The mining industry has the potential to grow if there is more investment in exploration projects. (Michele Spatari/Bloomberg via Getty Images)

South Africa’s mining industry has put on a brave face this week, as a better logistics outlook and a new licensing system promises to unshackle investment.

Although easing domestic constraints may have been enough to lift spirits at this year’s Mining Indaba, there is no doubt that the industry is in for another difficult 12 months.

The Minerals Councill kicked off the 30th Mining Indaba on a somewhat different note than it did last year, when Transnet’s decline cast a dark shadow over the conference.

Speaking on Monday ahead of the indaba’s official opening, Minerals Council chief executive Mzila Mthenjane suggested that the industry may be “on the cusp of a turnaround”, citing the organisation’s view that the country’s energy and logistics constraints appear to be easing.

After a near-disastrous year, less severe load-shedding has come as a relief. Meanwhile, recent developments at Transnet have brought some encouragement.

Although the logistics crisis will probably take a bit longer to abate, reforms have started to gain momentum, the Minerals Council’s chief economist Hugo Pienaar said.

On Transnet — which has cost the industry billions in recent years — Mthenjane said: “We’ve seen the changes that are coming through. If only it had been sooner. Going forward the tone will perhaps be a little less harsh, but we will continue to be assertive.”

Ahead of last year’s conference, it came to light that the Minerals Council had called for then Transnet chief executive Portia Derby’s removal. She has since resigned, followed by Nonkululeko Dlamini, the group’s former chief financial officer, as well as freight rail chief executive Sizakele Mzimela.

The private sector has worked closely with the government to arrest Transnet’s decline through the national logistics crisis committee. Late last year, President Cyril Ramaphosa’s cabinet approved the freight logistics roadmap.

Among the interventions set out in the plan is the concessioning of rail corridors to the private sector.

Meanwhile, on the eve of the indaba, Mineral Resources and Energy Minister Gwede Mantashe announced the government’s chosen service provider for the long-awaited revamped cadastre, thought of as an important step in clearing the mining rights backlog and paving the way for new mines.

The cadastre provides a record of available mining rights, as well as when rights are set to expire. It could take 12 months before the new system is in place.

While Ramaphosa expressed confidence that it would invite investment, others say it isn’t the silver bullet it has been made out to be.

Speaking to the Mail & Guardian on the sidelines of the mining conference, Thungela Resources chief executive July Ndlovu commented on the slow pace of change.

“As with most things in South Africa, we are very pedestrian. There is no reason why the cadastre has taken as long as it has. This is something we should be buying off the shelf,” he said.

“But look, we are where we are. At least now we are there. Let’s celebrate the little wins that we get.”

Ndlovu also questioned the government’s follow-through. “Our issue in South Africa is generally not the absence of the right tools … It’s implementation. We could have the most sophisticated licensing and mineral rights management system. But if we don’t implement it and issue those licences, no investment is going to happen.”

