The strong to stable rand and poor performance from First World equities over the 10-year period to end August 2010 should not deter South Africans from investing offshore.

Equity prices have traded sideways to slightly downwards since the start of 2010. Despite the strong recovery since the March 2009 lows, equity prices in general are still a good way off their October 2007 highs that prevailed before the credit crisis.

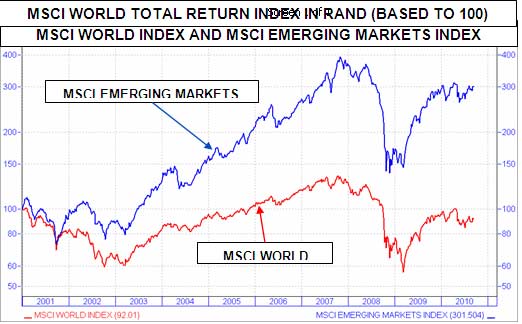

Developed-market equities, as represented by the MSCI World Index, are still almost 8% lower than they were 10 years ago. While dividends have made up for this loss, the MSCI World Total Return Index has yielded a return of just over 10%, or just over 1% annualised, in US dollar terms on an investment made 10 years ago.

Emerging-market equities, on the other hand, have yielded excellent returns over this period. Even excluding dividends, investors who were brave enough to buy emerging-market equities would have earned a return of 11,7% per annum in US dollar terms.

As exchange-control regulations were relaxed during the post-apartheid years, South African investors were very eager to expose their portfolios to mainly First World assets. This made sense in terms of reducing portfolio risk, as uncertainty regarding the new regime was a big issue in the first few post-apartheid years.

With South Africa regarded as an emerging market, it is not surprising that South Africans are among those with the highest foreign investment exposure to First World markets in their portfolios.

While some may think a weaker rand has compensated for the poor performance of developed-market equities, it has not done so. In rand terms, an investment in the MSCI World Total Return Index would have yielded a paltry 8% over the 10-year period to end of August 2010.

Instead of abandoning foreign investments, investors should rather consider additional diversification in their foreign portfolios.

It is not prudent for investors whose assets are mostly in an emerging market like South Africa to expose too large a portion of their portfolios to emerging markets. However, it may be time to rethink and invest in funds that focus on non-South African emerging markets.

This is especially relevant if emerging-market growth rates are likely to be higher than developed-market growth rates over the next few years. Some foreign-listed property exposure could also be an option.

However, the global economy is very uncertain at the moment, and emerging-market equities are not cheap. If you decide to go this route, apply a phasing-in approach over a few months or use any pullbacks in emerging-market equities to add exposure.

Paul Stewart is managing director of Plexus Asset Management

Read more news, blogs, tips and Q&As in our Smart Money section. Post questions on the site for independent and researched information.