South Africa, Poland, Brazil and Mexico stand to benefit, Packirisamy said. “Unless there is a spike in global risk off sentiment in which South African bonds and the currency would be hit.”

Not-so-risky South Africa

“You could actually see other emerging markets benefitting if a reallocation takes place. Money might be taken out of Russia and it will still need to be invested in the EM space. So my view is that South Africa is an example of an emerging market that is relatively stable and has less risk,” Packirisamy said, adding that South Africa’s fiscal situation has also improved, as evidenced by last week’s budget.

“I think South Africa could benefit, as well as any other emerging markets with relatively sound macroeconomic outlooks.”

South Africa has not experienced large contagion as a result of the current crisis, S&P Global sovereign ratings director Ravi Bhatia noted. “While there is heightened global volatility right now, South Africa — based on its fundamentals — seems to be weathering it, but will have to cope with significantly higher global oil prices.”

The rand, Bhatia pointed out, has been relatively stable. The country will more likely feel the pinch as a result of high oil prices, he added.

“But on the flip side,” Bhatia said, “other commodity prices are also likely to remain strong. So in terms of trade, it remains to be seen whether South Africa will suffer. So far it does not seem like South Africa’s terms of trade are being hit significantly, but it is a fast evolving situation.”

It is likely that the rand hasn’t deteriorated significantly because “South Africa doesn’t have very high exposure to Russia and South Africa a relatively low level of geopolitical risk.”

Shielded

South Africa’s trade links with Russia are relatively limited, with the country making up less than 0.4% of total merchandise exports in 2021. South Africa’s imported goods from Russia were worth R9.2-billion from Russia in 2021, less than 1% of total imports.

Geopolitical risk in South Africa is also quite low, Bhatia added. “South Africa is the dominant power in the region and it has largely good relations with its neighbours. It has good relations with the West and with India and China. The geopolitical risk that applies to Russia doesn’t apply to South Africa.”

Hugo Pienaar, chief economist at the Bureau for Economic Research, said the effect of the Russia crisis on emerging markets “very much depends on how large that default is”.

Russia’s default in 1998 was, at the time, the largest in history. The 1998 financial crisis was the result of a mix of factors, including a chronic fiscal deficit and the cost of Russia’s first war in Chechnya, which took a significant toll on the Russian economy.

If the current crisis leads to a default of the same scale as in 1998, there could be contagion for emerging markets, Pienaar said.

But, he noted, more recent defaults, such as in Argentina, have had little effect on South African assets. “I think nowadays investors differentiate a bit more than they did in the late 90s … During crises, I think investors tend to kick out more vulnerable countries — country’s with large current account deficits, large fiscal deficits.”

Even in the wake of a very large Russian default, Pienaar said, “South Africa is shielded a lot more than it was in the late 1990s.”

[/membership]