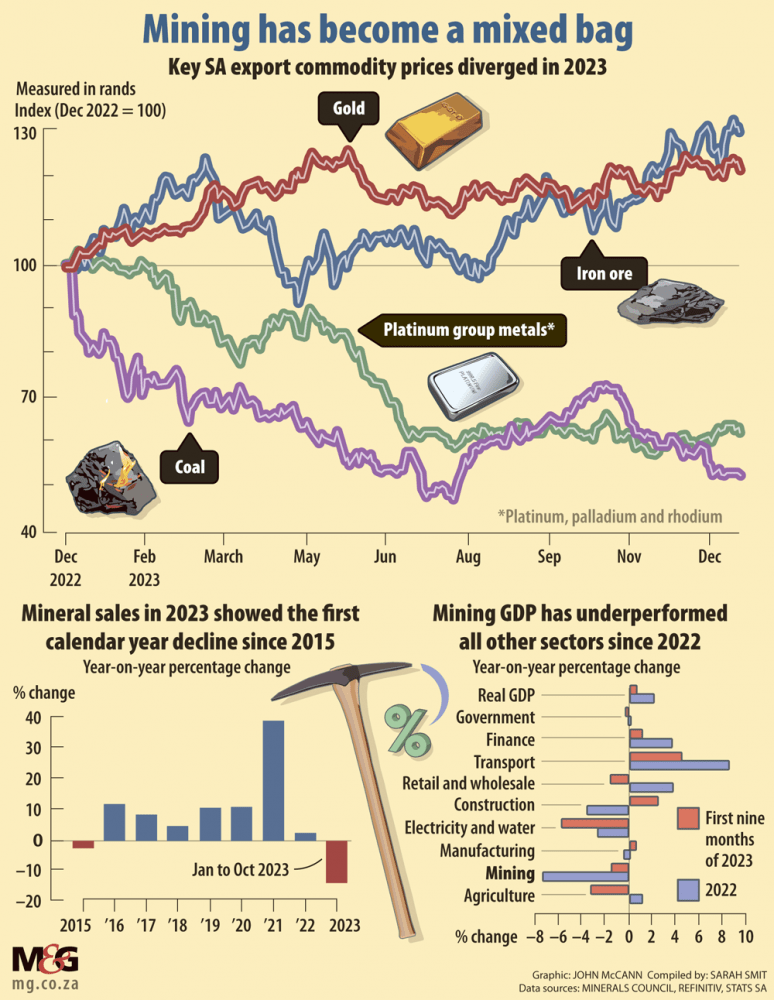

(Graphic: John McCann/M&G)

(Graphic: John McCann/M&G)

As a leading coal exporter, Transnet has a huge bearing on Thungela’s bottom line.

Ndlovu echoed the Minerals Council’s cautious optimism that the state port and rail operator was on the road to recovery. “But it’s early days,” he said.

Commenting on the industry’s relations with Transnet, Ndlovu added: “Ultimately we are joined at the hip. Even if we fight, all of us realise that we need to work together. We are their biggest customer as an industry and therefore we have suffered more than anybody else.”

According to the Minerals Council’s analysis, the value of total coal sales were down over 22% in 2023 compared to the year prior. Coal miners have been dealt a double blow inflicted by the Transnet crisis and sharply lower prices.

While the clouds appear to be clearing on the logistics front, the mining industry now has to contend with a predicament considered far more destructive: A tumble in commodity price.

While last year’s indaba signalled coal’s triumphant return — a symptom of the Russia-induced energy market shock — prices have cooled significantly. And coal producers are not alone in their despair. Platinum group metals (PGM) prices were also markedly lower.

According to the Minerals Council, PGM producers’ input costs began outstripping prices in August 2023, essentially leading them into “cash burning scenarios”. The industry body noted that various prominent PGM miners are restructuring their operations, potentially affecting 4 000 to 7 000 jobs.

Vusi Mpofu, sector lead for mining and chemicals at Nedbank Corporate and Investment Banking, suggested the industry’s ability to invest boils down to commodity prices.

“Despite everything that miners do, the ruler of the roost in terms of the factors that affect the fortunes of miners are commodity prices,” he said.

“Commodity prices are going to be driven by global demand, global growth. At the moment, all forecasts point to not-spectacular recovery coming in 2024.”

Peter Major, a veteran mining engineer, fund manager and analyst, was not convinced that easing economic constraints would unleash pent-up mining investments — especially in the wake of a commodity price slump.

“They are pretty scared. What the miner concentrates most on is the price of his commodity, especially if you are a producer. That’s everything … When the price goes down, nobody with money wants to talk to you,” he said.

“When the price is going up, everybody will talk to you. Most of the miners here, they need money.”

Major cited Anglo American’s predicament. Last December, the global mining company’s chief executive Duncan Wanblad revealed its plans to reduce capital expenditure by $1.8 billion in the period 2023 to 2026. This as the world’s largest platinum producer languishes under sharply lower prices. Anglo’s share prices plummeted on the news.

“That is what the other mining houses are experiencing. Everybody’s nervous … And there are almost no investors at this indaba. That’s who is really scarce here — people with money who want to spend money,” Major added.

That said, the Transnet-related logistics crisis is painful — especially for non-listed commodity producers.

“They live on cash flow. So prices have fallen and they can’t get the stuff out. They’re getting a double whammy,” Major noted.

“Iron ore has held up incredibly well, but Kumba can’t get it out … They’re bleeding, because they can’t get the volume out. It’s so frustrating.”

Last December, Kumba Iron Ore, a subsidiary of Anglo American, told investors that it would reduce its output target over the next three years, noting that logistics constraints had placed significant pressure on the company’s value chain.

Major also challenged the view that a new cadastre would cause new mines to spring up. “What is a cadastre going to do? It means you and I can log on to the system and see where our licence is. Does that change anything? No.”

Meanwhile South Africa’s mining industry has shrunk. Despite a commodity boom, the industry’s contribution to the country’s GDP fell a percentage point from 8% to 7% from the third quarter of 2017 to the third quarter of 2023. In this period, the number of mining jobs fell from 446 000 to 409 000.

“For most mining companies, it is tougher now than it has been in five years,” Major said, adding that this is an indictment of Ramaphosa’s presidency.